Mayo Report for 2020-03

|

|

Top Comics List Top Comics Breakdown Top Trades List Top Trades Breakdown

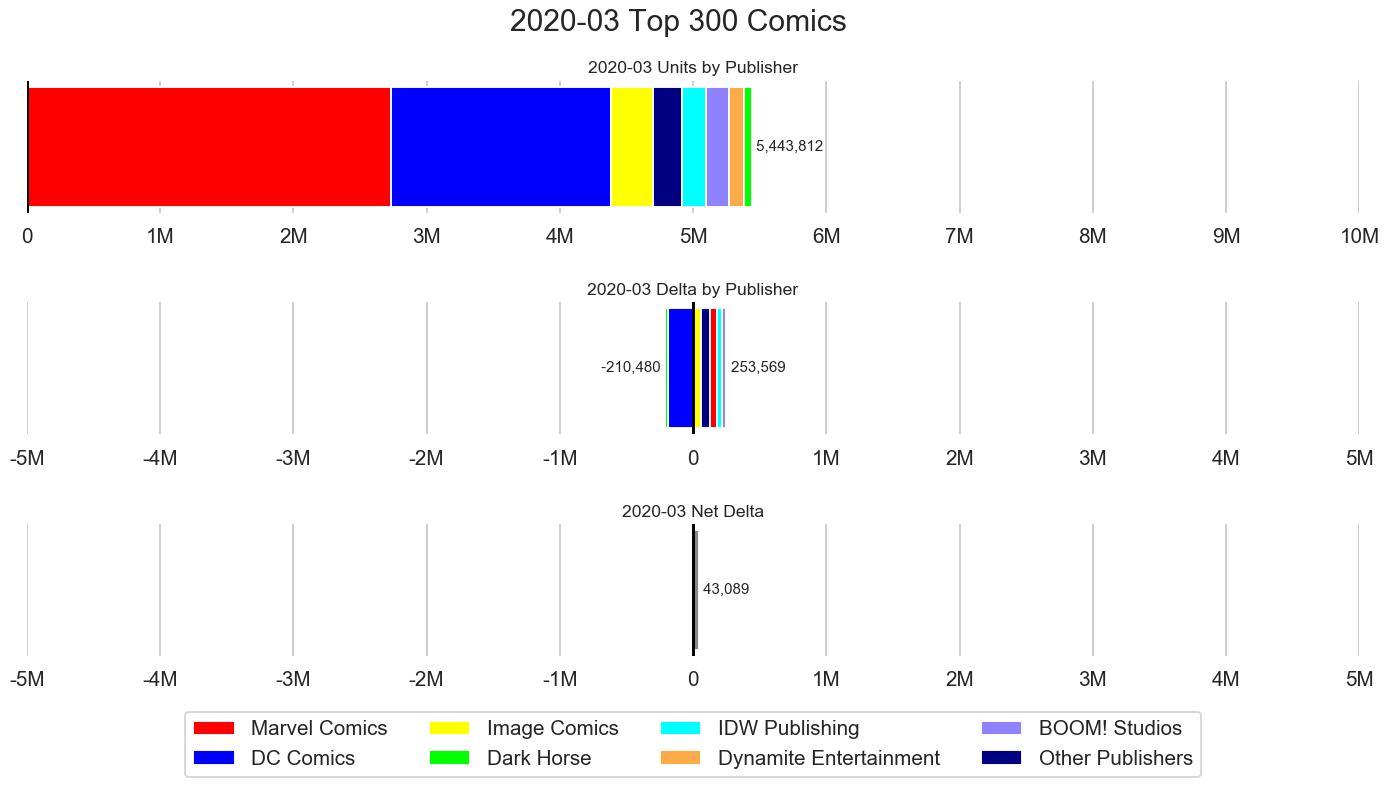

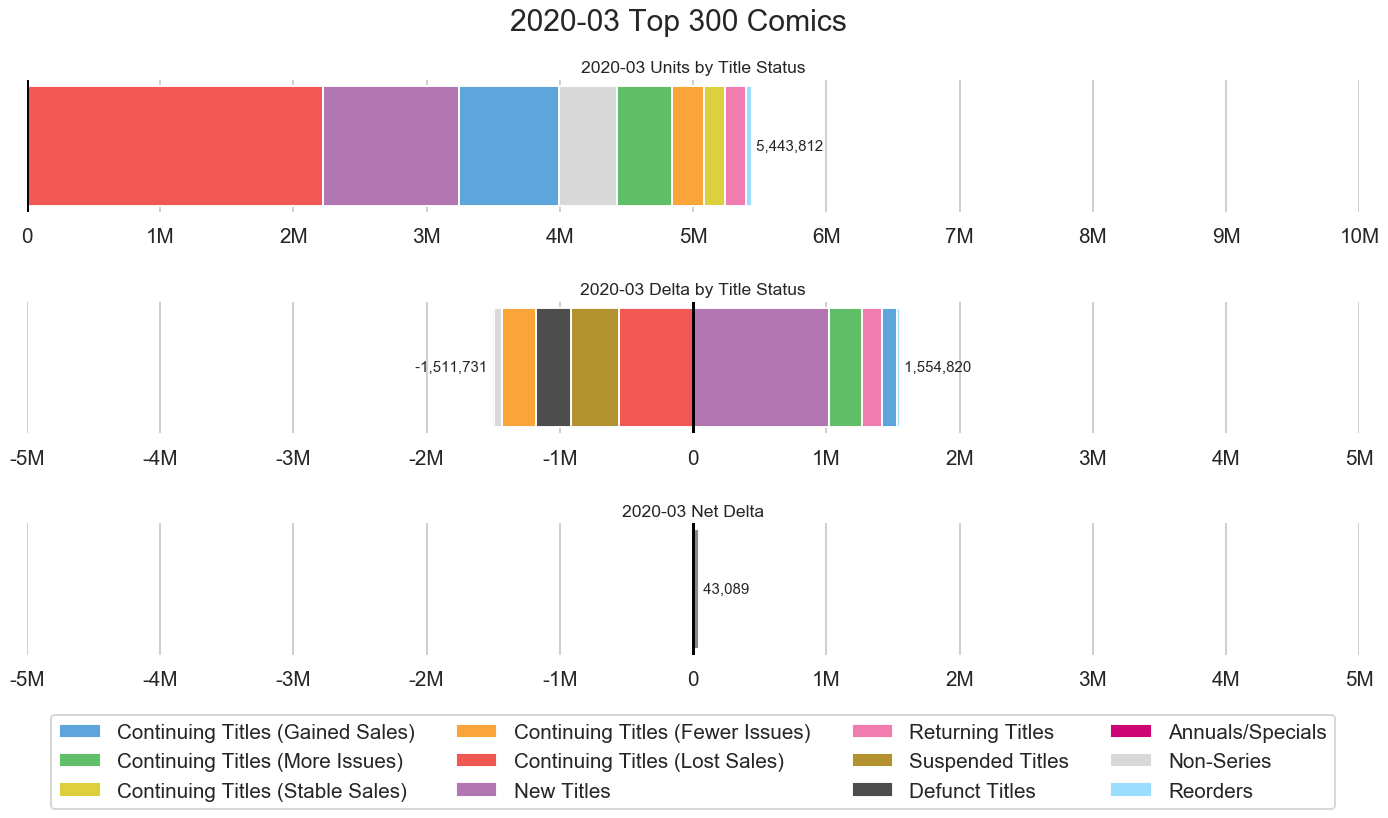

March 2020 had 5,443,812 units in the top 300 comics list, an increase of 43,089 units from last month.

To say March 2020 was an unusual month for the comic book industry is an understatement. Things went from totally normal at the beginning of the month to a full stop by the end of the month. During the month, stores in various parts of the country were forced to shutdown by stay at home orders in various states and communities. At the end of the month Diamond announced the suspension of new comic book distribution.

It is more important than usual to remember the data from Diamond measures the invoiced sales to retailers. It does not measure the number of units sold from retailers to readers. It is unclear how many of these units are unsold on the shelves of stores closed down by the pandemic. Many stores have been able to shift to curbside or mail order. In addition to the challenges retailers are facing, comic book readers find themselves impacted by either the COVID-19 virus or the associates economic impact, possibly both.

While a few new comics were distributed by to some stores during the final week of April, the industry was entirely shutdown during April. Given the general lack of new material released, there might not be sales data available for April 2020. We'll see what happens.

The expected demand for the material when it was originally ordered, and even when the final order cutoff date hit, was different than the actual demand when the material shipped. Out of the top 300 comics, 89.8% of the items accounting for 93.41% of the units had an order code from January 2020. January 2020 feels a lot longer ago than it actually was. The most recent final order cutoff date for items in the top 300 was March 2nd, 2020 which covered 24.83% of the items and 24.28% of the units. At that point in time, COVID-19 wasn't considered a pandemic and was still considered more an overseas problem than a problem here in the United States. The bottom line is the invoiced sales to retailers were based on pre-pandemic expectations.

Breaking the top 300 down by shipping week shows an increase of material both in term of number of items and in terms of number of units from week to week. More material moved through the system in the second half of the month as more stores were unable to operate as normal because of the pandemic. Some stores are shutting down for good as a result of the economic impact of the pandemic.

