Mayo Report for 2017-12

|

|

Top Comics List Top Comics Breakdown Top Trades List Top Trades Breakdown

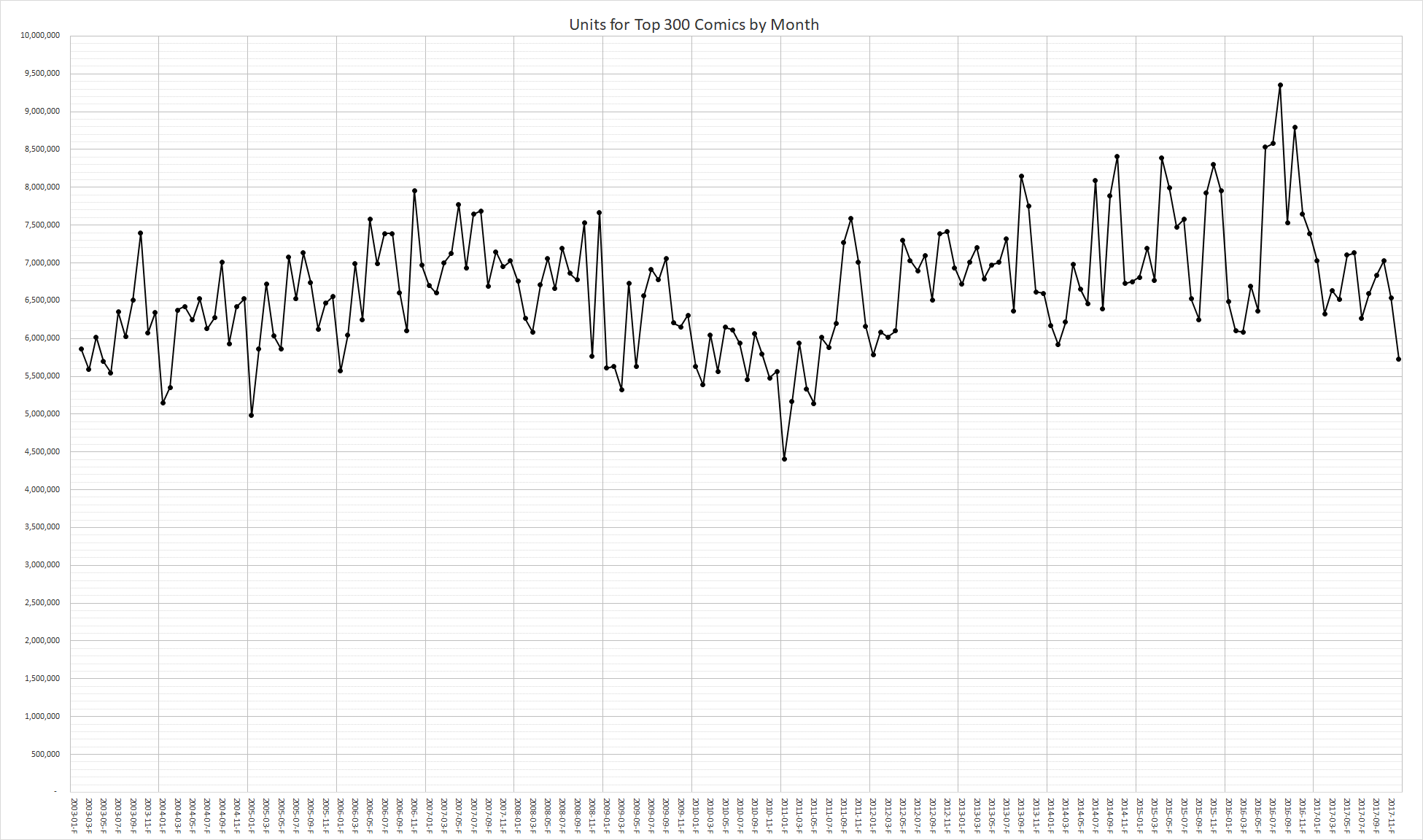

December 2017 had 5,726,608 units in the top 300 comics list, an decrease of 811,854 units from last month. This is the lowest the total units for top 300 comics sales has been since the May 2011. The top 300 comics averaged 5,525,358 units from July 2010 to June 2011 with a record low in January 2011 of 4,402,738 units. Things changes drastically over the course of 2011 with DC rebooting their super-hero line of comics with DC Rebirth which were offered with day-and-date release of digital versions of those comics. Before long day-and-date release of digital versions of comic became the norm. The top 300 comics has averaged 6,644,448 units over 2017 which closely matches the average of 6,645,570 units for the top 300 comics since February 2003 when Diamond first started releasing data based on invoices instead of preorders. Both averages are far below the record sales of 9,355,046 units in August 2016.

DC Comics placed 2,409,408 units in the top 300 comics and was down 515,069 units in the top 300 compared to last month and accounted for 42.07% of the total units for the top 300 comics. Marvel Comics placed 2,306,370 units in the top 300 comics and was down 141,613 units in the top 300 compared to last month and accounted for 40.27% of the total units for the top 300 comics. Image Comics placed 334,588 units in the top 300 comics and was down 138,926 units in the top 300 compared to last month and accounted for 5.84% of the total units for the top 300 comics. The premiere publishers accounted for 92.71% of the units in the top 300 comics this month while all of the other publishers with items in the top 300 accounted for 7.29% of the units.

The up-swing of 1,332,857 units from new and increased sales wasn't enough to compensate for the down-swing of 2,144,711 units from lost sales.

