Mayo Report for 2017-07

|

|

Top Comics List Top Comics Breakdown Top Trades List Top Trades Breakdown

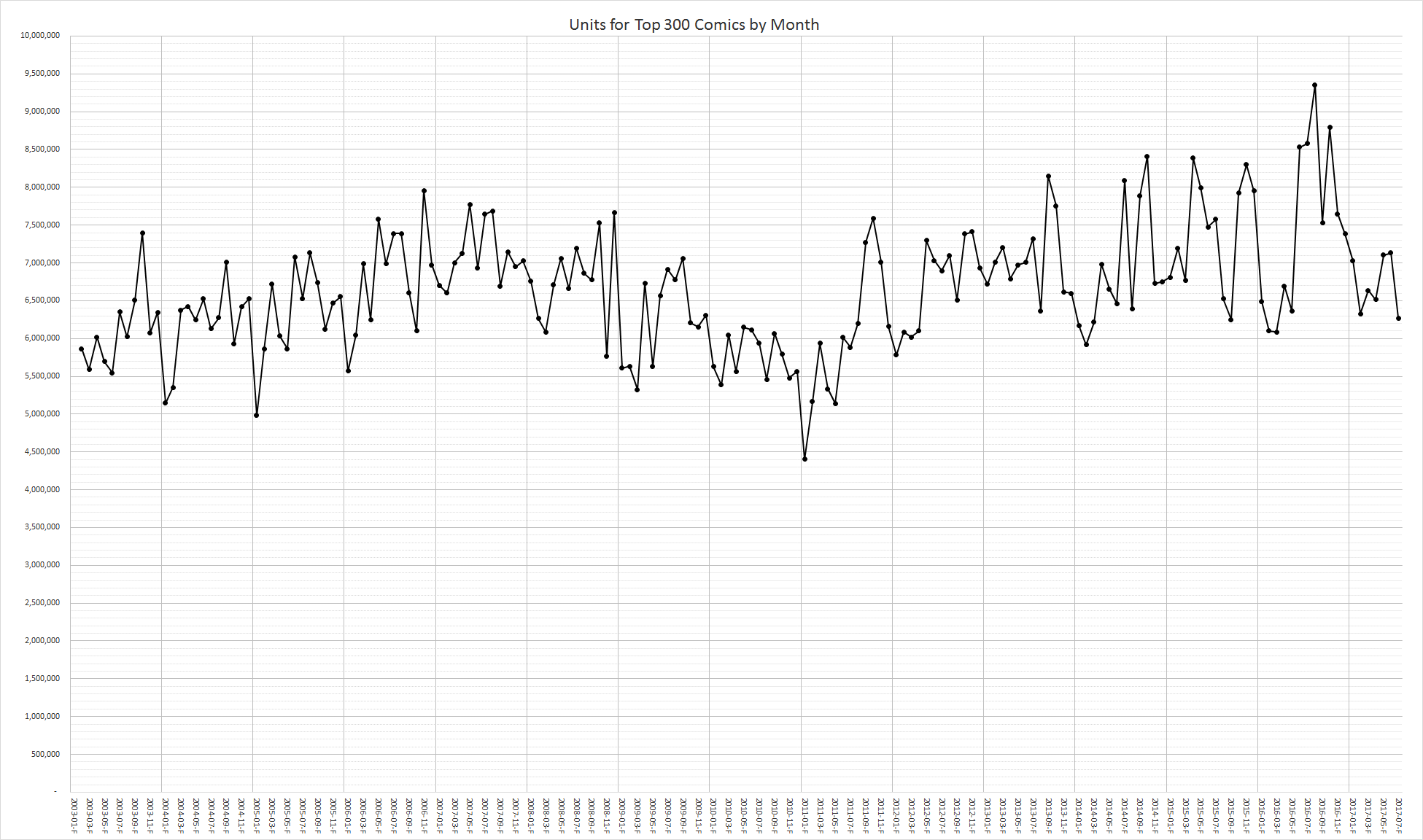

July 2017 had 6,238,806 units in the top 300 comics list, an decrease of 893,193 units from last month. This is the lowest the total units for the top 300 comics has been since the 6,087,932 units in March 2016.

While the aggregate sales aren't as bad as they were around the beginning of 2011, they are among the lowest we've seen since the around the start of 2012. Comics sales are inherently unstable given the constant rotation of titles over time.

The July 2017 sales equate to $24,007,622.00 at full cover price which is more than the $23,060,631.20 cover price total from February 2017.

The retail dollar trend over that same period looks a lot stronger. Much of that is due to the cover price increase over that last few years. Over the past few years a number of titles have gone from $2.99 to $3.99. What seems to have happened more frequently is a $2.99 title ending and getting replaced by a $3.99 title. The first case is a price hike while technically the second case isn't a price hike. It is a subtle distinction but it is more than a matter of semantics. It is a marketing tactics the publishers use to disguise the need to increase the cover price as sales on titles decline.