The big question is how much of this material is trapped at comic book stores and how much of it won't be sold as a result of the sharp increase in unemployment. Data for what was sold from retailers to readers could be very illuminating during the pandemic. It could shed some light as to what material is in that must-read category for most readers and what material is still sitting on store shelves.

Given the changes in the industry over the past month or so, it is worth taking a quick look at a few of the different distribution models the industry has used over the past few decades. This isn't intended to be a complete overview of the entire history of comic book distribution.

Back in the 1980s and 1990s there were multiple distributors. Many of them were regional and some were much larger than others. The key aspect of this era of comic book distribution was that all of the distributors could carry items from all publishers and all retailers could deal with any of the distributors. It was a competitive market. If a store was unhappy with the distributor they were using, they could always switch to another one.

In late 1994, Marvel Comics bought Heroes World Distribution which became the exclusive distributor for Marvel in July 1995. This forced retailers to get the comics published by Marvel from Heroes World and all of the other comics from another distributor. Diamond eventually won the distributor was when DC signed an exclusive agreement with them. The period of multiple distributors with exclusive agreements with different publishers only last about two years. During that the number of comic book shops dropped significantly. Some of that was a direct result of the distributor wars but some of it was a result of the speculator boom and bust around that time. Prior to the Heroes World move there were a dozen or two distributors and afterward there was just one.

As of April 1997, Diamond was the sole distributor of new comic books up until March 2020. There was another distributor or two during that time which carried some of the smaller publishers but nothing which was serious competition for Diamond. This era of a single distributor has ups and downs but overall it worked out well for the industry.

April 2020 marked the first time in the history of the comic book direct market, and all of comic book history for that matter, when there wasn't any active comic book distribution. With multiple states under stay at home orders, Steve Geppi made the decision to halt comic book distribution at the end of March. For stores unable to open because of the stay at home orders, this worked out. For stores not impacted by such orders, the lack of new comics hurt them. The pandemic was impacting different communities in different ways and what was helpful for one area like stopping the distribution of new comics, was harmful in other areas.