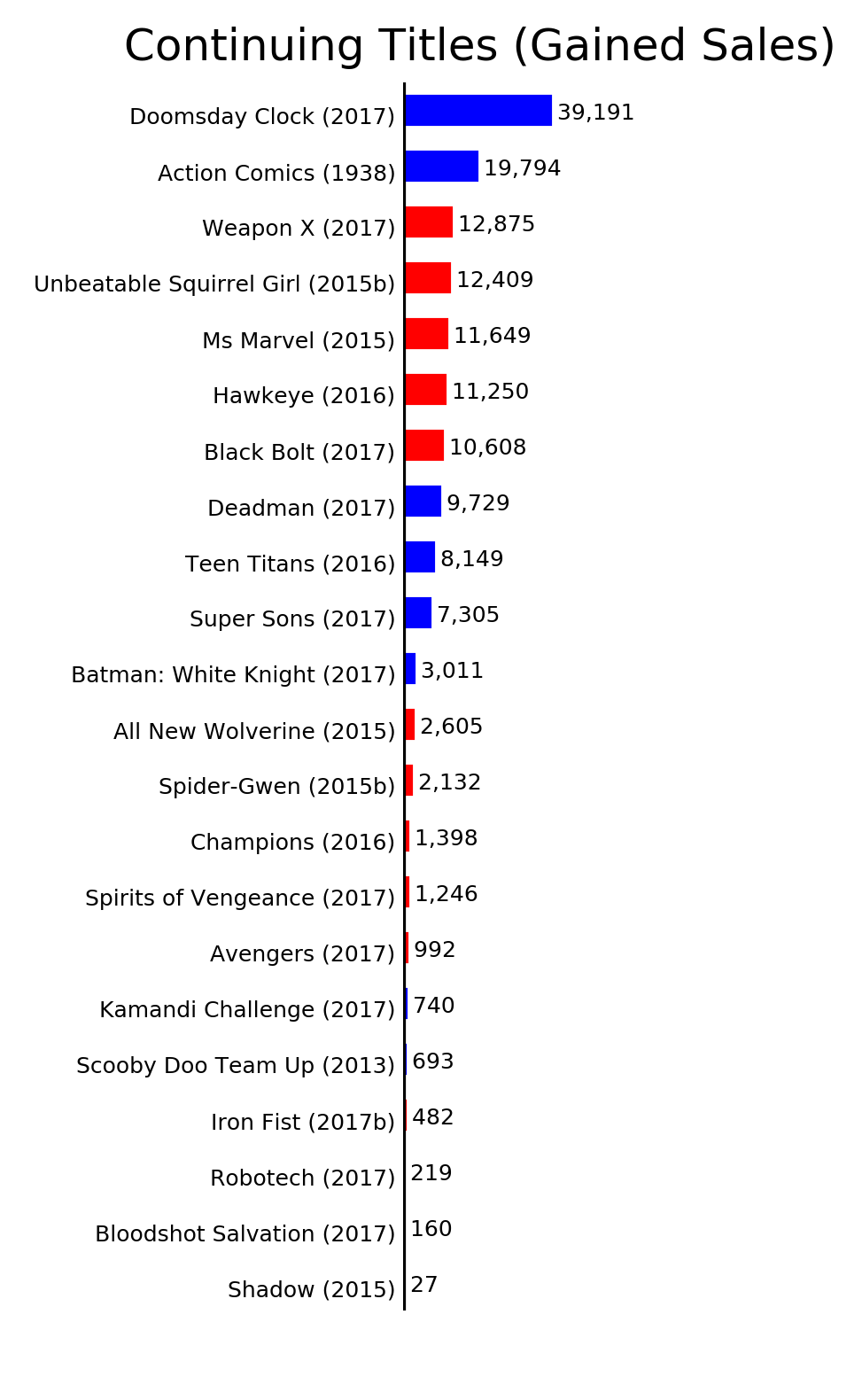

The continuing titles which gained sales category added 156,664 units compared to last month. The total for this category is a little misleading because of how different price versions of the same comic get reported. Last month _Doomsday Clock_ #1 had issues at two different price points because of the lenticular cover variant. Since the lenticular gimmick was only used on the first issue, I put those sales into the annuals/specials category since the sales of the lenticuilar cover couldn't continue from month to month. As a result, this month _Doomsday Clock_ has what looks like an increase in sales in this category of 39,191 units and a decrease of 119,231 units in the annuals/specials category. The net change in sales for the title is a drop of 80,040 units which does not include the 22,603 units of reorder activity this month.