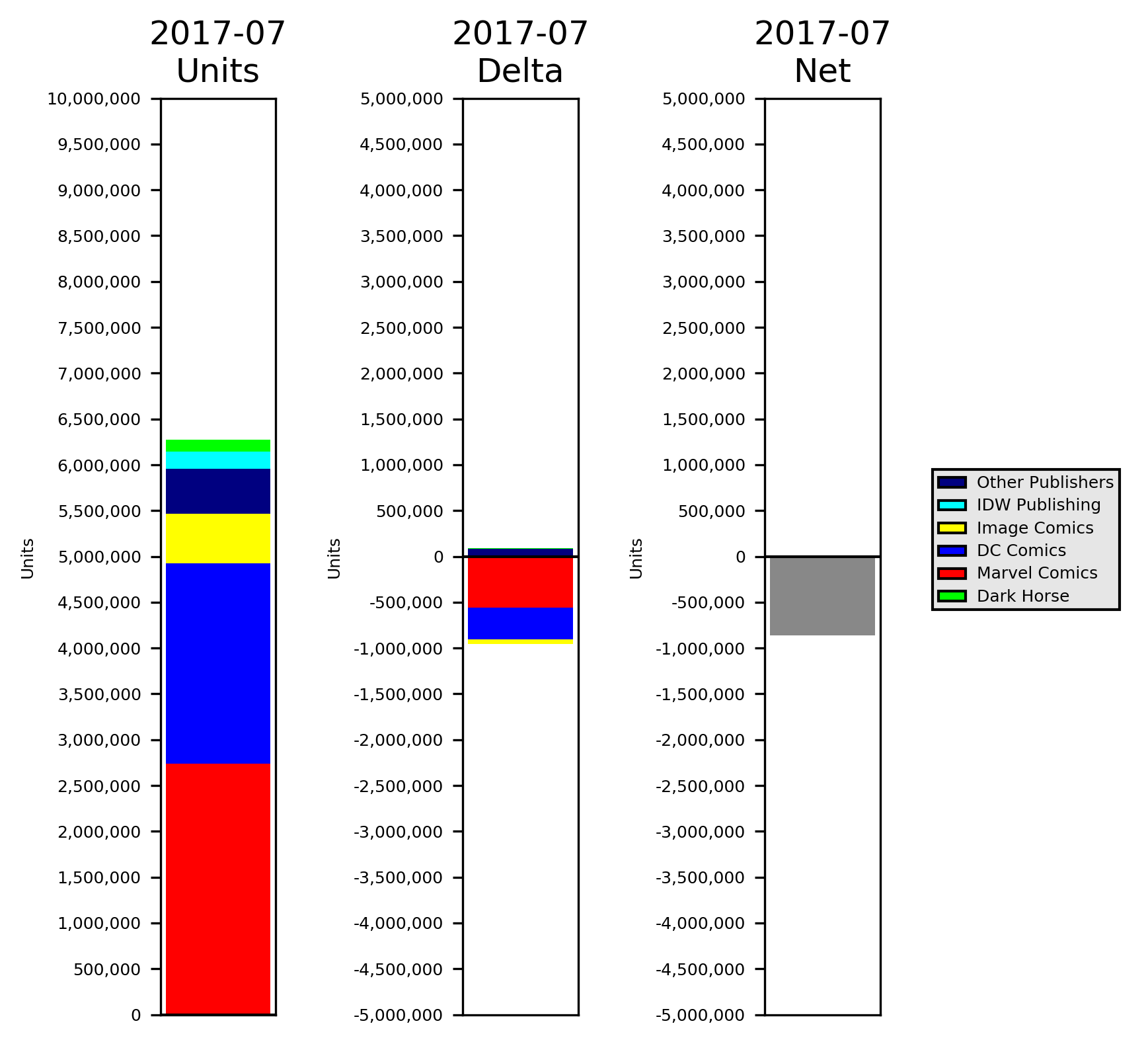

Marvel Comics placed 2,741,591 units in the top 300 comics and was down 560,174 units in the top 300 compared to last month and accounted for 43.72% of the total units for the top 300 comics.

We may be about to see a fundamental shift in how Marvel operates with the upcoming legacy numbering. For years Marvel has been rotating titles in an out on a regular basis. Some of these titles like the recent Thunderbolts series serves as a bridge from one event to another. These events serve as de facto demarcations of the change of "seasons" at Marvel. Shifting to legacy numbering seems to imply this practice of continually stopping and restarting titles is at an end, at last for a while, at Marvel. After all, it doesn't make sense to renumber a title to the legacy numbering only to relaunch the title with yet another #1 six month or a year or so from now.

Marvel has been heavily reliant on the sales boost from first issue and the various incentive covers they tend to have. Presuming the use of incentive covers decreases, shifting to legacy numbering may hep stabilize sales on Marvel titles but removing the sales inflate on fist issues from those variant covers and the corresponding sharp second issue drops on those titles. Of course, there is no reason to think Marvel will cut back on the heavy use of incentive covers until the marketing tactic stops working for them.

DC Comics placed 2,179,447 units in the top 300 comics and was down 343,927 units in the top 300 compared to last month and accounted for 34.75% of the total units for the top 300 comics. This is the lowest total for the DC portion of the top 300 comics since May 2016 when DC only accounted for 1,801,203 units for the top 300 comics. In July, Dark Days: The Casting #1 topped the list with 128,261 units which is 2,390 units above the sales of Dark Days: The Forge #1 last month. Hopefully this will be a strong event for DC and serve to increase interest and sales across the line.

Image Comics placed 545,565 units in the top 300 comics and was down 48,953 units in the top 300 compared to last month and accounted for 8.70% of the total units for the top 300 comics.

IDW Publishing placed 181,826 units in the top 300 comics and was up 3,331 units in the top 300 compared to last month and accounted for 2.90% of the total units for the top 300 comics.

Dark Horse placed 130,550 units in the top 300 comics and was up 5,243 units in the top 300 compared to last month and accounted for 2.08% of the total units for the top 300 comics.

The premiere publishers accounted for 92.63% of the units in the top 300 comics this month while all of the other publishers with items in the top 300 accounted for 7.37% of the units.

BOOM! Studios placed 113,907 units in the top 300 comics and was up 51,090 units in the top 300 compared to last month and accounted for 1.82% of the total units for the top 300 comics.

Dynamite Entertainment placed 100,667 units in the top 300 comics and was down 22,054 units in the top 300 compared to last month and accounted for 1.61% of the total units for the top 300 comics.

Valiant Entertainment placed 70,296 units in the top 300 comics and was up 5,038 units in the top 300 compared to last month and accounted for 1.12% of the total units for the top 300 comics.

Aftershock Comics placed 48,504 units in the top 300 comics and was up 3,250 units in the top 300 compared to last month and accounted for 0.77% of the total units for the top 300 comics.

Archie Comics placed 40,266 units in the top 300 comics and was down 6,995 units in the top 300 compared to last month and accounted for 0.64% of the total units for the top 300 comics.

Oni Press placed 37,016 units in the top 300 comics and was up 11,643 units in the top 300 compared to last month and accounted for 0.59% of the total units for the top 300 comics.

Action Lab Entertainment placed 15,848 units in the top 300 comics and was up 9,893 units in the top 300 compared to last month and accounted for 0.25% of the total units for the top 300 comics.

Benitez Productions placed 14,065 units in the top 300 comics and accounted for 0.22% of the total units for the top 300 comics. Lady Mechanika: Clockwork Assassin #1 at rank 147 was the only item for Benitez Productions in the top 300 comics in July. The Lady Mechanika property launched in 2010 through Aspen. The character and title faded away between 2012 and 2014 but Joe Benitez has been writing and drawing a handful of miniseries featuring the character over the past two years under his own banner of Benitez Productions. Many DC and Marvel titles sell below 14,000 units. While the Lady Mechanika property might not seem like a huge success to some people, it is just one of many of the smaller, quieter success stories in the industry. Just because a creator owned title from a publisher hidden in the back of Previews isn't at the top of the sales chart, or even on it for that matter, doesn't mean it isn't successful or profitable.

Black Mask Studios placed 8,781 units in the top 300 comics and was up 2,976 units in the top 300 compared to last month and accounted for 0.14% of the total units for the top 300 comics.

UDON Entertainment placed 7,596 units in the top 300 comics with Street Fighter 2017 Swimsuit Special and was down 4,192 units in the top 300 compared to last month and accounted for 0.12% of the total units for the top 300 comics.

Abstract Studios placed 6,596 units in the top 300 comics with Motor Girl #7 at rank 250 and accounted for 0.11% of the total units for the top 300 comics.