We are entering a new phase of comic book distribution. DC is no longer exclusive with Diamond. Two new distributors, Lunar Distribution run by online retailer DCBS and UCS Comic Distributors run by Midtown Comics, have been formed to start distributing comics published by DC Comics. Right now, the United States is divided between the two distributors. Diamond is still able to distribute comics from DC but isn't planning on resuming distribution until May 20th while Lunar Distribution shipped items for release on April 28th with UCS Comic Distributors is set to start distributing in the next week or so.

The only thing certain is that DC is no longer exclusive with Diamond and Midtown and DCBS are trying to spin up distribution channels in an impressively short time frame. Things are still very fluid with things seeming to constantly change.

The important thing is that DC is not exclusive to Lunar and UCS. Had DC gone exclusive with those two new distributors it would have forced all of the retailers to open accounts with them in order to get DC items in addition to dealing with Diamond for everything else. DC accounts for roughly 30% of the top 300 comics sales by units. Forcing retailers to move 30% of their orders from Diamond to one of these new distributors would have reduced the overall volume the retailers had at Diamond which could have impacted their discount level at Diamond. Fortunately that isn't being forced on retailers although it did seem that way at first

Some retailers are signing up with these new distributors but others are remaining with Diamond. This is the biggest shift we seen in the market in decades. It is going to be interesting to see how things shape up going forward.

The sales data I report on here is based on data released by Diamond. Since April 1997, that data has covered the entire direct market. As of April 2020 that will no longer be the case.

I sent an email to Lunar Distribution and UCS Comic Distributors asking for more a copy of the first order form and if sales data would be released. Over a week later I haven't heard back. Of course, that was the first week right after the two distributors were announced and were signing up new accounts. Since neither Lunar nor UCS have provided me with any data such as an order forms of shipping list, I have no idea what data I might have to work with for reporting sales through those distributors. While I would like to include those sales for the sake of completeness, I have a long standing policy of only dealing with numbers that I can see and kick around in my ever evolving number crunching system. The sooner I start getting any data from these new distributors, the more likely it is that I'll be able to include sales through them in my analysis.

At the very least, gap in sales through Diamond of at least seven weeks is likely to cause some chaos with my monthly title sales categories. If shipping through Diamond resumes on May 20th then May will have two weeks of sales compared to no sales of new issues at all in April. The throttled back output from some publishers will also skew the numbers for a while. Sales trends are going to change, certainly in the short term and most likely in the long term. Statistics which were useful in a stable market probably aren't going to be as useful while the industry is in a recovery mode. The question because what metrics are useful in this recovery mode the industry is about to enter. If you have suggestions on what metrics should be tracked as the industry spins back up, please feel free to email me at John.Mayo@ComicBookResources.com.

At this point we have to consider the possibility and probability that the sales trends we grown accustom to seeing might not continue moving forward. While some will probably continue there is a risk in assuming what was true before remains true during and after the pandemic. One such belief is around digital comics. Prior to the pandemic is was generally thought that the print audience and the digital audience were distinct. Sure, there was some overlap but reports were that digital sales were not cannibalizing print sales. That seems to be true when both were easily available. During the duration of the stay-at-home orders, print comics weren't available and digital comics were easily available. The question is if a month or two of no print comics causes some readers to convert to digital readers.

Some things are going to change from the pandemic, the economic impact and the suspension of new comic book distribution for a month or two. Between that and the fact that the invoiced sales were based on pre-pandemic expectation but shipped as the pandemic was first hitting the United States, it doesn't make sense to dive too deep into the March 2020 data. That having been said, here are the usual monthly charts for each of the categories with only a little of the usual analysis per category.

Marvel Comics placed 2,736,685 units in the top 300 comics, an increase of 53,613 units and accounted for 50.27% of the total units.

DC Comics placed 1,644,295 units in the top 300 comics, a decrease of 191,717 units and accounted for 30.20% of the total units. Expect the numbers for DC to drop moving forward as sales shift from Diamond to the two new distributors. If I can get sales data from those distributors, I'll include the information and track how the sales are split across the distributors.

Image Comics placed 320,620 units in the top 300 comics, an increase of 63,002 units and accounted for 5.89% of the total units.

The premiere publishers accounted for 96.00% of the total units for the top 300 comics this month while all of the other publishers with items in the top 300 accounted for 4.00% of the total units for the top 300 comics.

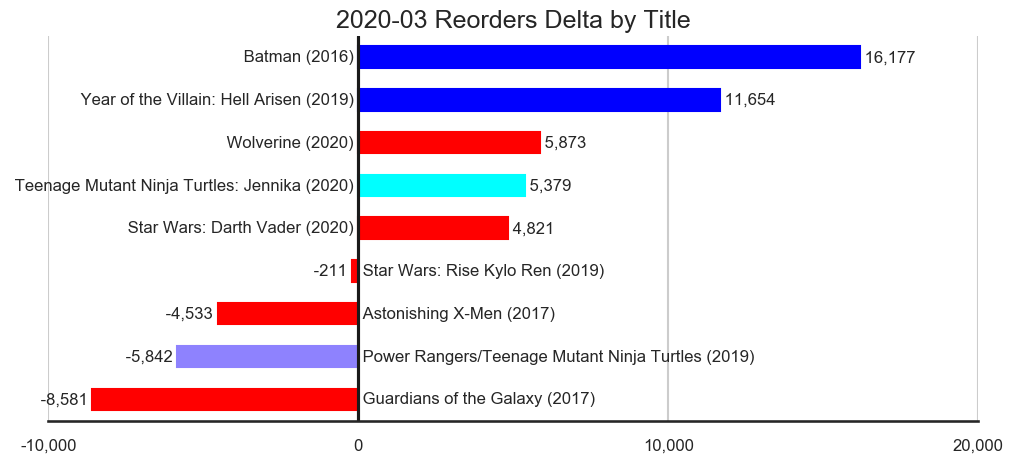

The up-swing of 1,554,820 units from new and increased sales was enough to compensate for the down-swing of 1,511,731 units from lost sales for the net increase of 43,089 units.