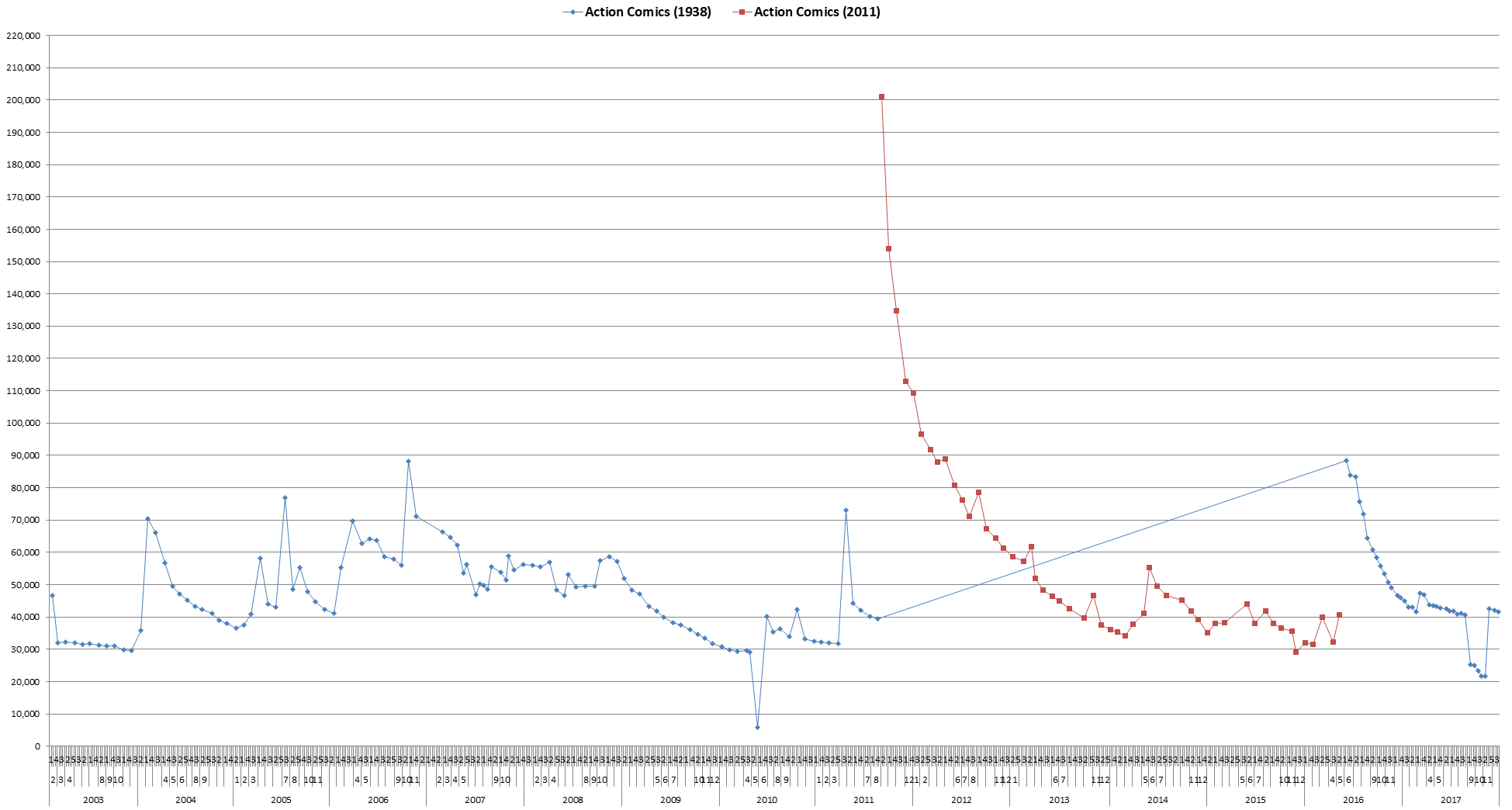

The same thing is happening with _Action Comics_ with the title selling slightly better than it was prior to "The Oz Effect" storyline. This chart shows the aggregation of sales including the lenticular covers and clearly illustrates how the total sales for the "The Oz Effect" storyline were well above average for the title:

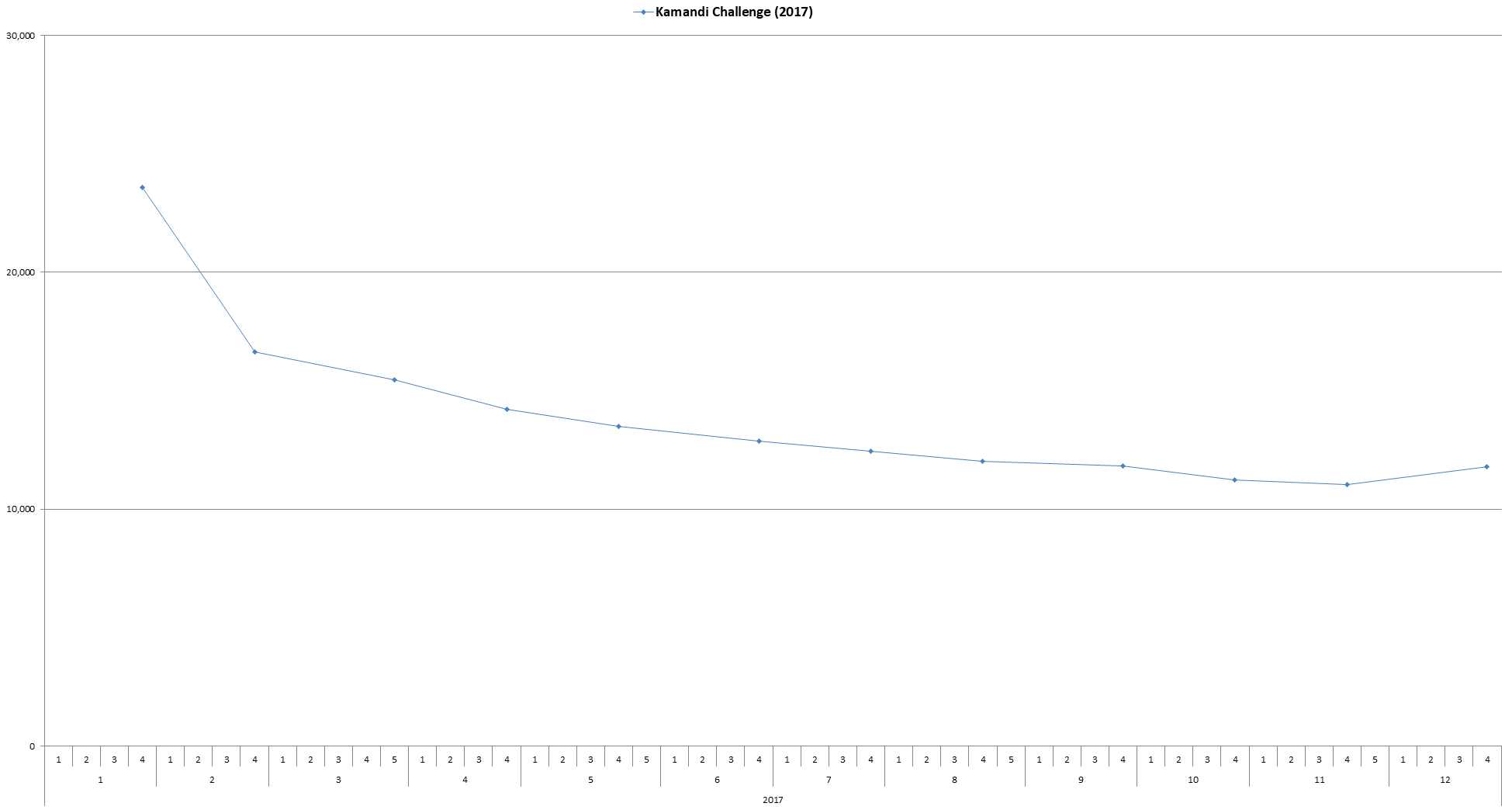

The _Kamandi Challenge_ completed in December with a slight uptick in sales. This conclusion bump happens with title with a potential audience curious enough about how things resolve but not curious enough to go long for the full journey of the story. Typically a major event series will see this sort of conclusion bump when the resolution of the event impacts the ongoing status quo of the narrative universe. In the case of _Kamandi Challenge_ which has no impact on any ongoing continuity, the conclusion bump is the result of people being curious if the final creative team could pull all of the plot threads together into a coherent story. The shared universe nature of comic book storytelling is one of the factors which causes this sales phenomenon.

The continuing titles which shipped more issues category added 96,133 units compared to last month. December had four shipping weeks compared to the five of November. A few titles had two issues releases instead of a single issue and most of them were Marvel titles. Unfortunately, releasing that additional issue didn't help _Ben Reilly, Scarlet Spider_ or _Doctor Strange_ which both had minor month to month drops in sales.

The recent sales on _Ben Reilly, Scarlet Spider_ are following the standard attrition slope. As with most Marvel titles these days, the heavy promotional push in the form of variant covers on the initial issue results in a massive second issue drop giving the impression readers are sampling a title only roughly half of them continue with it. If we had sell-through information we'd be able to tell if the regular copies are sitting idle on store shelves while the variant covers sell or if readers really are sampling these titles and not adding them to their reading list.

_Doctor Strange_ relaunched with Legacy numbering and the associated promotional push last month. _Doctor Strange_ #381 which launched the Legacy volume of the title had a regular cover, a 1-in-10 cover, a 1-in-25 cover, a 1-in-50 cover and two meet or exceed 175% of _Doctor Strange_ #24 covers. The following two issues released in December only had regular covers. The first of the two issues released in December lost half of the sales of the initial Legacy issue and following issue lost another 5.21% of sales taking the title from initial sales of 48,804 units down to 23,021 units in about six weeks.

The continuing titles with reasonably stable sales category removed 3,199 units compared to last month.

The continuing titles which shipped fewer issues category removed 372,903 units compared to last month. One fewer shipping weeks in the month results in some titles releasing fewer issue during the month. Since DC tends to publisher comics either once or twice a month and uses fifth weeks for annuals and things like the DC/Hanna-Barbera one-shots, the number of weeks doesn't impact DC too heavily. Marvel titles tend to show up in the category more often. Marvel titles accounted for 315,874 of the 372,903 units in this category this month which is nearly 85% of the units.