Bongo Entertainment placed 5,876 units in the top 300 comics with Simpsons Comics #240 at rank 269 and accounted for 0.09% of the total units for the top 300 comics.

Broadsword Comics placed 4,841 units in the top 300 comics with Tarot: Witch of the Black Rose #105 at rank 290 and accounted for 0.08% of the total units for the top 300 comics.

United Plankton Pictures placed 4,574 units in the top 300 comics with Spongebob Comics #20 at rank 293 and accounted for 0.07% of the total units for the top 300 comics.

Space Goat Publishing placed 4,552 units in the top 300 comics with Howling #1 at rank 294 and accounted for 0.07% of the total units for the top 300 comics.

Albatross Funnybooks placed 4,492 units in the top 300 comics with Namwolf #4 at rank 298 and accounted for 0.07% of the total units for the top 300 comics.

American Mythology placed 4,474 units in the top 300 comics with Casper, The Friendly Ghost #1 at rank 299 and accounted for 0.07% of the total units for the top 300 comics.

Joe Books and Titan Comics dropped out of the top 300 comics this month.

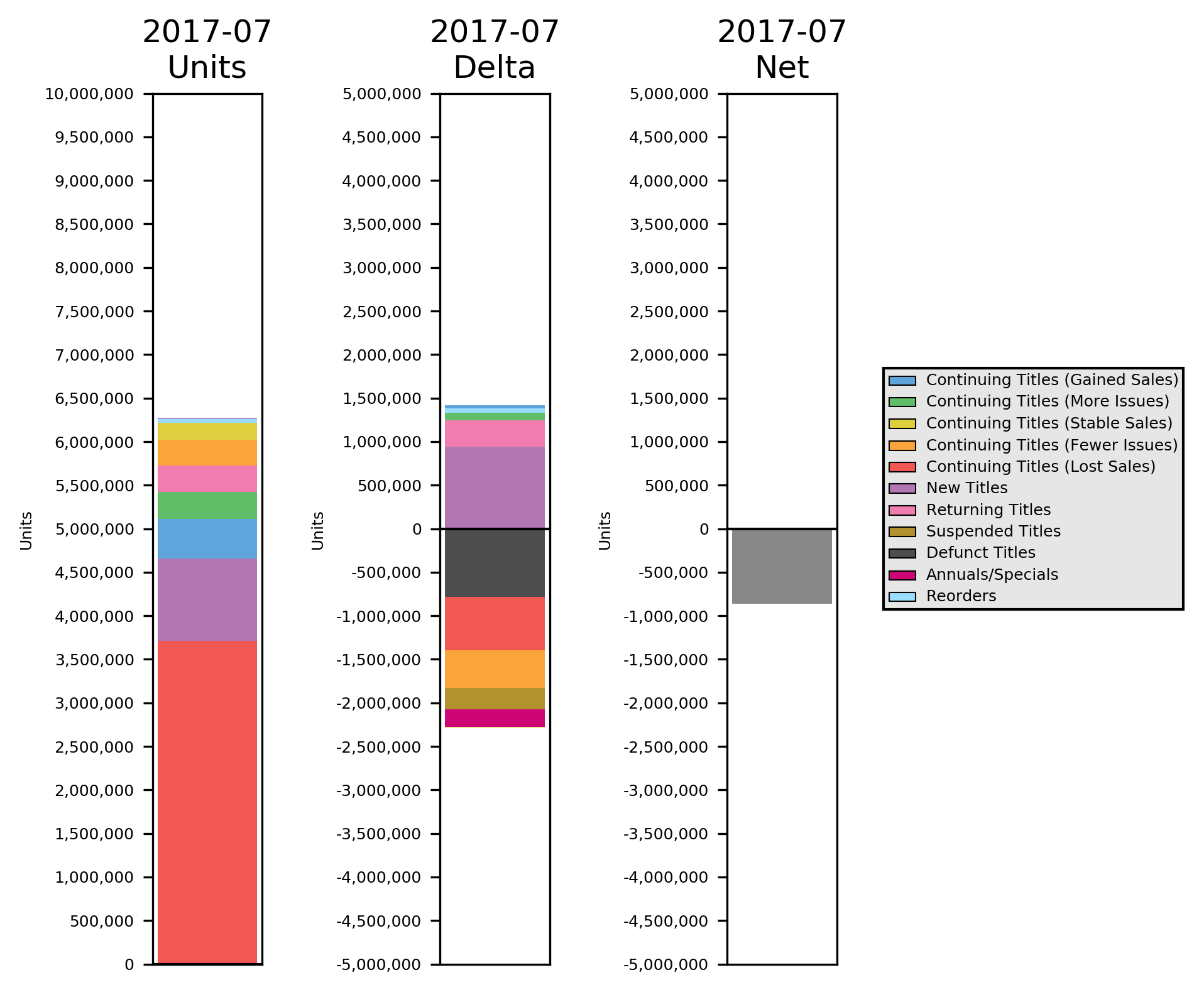

The categories increasing month-to-month sales caused an up-swing of 1,419,992 units while the categories decreasing month-to-month sales caused a down-swing or 2,280,661 units resulting in a net loss of 860,669 units for the month.