AS usual, new titles was the major upward force. With some publishers reducing their output for a while, it will be interesting to see how that impacts the categories. Will we see fewer new titles? Will we see titles go bi-monthly and alternate between the suspended and returning categories? Most importantly, will we see fewer but stronger titles or just fewer titles?

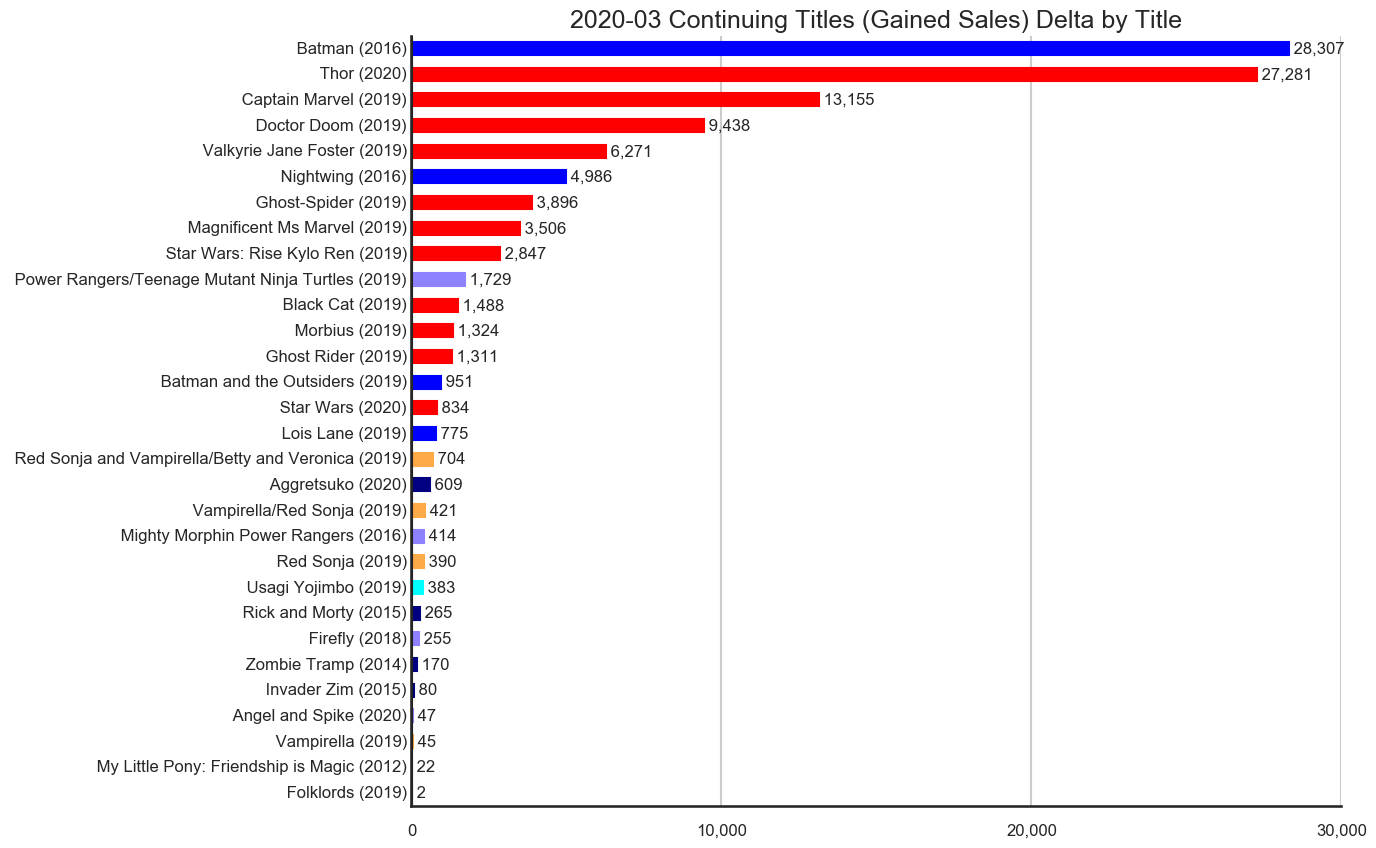

The 30 titles across the 7 publishers in the continuing titles which gained sales category accounted for 753,271 units in the top 300 comics with an upswing of 111,906 units.

Batman was up the most. Jim Lee has said that Batman #92 with Punchline had around 230,000 units. With DC titles getting order reset to zero and then effectively reordered via the final order cutoff system, it will be interesting to see how Batman #92 does when it hits the sales charts.