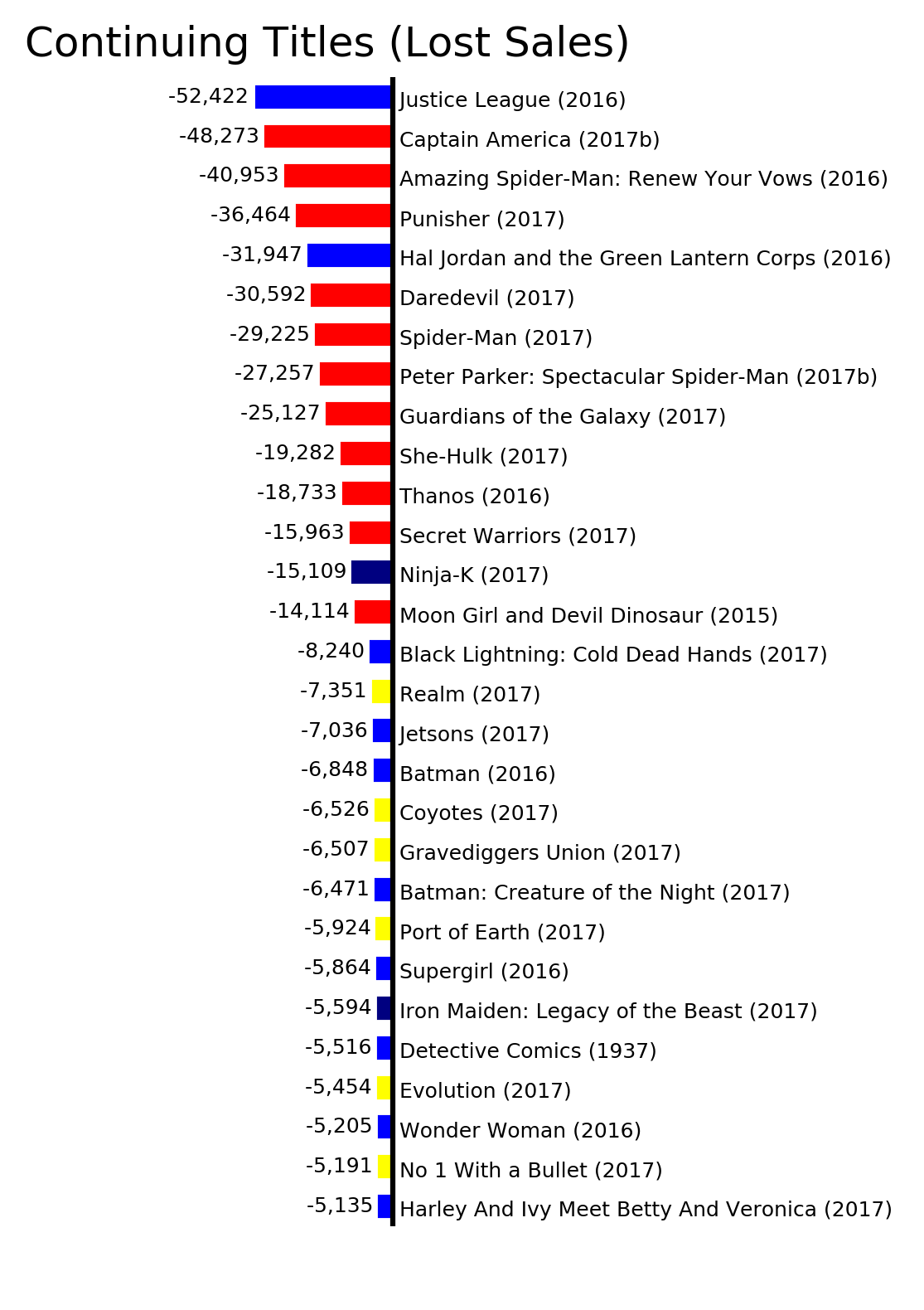

The continuing titles which lost sales category removed 659,554 units compared to last month. A little over 52% of the units lost were from Marvel titles. DC accounted for another 30% of the lost units and Image around another 9.5% of the units lost. This isn't shouldn't surprise anybody since it is a rough reflection of the typical breakdown of the sales for the top 300. _Hal Jordan and the Green Lantern Corps_ and _Justice League_ were both _Dark Nights: Metal_ tie-ins last month but were not this month. seem to be losing steam. Most of the losses at Marvel reflect drops on the new Legacy volumes of various titles.

