Mayo Report for 2016-07

|

|

Top Comics List Top Comics Breakdown Top Trades List Top Trades Breakdown

July 2016 was another breaking month for the top 300 comics with 8,581,015 units, 49,039 units above the recording breaking June 2016 sales. DC took 18 of the top 20 slots with "Civil War II" from Marvel filling in the other two slots. As with June, many items on the Jul 2016 top comics list were returnable. The total units for the top 300 comics would have been 9,410,067 units if the returnable items were not reported at 80% of the invoiced units which is 357,411 units more than the same metric for last month.

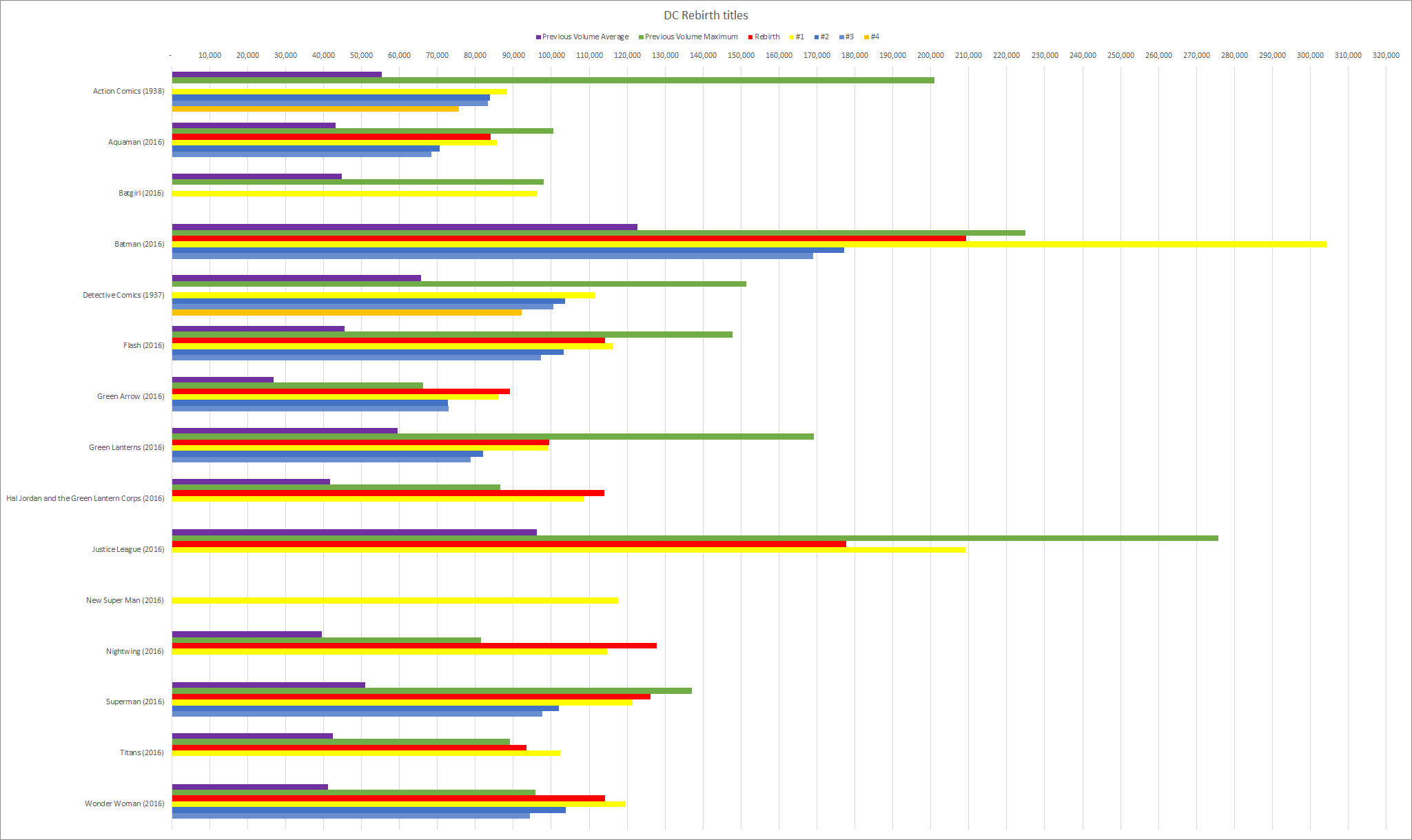

"Justice League" #1 was the top selling comics for July 2016 with 209,187 units. "Justice League Rebirth" #1 was in second place with 177,638 units. "Batman" #2 dropped 41.79% to 177,105 units followed by "Batman" #3 dropping only 4.61% to 168,983 units. "Nightwing Rebirth" #1 rounded out the top five comics from DC with 127,845 units. Overall, the Rebirth initiative seems to be working out well for DC. Sales are very strong and the drops on issues after the first are much shallower than we are typically seeing on recent Marvel titles.