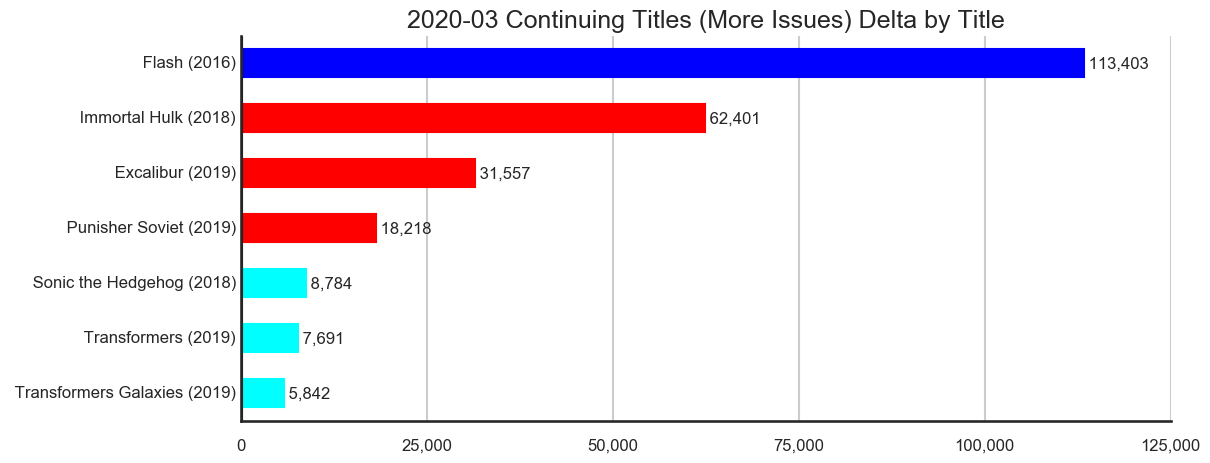

The 7 titles across the 3 publishers in the continuing titles which shipped more issues category accounted for 413,504 units in the top 300 comics with an upswing of 247,896 units.

The 14 titles across the 5 publishers in the continuing titles with reasonably stable sales category accounted for 157,901 units in the top 300 comics with a downswing of 2,285 units.

The 8 titles across the 2 publishers in the continuing titles which shipped fewer issues category accounted for 243,328 units in the top 300 comics with a downswing of 251,699 units.

Many Marvel titles tend to release on a slightly more frequent than monthly pace causing those titles to alternate between the more issues and fewer issues categories.

The 113 titles across the 12 publishers in the continuing titles which lost sales category accounted for 2,225,293 units in the top 300 comics with a downswing of 557,575 units.

Wolverine #2 had a second issue drop of 62.21% but the issue still places in the top five comics for the month.

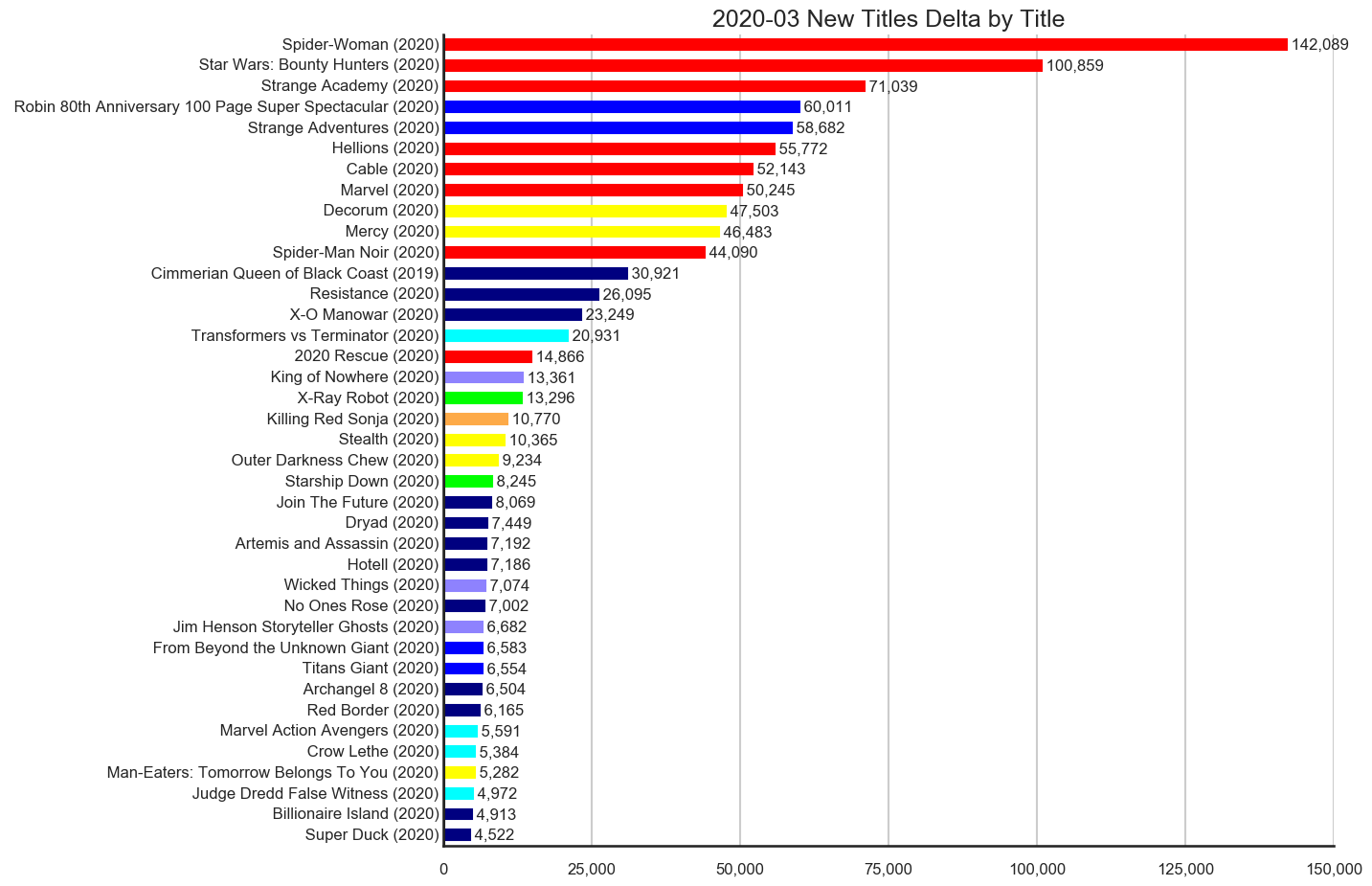

The 39 titles across the 15 publishers in the new titles category accounted for 1,017,373 units in the top 300 comics.