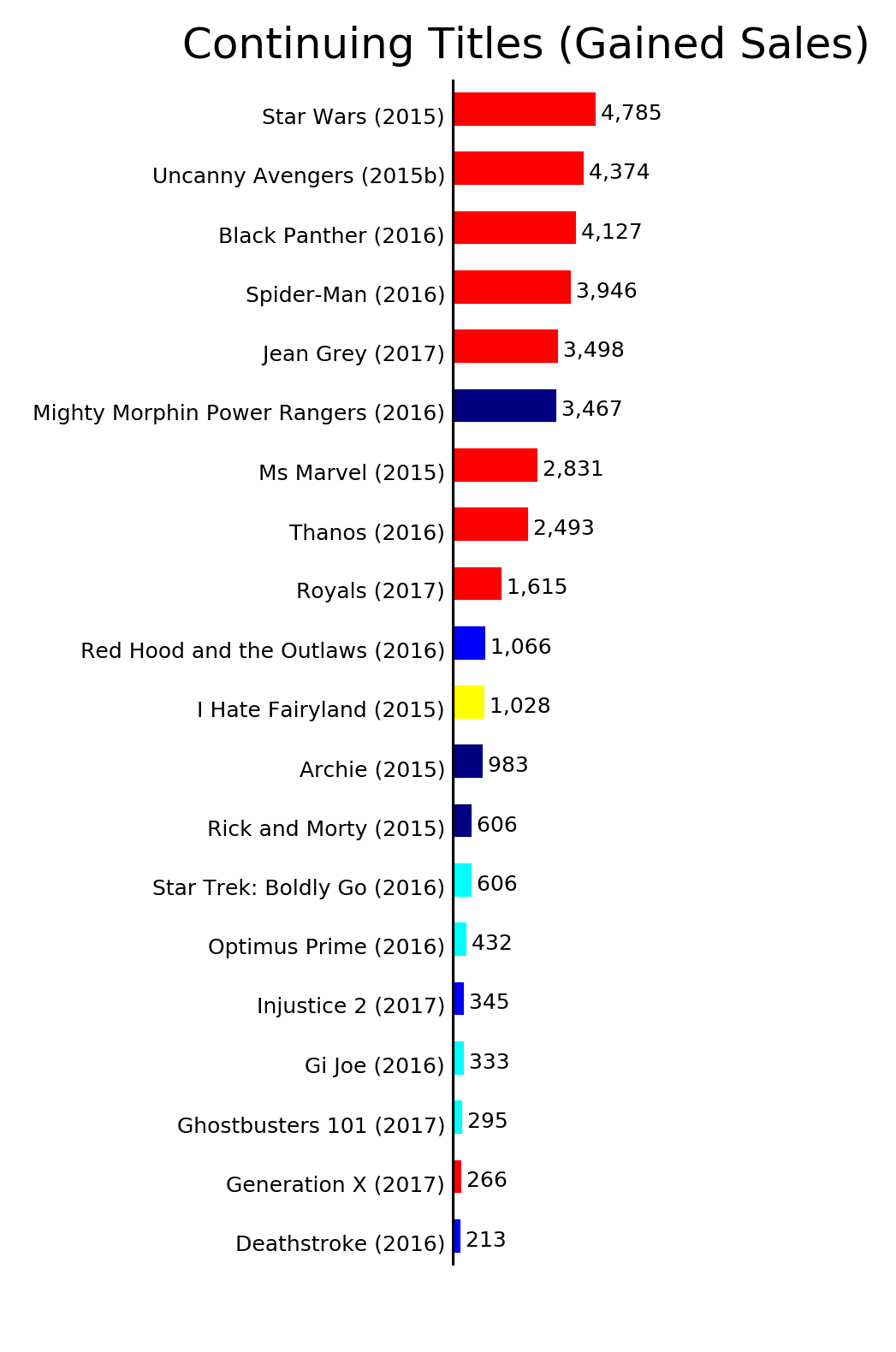

The continuing titles which gained sales category added 37,309 units compared to last month. Most of the month-to-month sales gains happened on Marvel titles with Star Wars having the largest gain of 4,785 units.

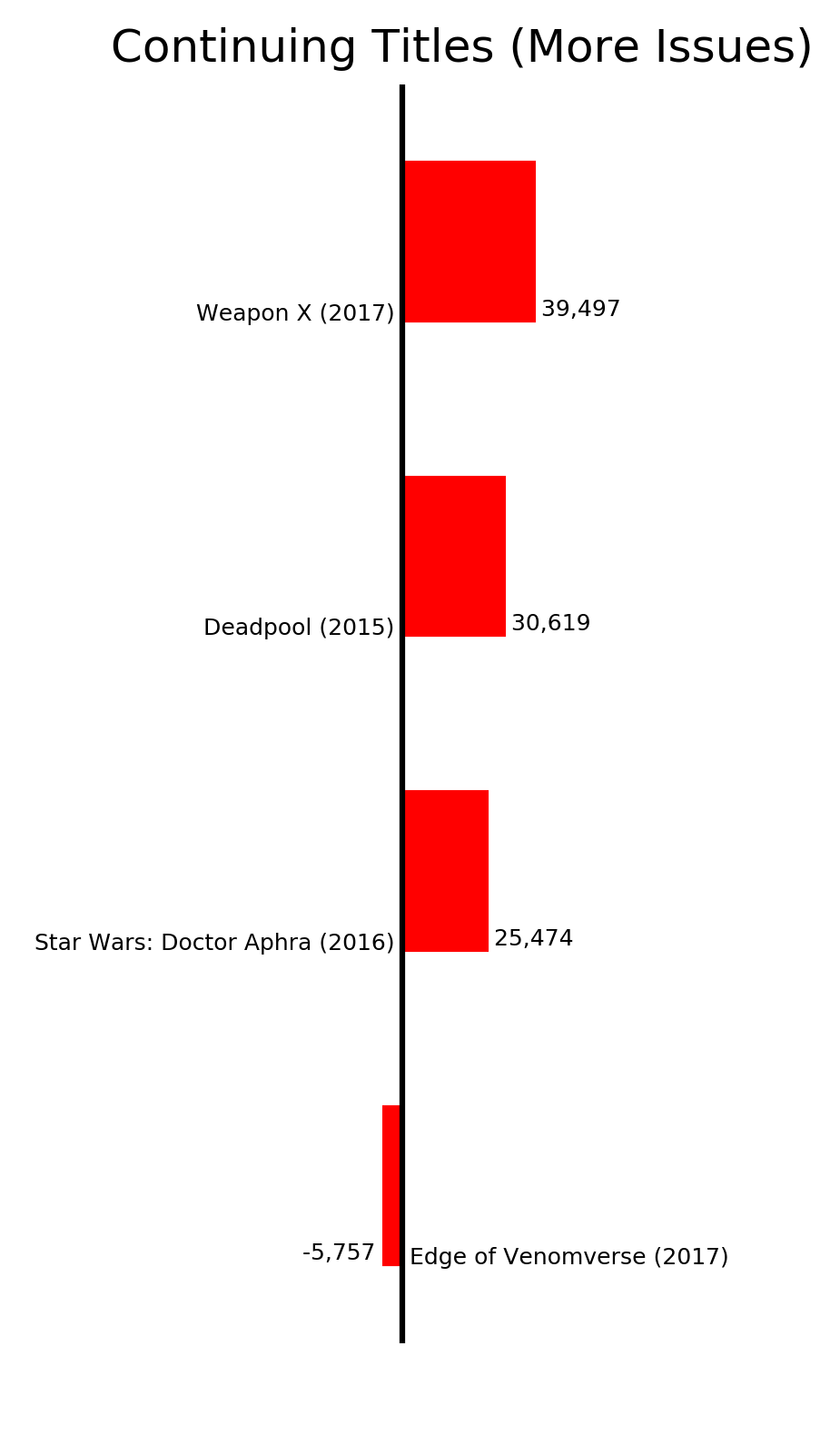

The continuing titles which shipped more issues category added 89,833 units compared to last month. June and July both had four weeks. Four titles shipped 2 issues in July compared to a single issue per title in June. Most of the titles increased in sales as a result but Edge of Venomverse dropped by 5,757 units since the sales of the second and third issues released in July failed to measure up to the first issue sales in June.

The continuing titles with reasonably stable sales category removed 1,719 units compared to last month. The definition of stable sales is a month-to-month lose of no more than 250 units.