The increased pace of release could be helping sales for Rebirth but the decision to have fewer titles might make the bigger difference in the long term success for the initiative. Simply put, it is easier to keep track of fewer titles even if they come out faster. A key difference between two monthly titles and one title which comes out twice a month is the number of decision points. Two monthly titles equal two decision points while one twice monthly title equals a single decision point. That can work for or against a publisher depending on how much the readers are liking the titles.

In the case of the New 52 launch, readers were sampling more titles than they were likely to get long term. With Rebirth, between having fewer titles and spacing out the relaunches, there is a stronger chance of reader retention. In July, the average second issue drop for Rebirth titles was around 18.95% with third issue drops around 4.39%.

Some of the reorder activity for this month compensates for some of the items last month which were reported at a lower rate. "Flash Rebirth" #1 had reorder activity of 24,534 units which is more than the projected 22,405 units it was unreported at last month. The 21,315 units of reorder activity for "Titans Rebirth" #1 exceeded the 18,021 it was under reported by last month. The reorder activity for Rebirth items totaled to 230,478 units in July. Rebirth is still in the "honeymoon" stage when the sales are based on how the stores expected sales to be versus ordering based on how these initial issues sold to readers.

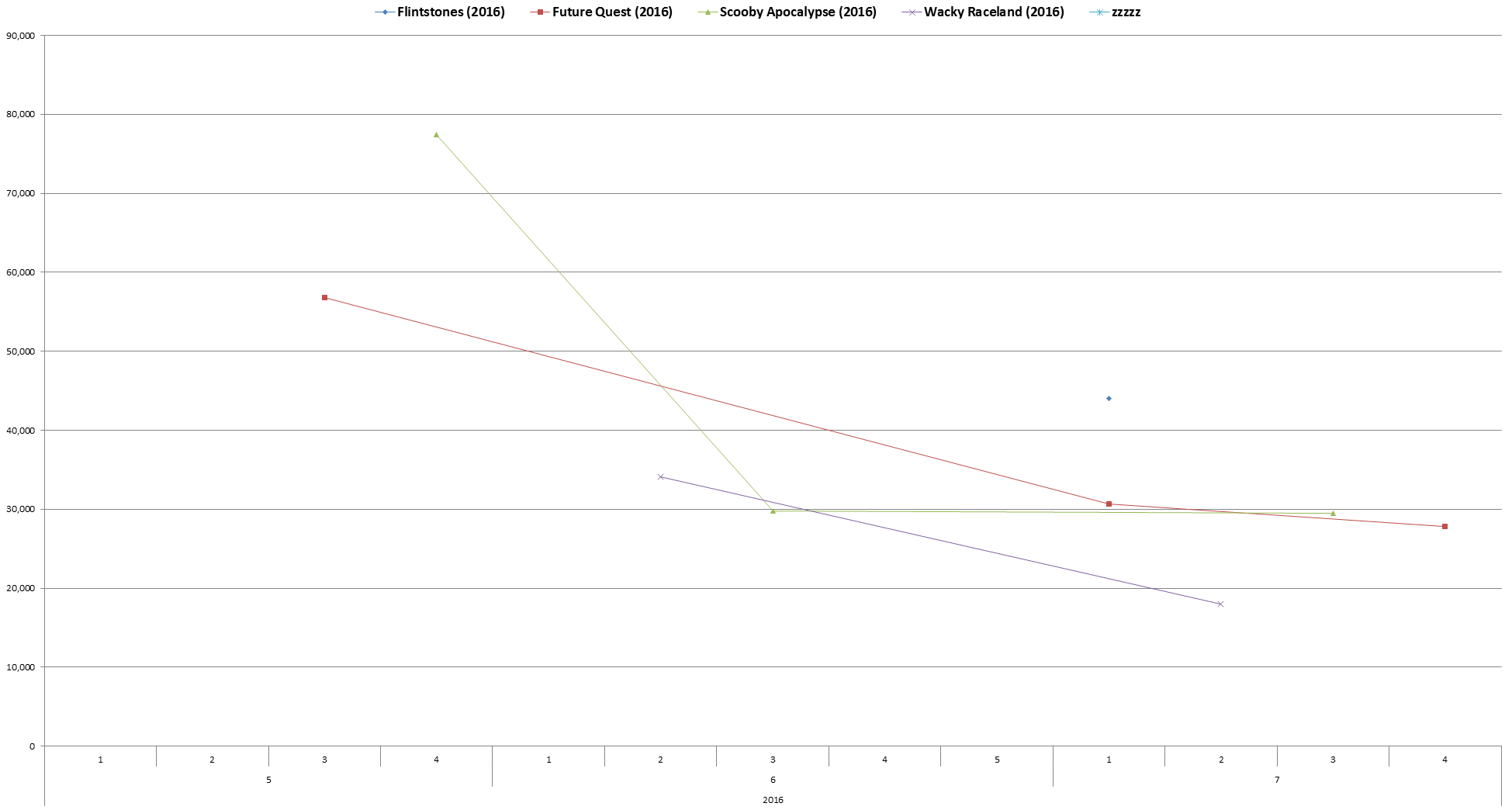

Sales are cooling off on the Hanna-Barbera relaunch titles. Scooby Apocalypse" #3 dropped only 1.07% from the second issue to 29,493. While that is a very low third issue drop, the second issue drop of 61.49% last month was very high. "Future Quest" #2 was down 45.89% from the first issue to 30,709 units and the "Future Quest" #3 dropped another 9.52% to 27,785 units. "Wacky Raceland" #2 was down 47.16% to 18,001 units and seems to have been shifted to a six issue miniseries as of the solicitation for the fourth issue. "Flintstones" #1 launched with 43,995 units. This group of titles is also still in the honeymoon period and the sales of the fourth issues could be very telling. There is a chance retailers were overly conservative on the second and third issue orders and, if so, sales will bounce back on the fourth issues.

If these drops are reflective of sales to readers then it begs the question of why these properties were launched with bold, new takes on properties at the same time the core DC Universe titles were being retooled to be more "comfortable and familiar." If shaking things up with the New 52 didn't work for those properties, why try to re-envision the Hanna-Barbera properties? If fairness, the "Flintstones" and "Future Quest" titles are not radical departures from the source cartoons like "Scooby Apocalypse" and "Wacky Raceland." Personally, I've found "Wacky Raceland" to be virtually unrecognizable as any sort of version of the classic "Wacky Races" cartoon. Once these titles get out of the honeymoon period, it will be interesting to see if sales are lower for titles which depart further from the source material.

Over at Marvel, "Civil War II" #3 was the top seller with 178,876 units, up 19.19% from the previous issue followed by "Civil War II" #4, down 28.27% with 126,865 units. "Amazing Spider-Man" #15 was up 34.04% to 87,993 units potentially on the strength of the cover which teased Mary Jane Watson as the new Iron Spider. The issue also had a variant Death of X cover retailers could freely order if their orders for the regular cover met or exceeded 90% of their orders for "Spider-Man" #13.