Expects to see a large second issue drop on Spider-Woman #2 when it comes out.

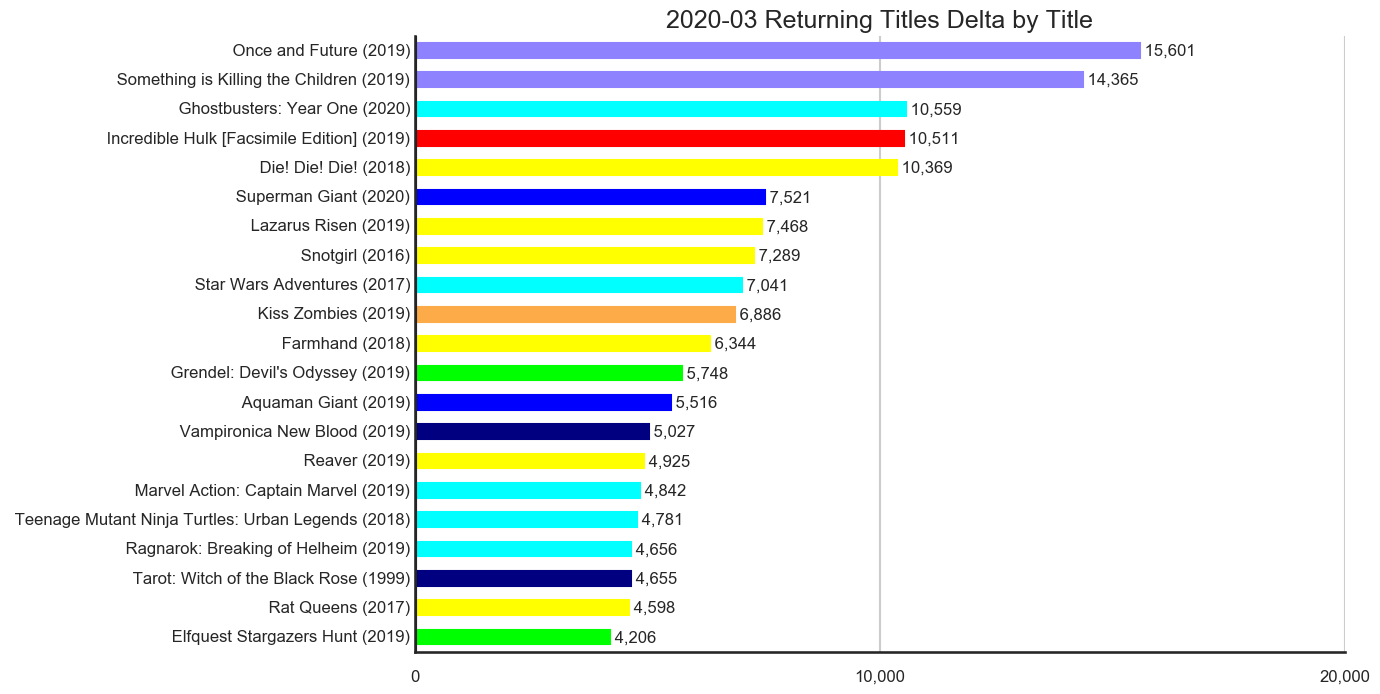

The 21 titles across the 9 publishers in the returning titles category accounted for 152,908 units in the top 300 comics.