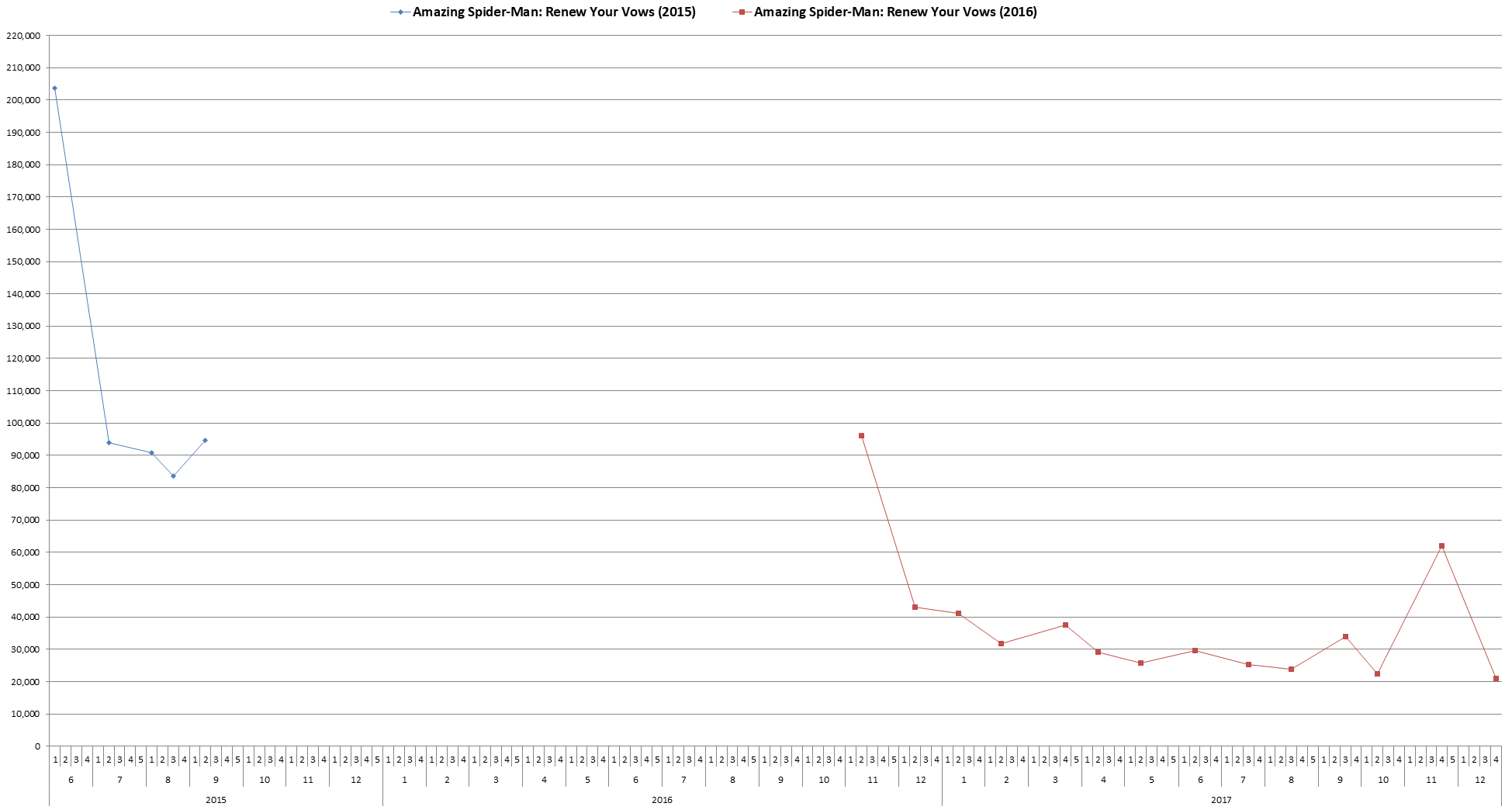

_Amazing Spider-Man: Renew Your Vows_ switched creative teams and jumped the story ahead eight years which effectively relaunched the title as far as the sales trends go. The 66.17% drop on _Amazing Spider-Man: Renew Your Vows_ #14 is the equivalent of a second issue drop. _Amazing Spider-Man: Renew Your Vows_ #13 had a regular cover, a 1-in-10 cover, a 1-in-25 cover and two meet or exceed 175% of _Amazing Spider-Man: Renew Your Vows_ #9 covers. All of the issues after that solicited in October through January only have a regular cover and no variant or incentive covers.

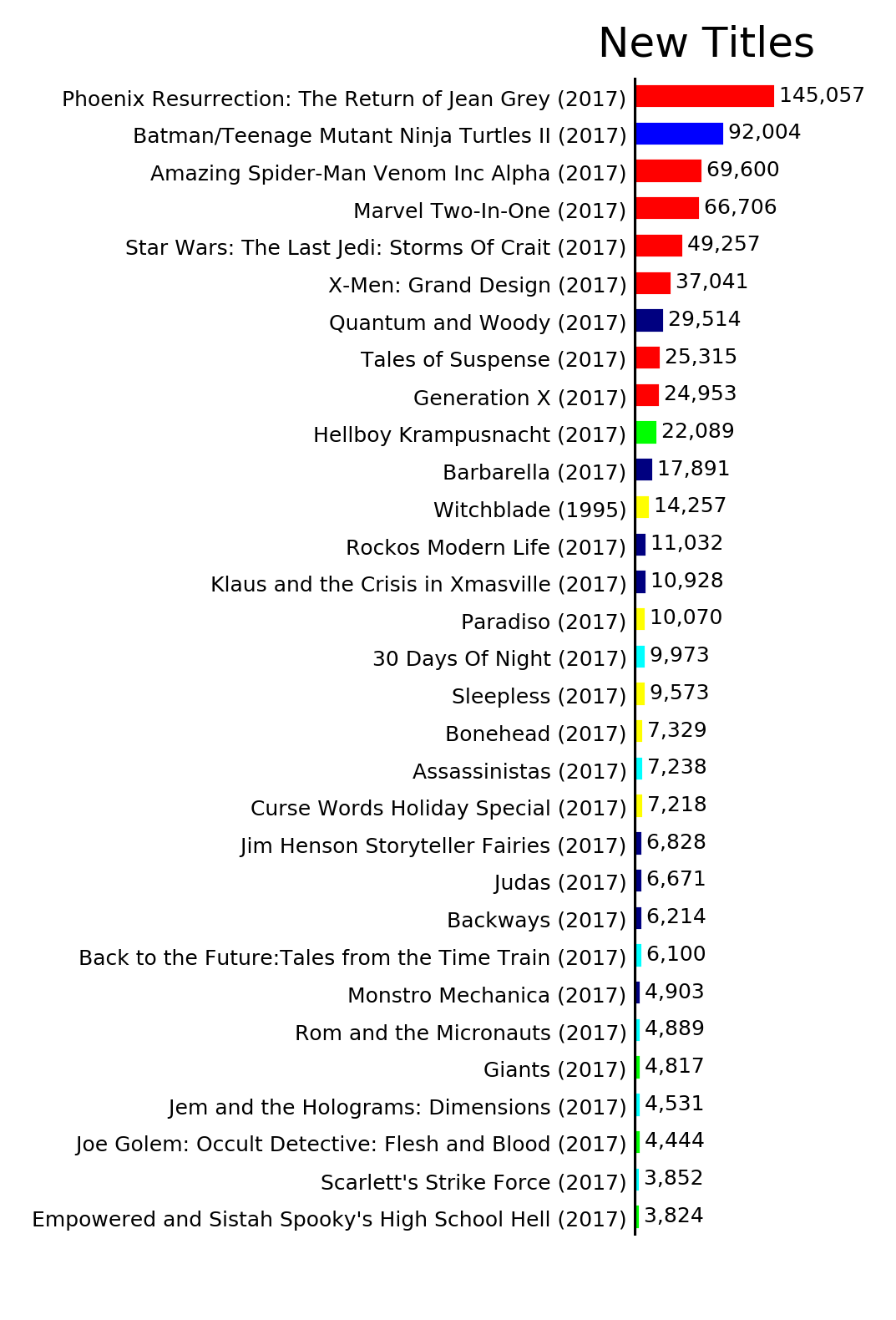

The new titles category added 724,118 units compared to last month. A couple of new titles launched strong in December: _Batman/Teenage Mutant Ninja Turtles II_, _Amazing Spider-Man Venom Inc Alpha_, _Marvel Two-In-One_ and _Phoenix Resurrection: The Return of Jean Grey_. _Phoenix Resurrection: The Return of Jean Grey_ #1 had a regular cover, an open-to-order cover, a 1-in-25 cover, a 1-in-25 cover, two 1-in-100 covers, a 1-in-1000 cover, a 1-in-2000 cover and two meet or exceed 225% of _Astonishing X-Men_ #2 covers. _Marvel Two-In-One_ had two 1-in-10 covers, a 1-in-25 cover, two 1-in-50 covers, a 1-in-1000 cover and two meet-or-exceed 200% of _Peter Parker Spectacular Spider-Man_ #2 covers. Expect significant drops on both of those titles. While both titles have promotional covers on some of subsequent issues they are much more limited in scope.