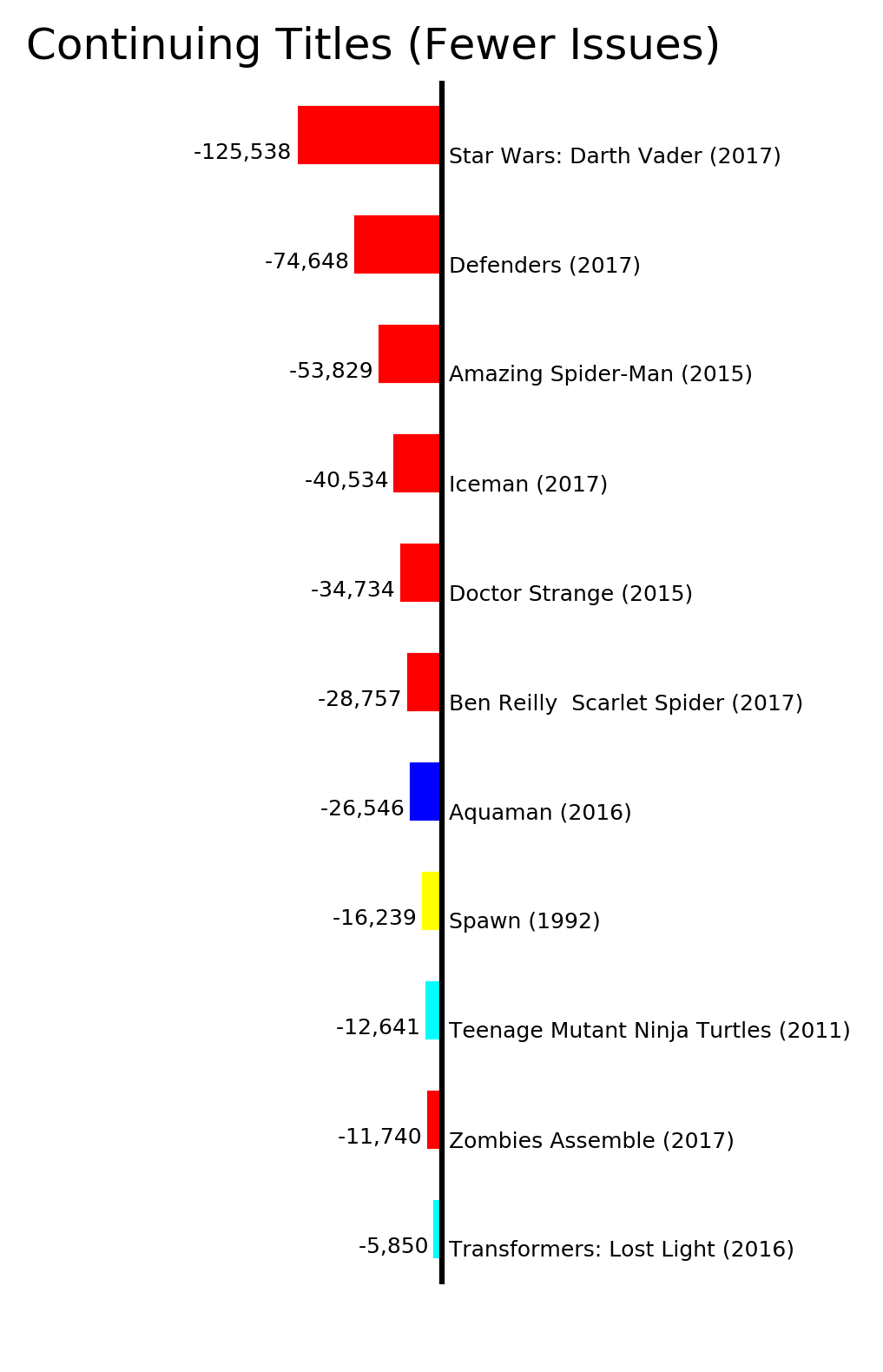

The continuing titles which shipped fewer issues category removed 431,056 units compared to last month. Most of the units lost in this category were on Marvel titles. Star Wars: Darth Vader lost the most units due to the first two issues of the volume coming out last month and only the third issue this month. Star Wars: Darth Vader #3 sold 59,522 units this month but the first issue sold 118,644 units and the second issue sold 66,416 units both of which shipped last month. The issue to issue drop of 10,38% on the third issue isn't bad but leaves the volume selling about half of the units of the first issue.

Defenders was a similar matter of the first two issues shipping in June and only the third issue shipping in July Defenders #1 sold 64,253 units, Defeders #2 sold 46,158 units and Defenders #3 sold 35,763 units.

As should be expected, a title which launches and ships multiple issues in a given month can show up in this category with what appears to be a huge drop the following month even if the issue-to-issue drops are within the expected ranges.