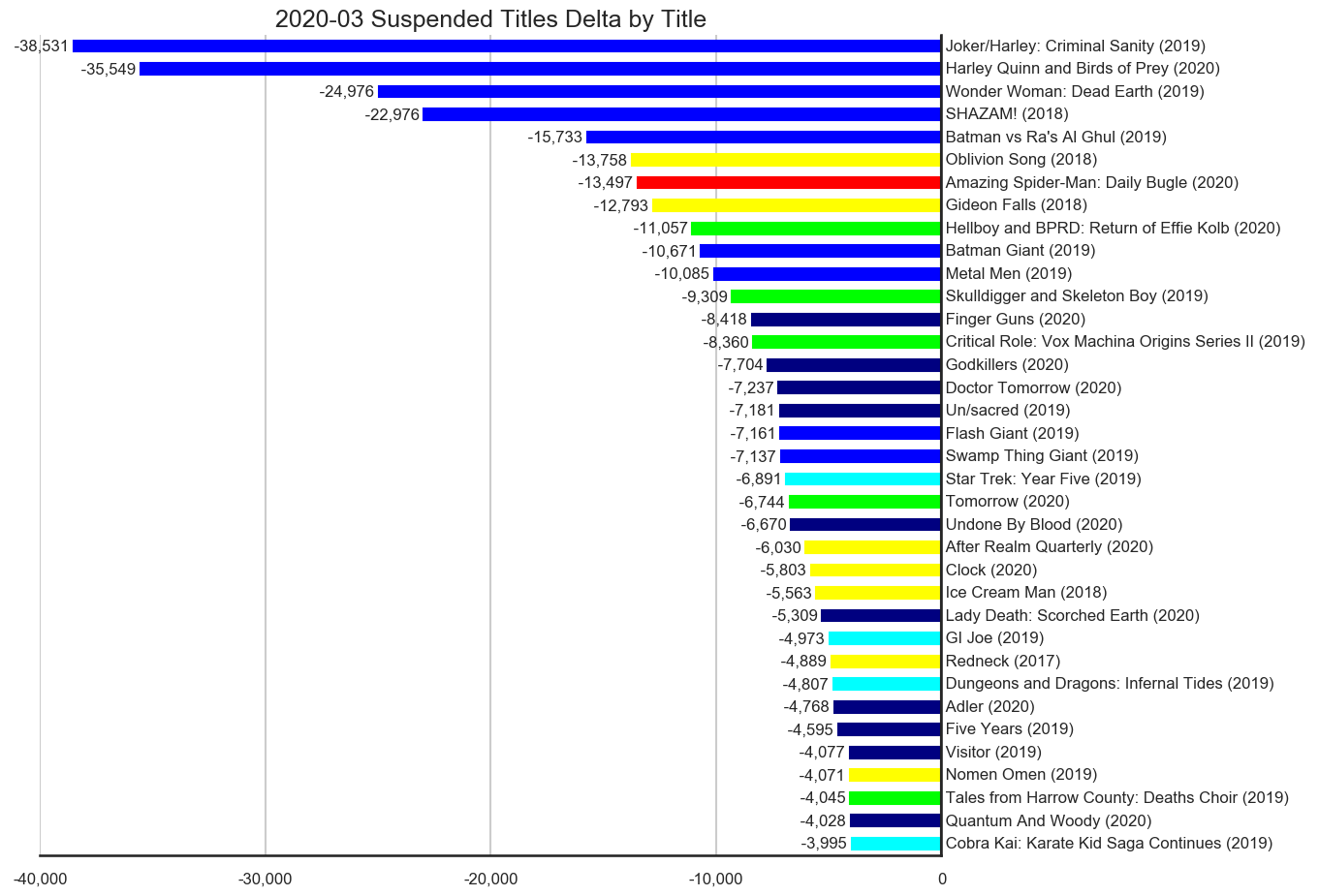

The 36 titles across the 12 publishers in the suspended titles category accounted for a downswing of 359,391 units.

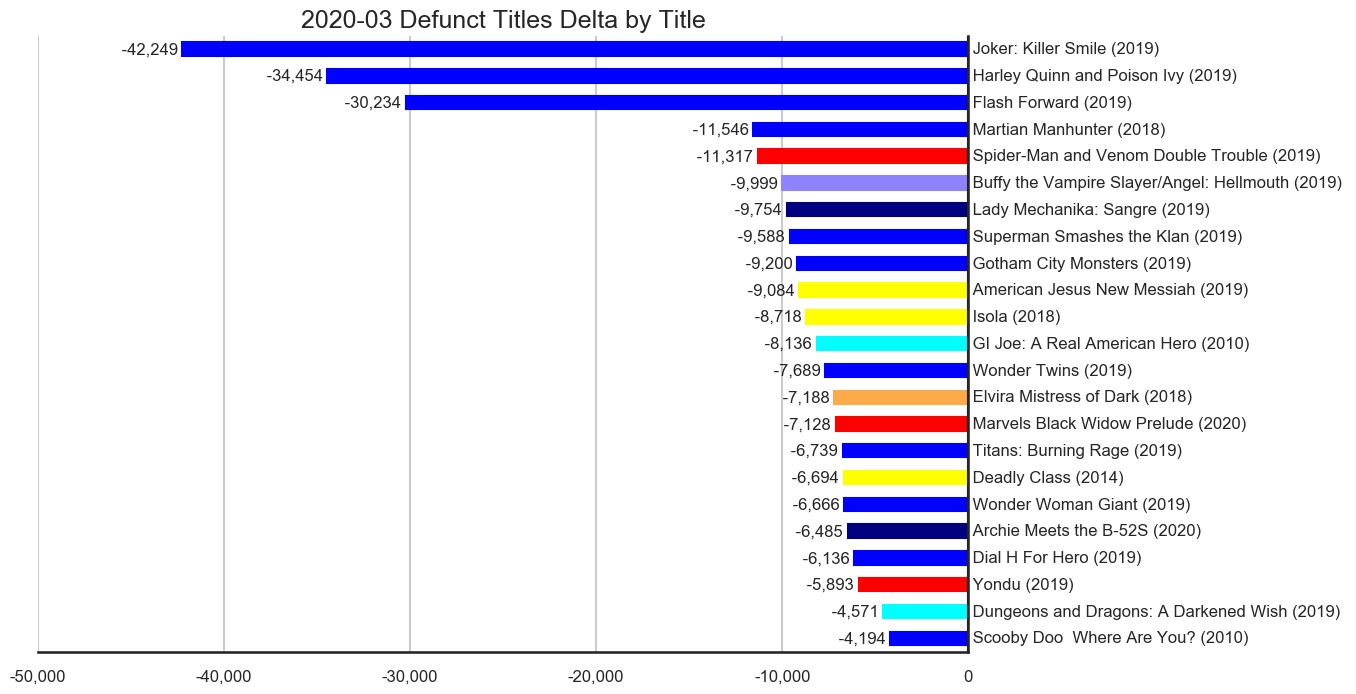

The 23 titles across the 8 publishers in the defunct titles category accounted for a downswing of 263,662 units.