A number of other Marvel comics were up in sales in July. Some were Civil War II tie-ins like "Spider-Man" #6, "Power Man and Iron Fist" #6, "Spider-Woman" #9 and "Agents of S.H.I.E.L.D." #7. "Spider-Man" #6 and "Power Man and Iron Fist" #4 each had a Death of X variant cover based on ordering 90% or more of the regular cover than the orders fourth issue of the respective series. Neither "Spider-Woman" #9 nor "Agents of S.H.I.E.L.D." #7 had variant covers in the original May solicitations. Often, sales increased on issues of a Marvel title can be directly traced to variant covers or event crossover.

Marvel uses variant covers heavy to increase sales on new titles. One the one hand, this is a collectibles market so those tactics make as certain amount of sense. On the other hand, it results in large second issue drops. "Star Wars" Han Solo" #2 dropped 45.12% to 83,738 units which is a much more realistic sales level than the 152,595 units of the first issue. The average second issue drop for Marvel was 33.30% in July and all of the titles involved were miniseries.

All three issues of "Captain America: Steve Rogers" were on the list. "Captain America: Steve Rogers" #3 moved 65,455 units into stores. "Captain America: Steve Rogers" #1 had heavy reorder activity with another 27,444 units moving into stored along with another 8,468 units of "Captain America: Steve Rogers" #2. While the storyline is controversial, it is selling. And, if controversial storylines are what sells, expect more of them.

"Walking Dead" #156 was the top selling comic not published by DC or Marvel with 76,354 units. The rebooted "Betty and Veronica" #1 was not far behind with 70,829 units. While the rebooted Archie titles are doing well, "Betty and Veronica" will most likely dropped considerably to around the 15,199 units for "Archie" #10 this month. "Mighty Morphin Power Rangers" #5 dropped out of the top five comics not by DC or Marvel with 28,504 units and was the top selling comic from BOOM! Studios. Power Morphicon 2016 was help on August 12-14 and potentially introduced the comic to a number of diehard Power Rangers fans. The Power Rangers franchise seems to be getting more and more visible with the Power Rangers movies coming out in 2017 and Bandai stepping up the release of toys, including action figures of the original Mighty Morphin Power Rangers.

Recording breaking sales for the top 300 comics list for two months in a row is great news. Certainly the combination of a line wide retooling at DC with Rebirth and a line wide event at Marvel with "Civil War II" are major factors. Sales are strong for the other publishers as well. Perhaps comics are getting the benefit of the mass market awareness of the properties thanks to movies, television shows and video games. The question is if this is a temporary bubble or not. Perhaps it will only last as long as the Rebirth excitement and the "Civil War II" event. Perhaps comics have started to turn a corner and this is the start of a new period of strong sales for comics. Either way, it is a radical departure from the abysmal sales of just a few years ago when the top 300 comics only sold 4,402,602 units in January 2011. Hopefully all of the publishers, large and small, can leverage this period of strong sales to get readers hooked on titles for the long term.