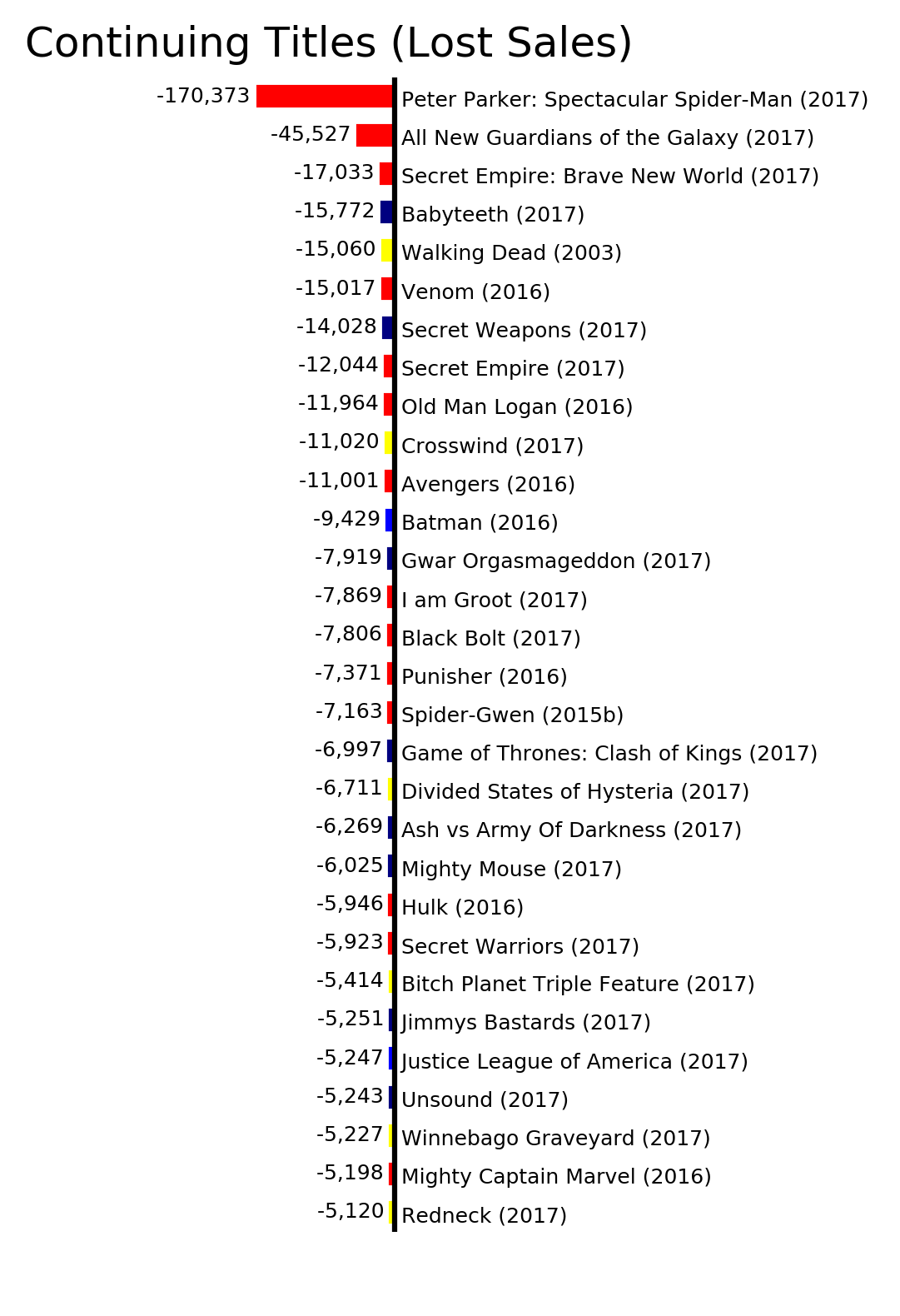

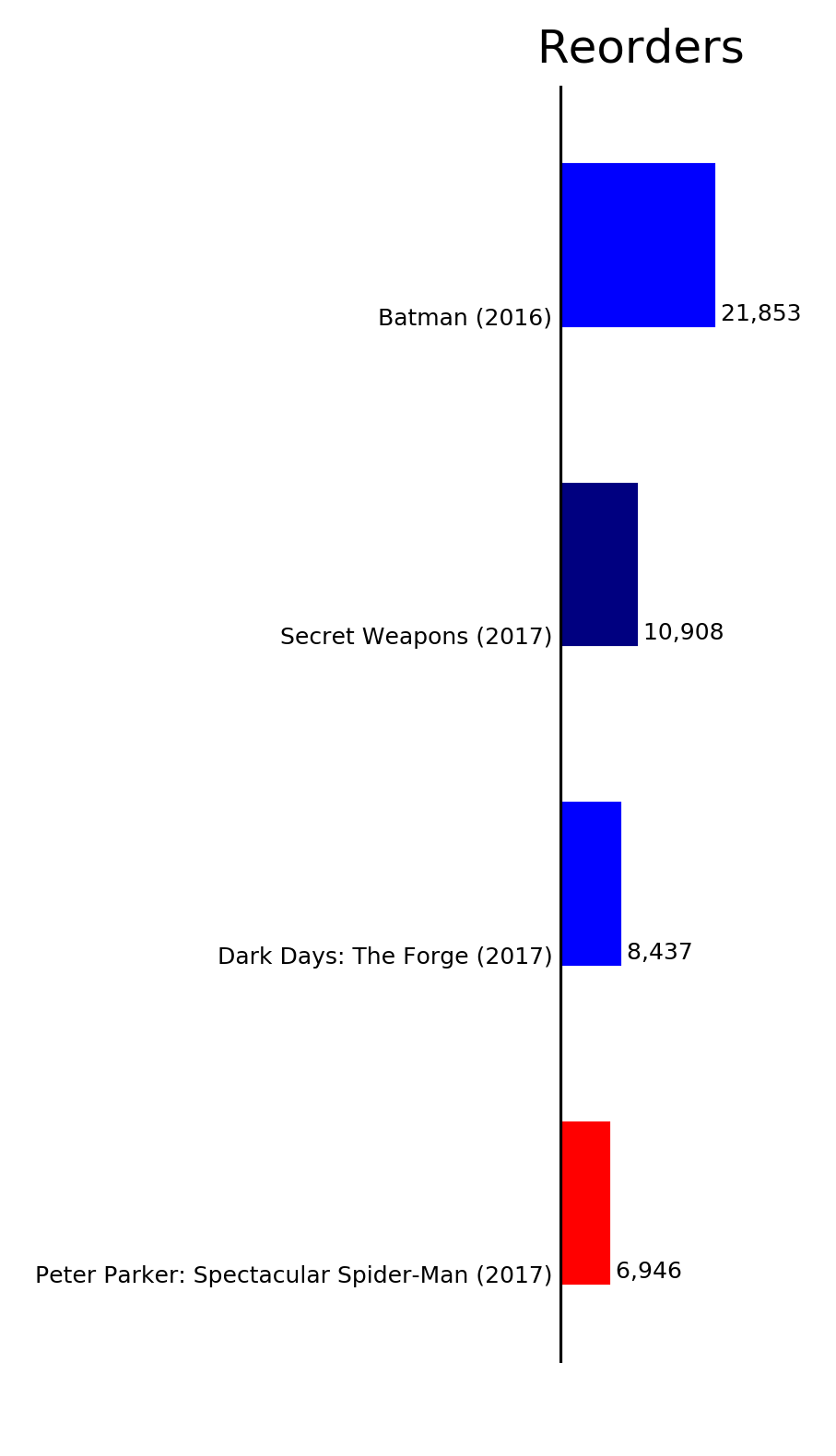

The continuing titles which lost sales category removed 614,860 units compared to last month. Unsurprisingly, the title with the largest drop in this category was Peter Parker: Spectacular Spider-Man with a month-to-month loss of 170,373 units. The issue-to-issue drop on Peter Parker: Spectacular Spider-Man #2 was a slightly larger 177,319 unit drop which equates to 76.97% of the first issue sales because of the 6,946 units of reorder activity on the first issue in July. The result is Peter Parker: Spectacular Spider-Man #2 sold about 1,813 units below Amazing Spider-Man #30.

In the past, the flagship title of of a franchise often sold about twice the sales of the next best selling title in the franchise. That heuristic doesn't seem to apply as much these days and certainly doesn't apply to the Spider-Man franchise. The Spider-Man franchise is rather confusing these days with Amazing Spider-Man and now Peter Parker: Spectacular Spider-Man feature the Peter Parker Spider-Man while Spider-Man features the Miles Morales Spider-Man and Spider-Man 2099 features a time displaced Spider-Man from 2099. Adding to the confusion is the Ben Reilly, Scarlet Spider featuring the Ben Reilly clone of the Peter Parker Spider-Man.