The returning titles category added 324,145 units compared to last month. _Dark Nights: Metal_ returns after a ten week gap and accounts for 47% of the units in this category.

The suspended titles category removed 342,792 units compared to last month. Image titles account for a little over half of the units in this category. Many of these are planned breaks in publication. _Mystic U_ is a bimonthly title so it will alternate between this category and the returning titles category.

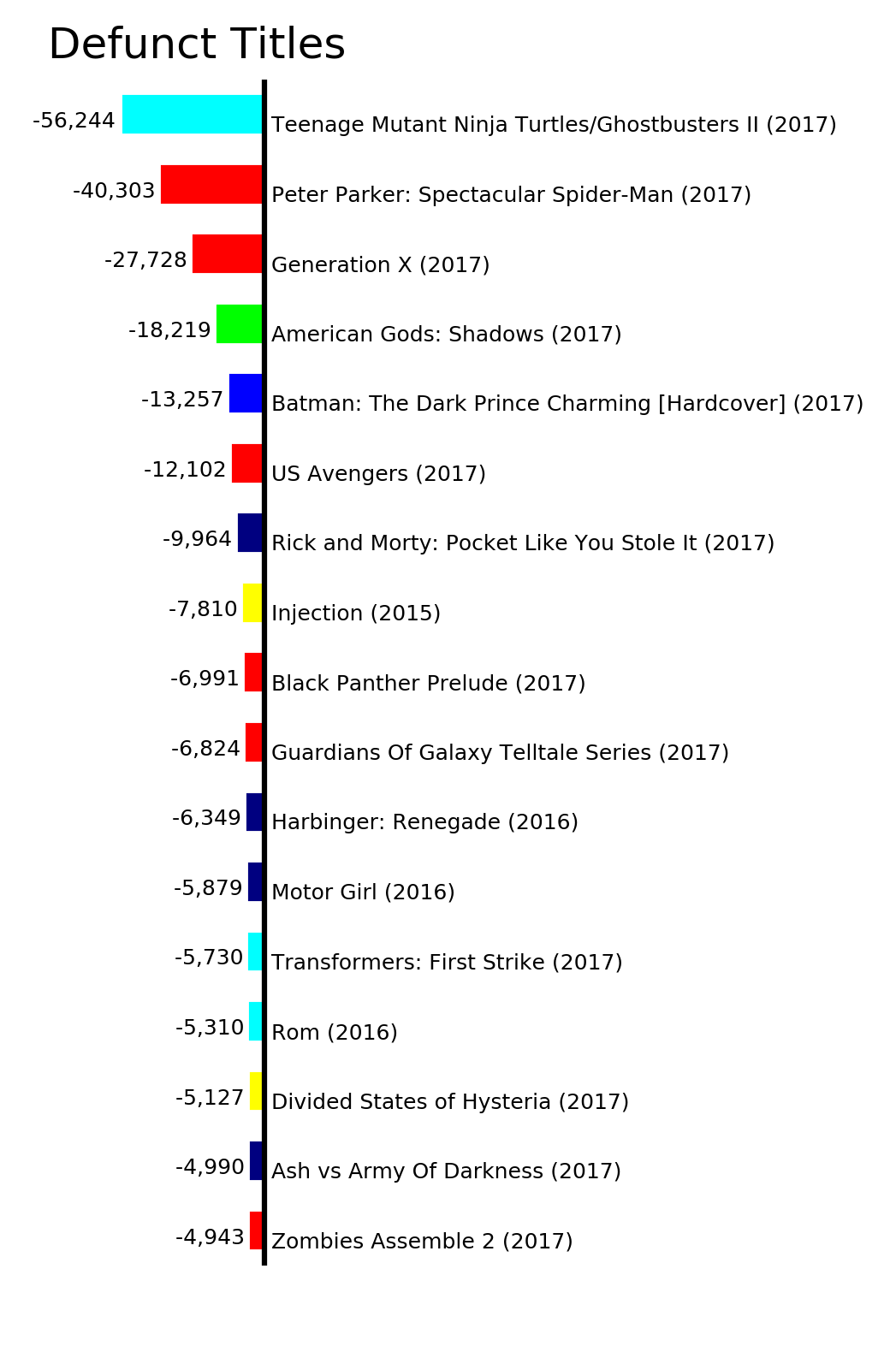

The defunct titles category removed 237,770 units compared to last month. _Batman: The Dark Prince Charming_ fell into the defunct category because the second part hasn't been solicited yet.

The annuals/specials category removed 351,107 units compared to last month. DC accounted for the majority of this category with most of that activity being annuals or oddities like the lenticular covers. DC's strategy of releasing annuals in five week months means there is additional product flowing through stores on those months without impacting the cadence of the ongoing titles.