The new titles category added 944,878 units compared to last month. Most of the increases here are from Dark Days: The Casting, Astonishing X-Men, Deadpool Kills the Marvel Universe Again and Spider-Men II.

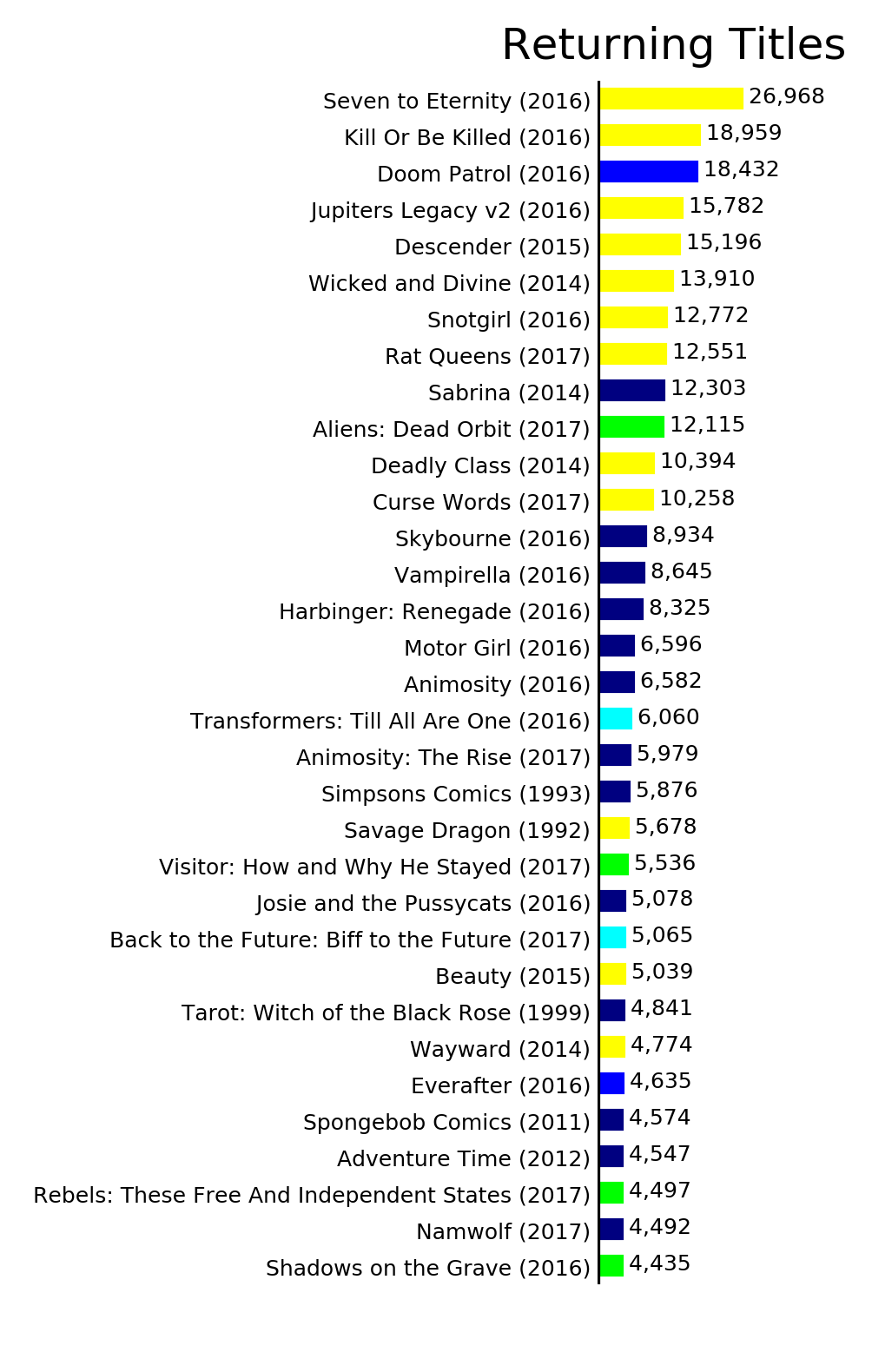

The returning titles category added 299,828 units compared to last month. A number of Image titles shipped in July after being absent from the top 300 comics list for one or more months. While some titles might be returning from a schedule haitus, a few like Doom Patrol and Skybourne were just late.

The suspended titles category removed 246,204 units compared to last month. A number of titles didn't ship in July. Some of these were expected either because of how the title was scheduled. Other titles like Silver Surfer seem to just be running late.

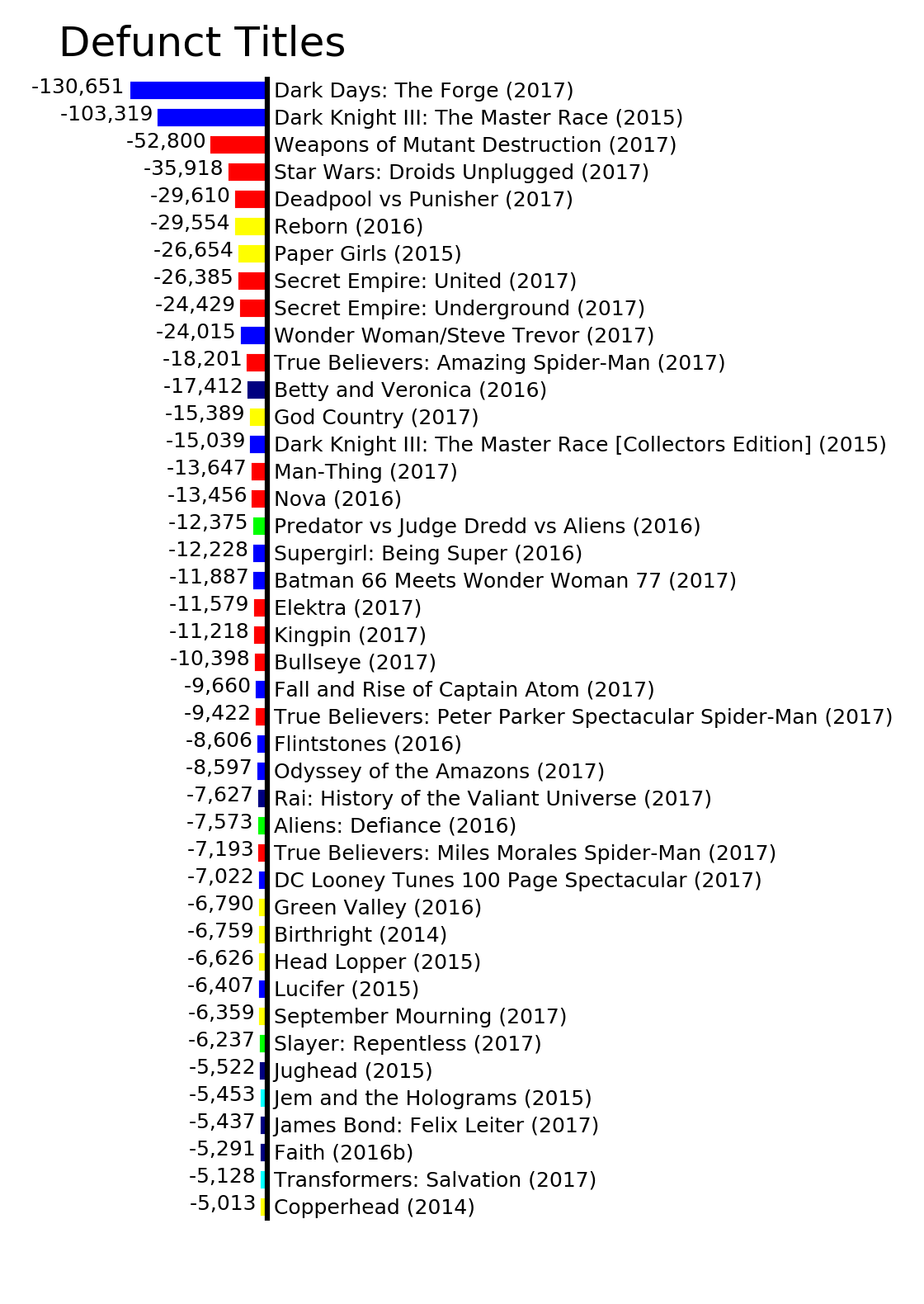

The defunct titles category removed 782,886 units compared to last month. Dark Days: The Forge and Dark Knight III: The Master Race end last month taking 233,970 of the units from June off the board for DC in July.

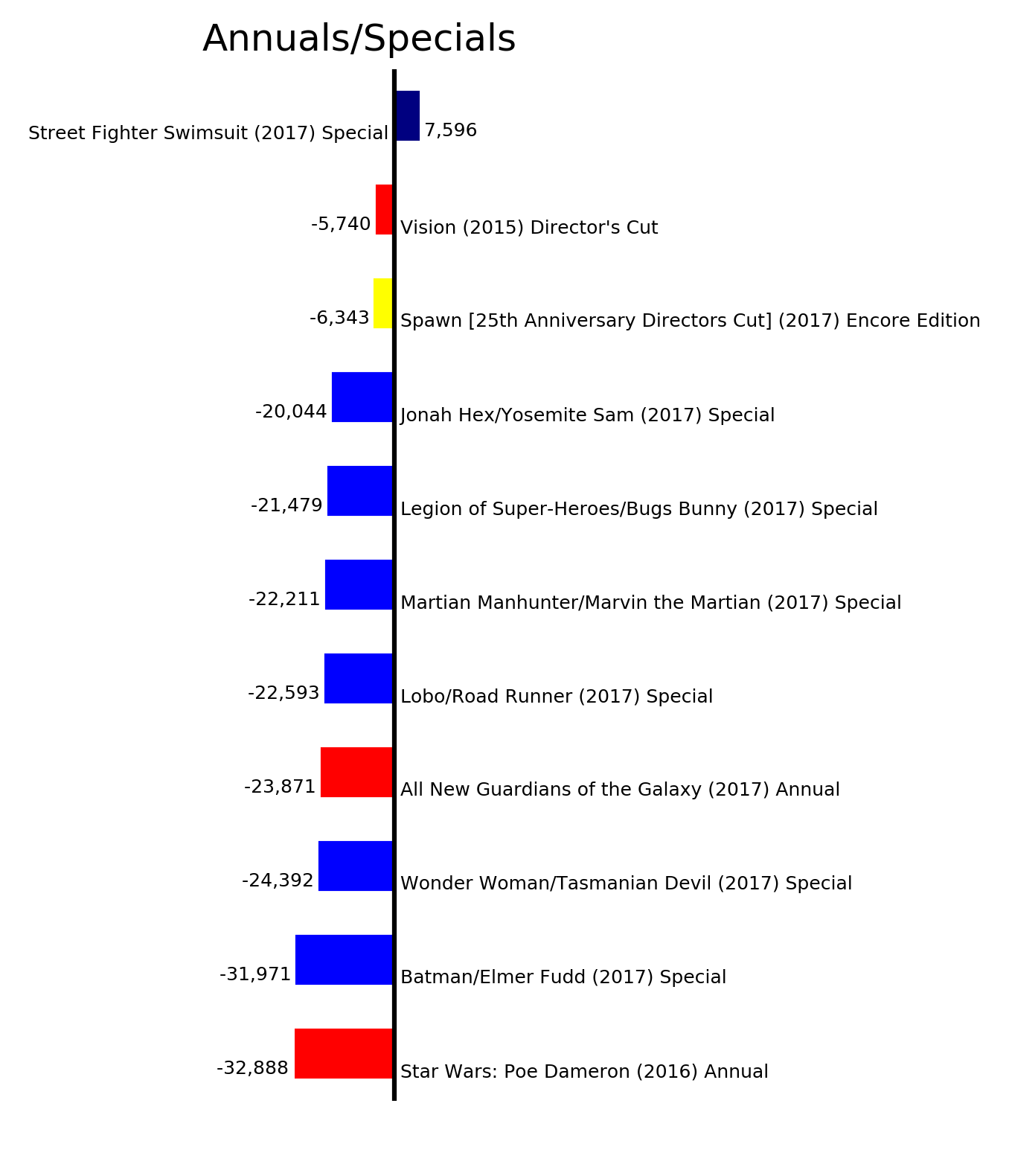

The annuals/specials category removed 203,936 units compared to last month. The various one-shots with DC characters interacting with Warner Brothers cartoon characters which shipped last month account for the majority of the units lost in this category.

The reorders category added 48,144 units compared to last month.

Around this time last year we were seeing record high sales for the top 300 comics. I've always found the aggregate sales of the top 300 comics to be a potentially misleading indicator of how the marketplace is doing. For most of the past year I've been focusing my article on the month-to-month change in the aggregate sales of the top 300 comics in order to better understand metric of the total units for the top 300 comics and how changes each month. My conclusion so far is the influx of new titles compensates for and masks the weakness of the ongoing titles. This forces a churn in titles and therefore in the sales which didn't exist a few decades ago. The churn in titles forces the promotion push on "new" titles which is what has resulted in the massive use of incentive covers and other sales tactics focused on how the product is packages instead of on the contents of the product itself. Comics can be seen as either physical goods or as a pieces of intellectual property. The marketing of physical goods and the marketing of intellectual property are fundamentally different. The industry has been treating comics as physical goods and it isn't working out that well. Perhaps it is time to take a step back and rework the marketing model to be more focused on the intellectual property, the characters and the stories, and see if that works better.