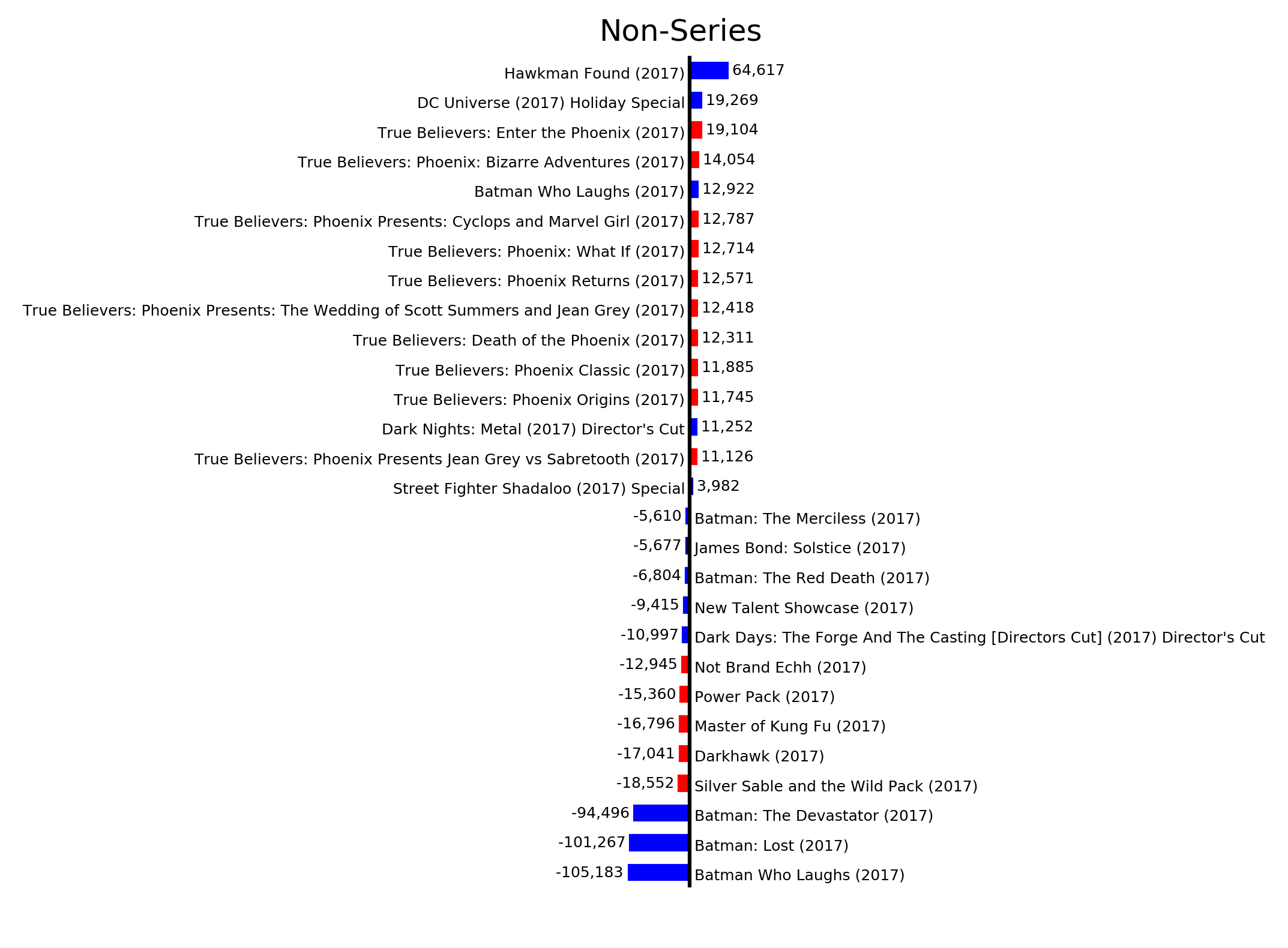

The non-series category removed 177,386 units compared to last month. Marvel had a net increase of 50,021 units in this category this month with the True Believers reprints more than compensating for the Legacy one-shots from last month. DC had a net loss of around 225,712 units in the category this month because of the various _Dark Nights: Metal_ one-shots from last month. The nature of this category is a positive one month becomes as corresponding negative the next since these are items and sales which aren't expected to repeat from month to month.

The reorders category added 31,797 units compared to last month. DC accounts for the net increase reorder activity in this month with both _Batman: White Knight_ and _Doomsday Clock_ having over 15,000 units each in reorders.

DC is in the unusual state of having two event titles (_Dark Nights: Metal_ and _Doomsday Clock_) and a strong out of continuity miniseries of _Batman: White Knight_ all running in parallel. Those three titles added 424,424 units to DC's total units for December. Meanwhile, Marvel is in the honeymoon period with the Legacy volumes of numerous titles and the resulting loss in sales during that part of the typical sales trend.

_X-Men: Grand Design_ is the first of three miniseries which attempts to put the entire X-Men continuity together in chronological order. While I'd like to think this is a sign of Marvel recognizing the advantages of having a clear continuity and telling stories which gracefully fit inside it, Marvel has a long love/hate relationship with the very concept of continuity. On the one hand, Marvel has a decades long unbroken continuity even if there are some major quirks in it. On the other hand, editors and creators at Marvel have from time to time been very dismissive of continuity both in what they have said and in some of the stories themselves. One of the things which makes comic book story telling unique is the use shared universes and continuity. When done well, the stories fell all the more real because there are consequences to the actions the characters take. Long term readers often get a layer of a story which provides a payoff for the investment in the story over a prolonged period. These factors are what create things like the conclusion bump at the end of stories the readers deem important.