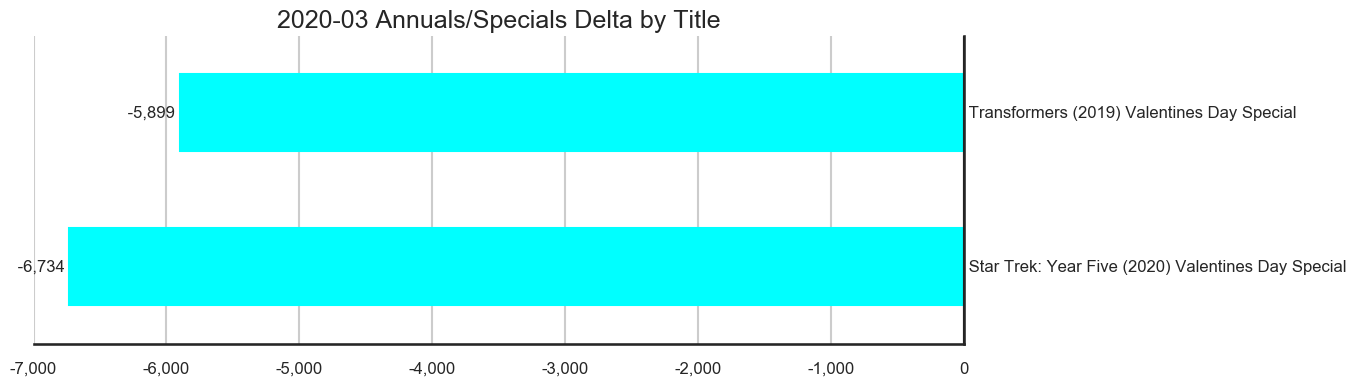

The two titles from IDW in the annuals/specials category accounted for a downswing of 12,633 units.

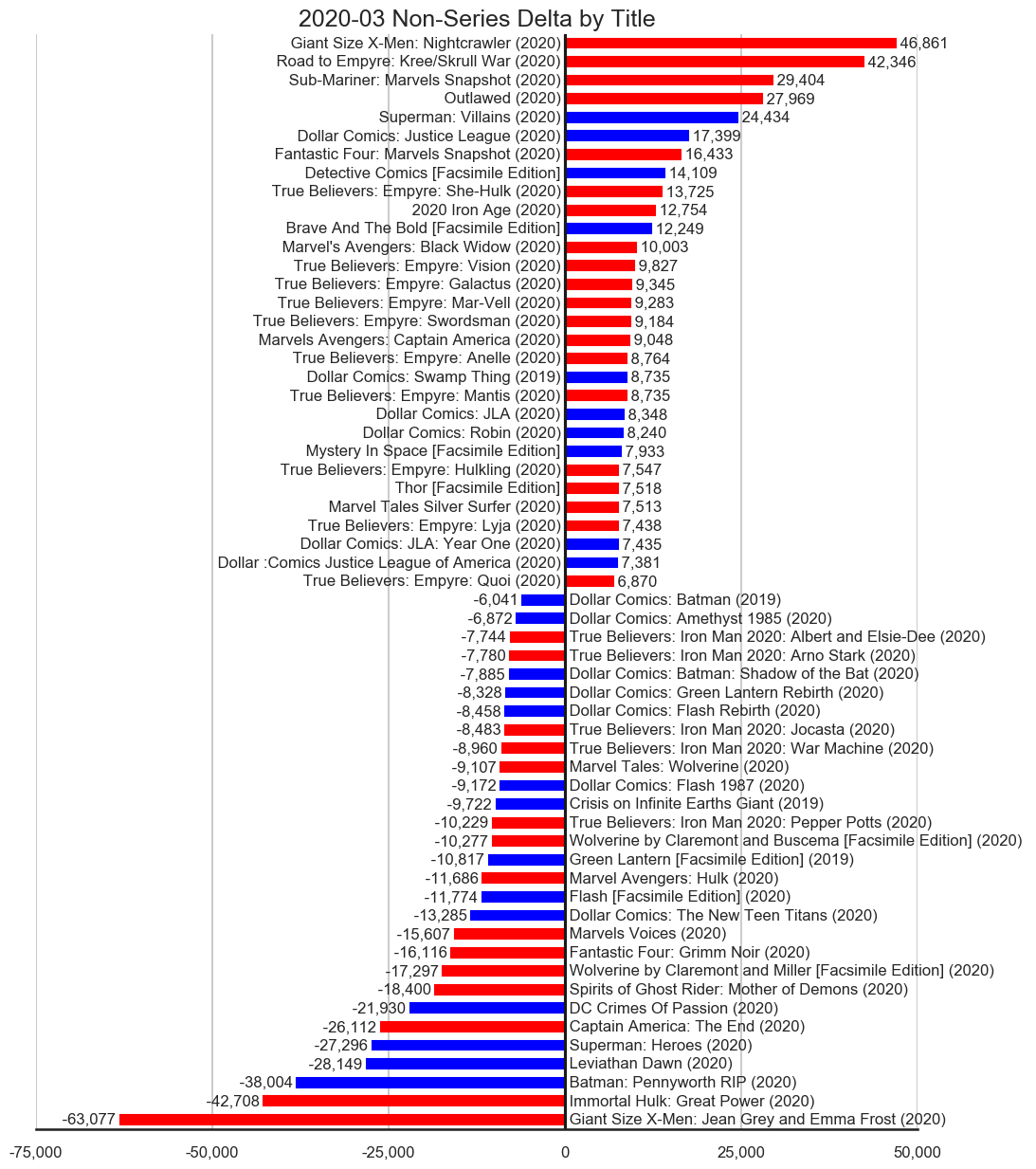

The 59 titles across the 2 publishers in the non-series category accounted for 430,327 units in the top 300 comics with an upswing of 416,830 units, a downswing of 481,316 units for a net a decrease of 64,486 units.

The 9 titles across the 4 publishers in the reorders category accounted for 49,907 units in the top 300 comics with an upswing of 43,904 units, a downswing of 19,167 units for a net an increase of 24,737 units.

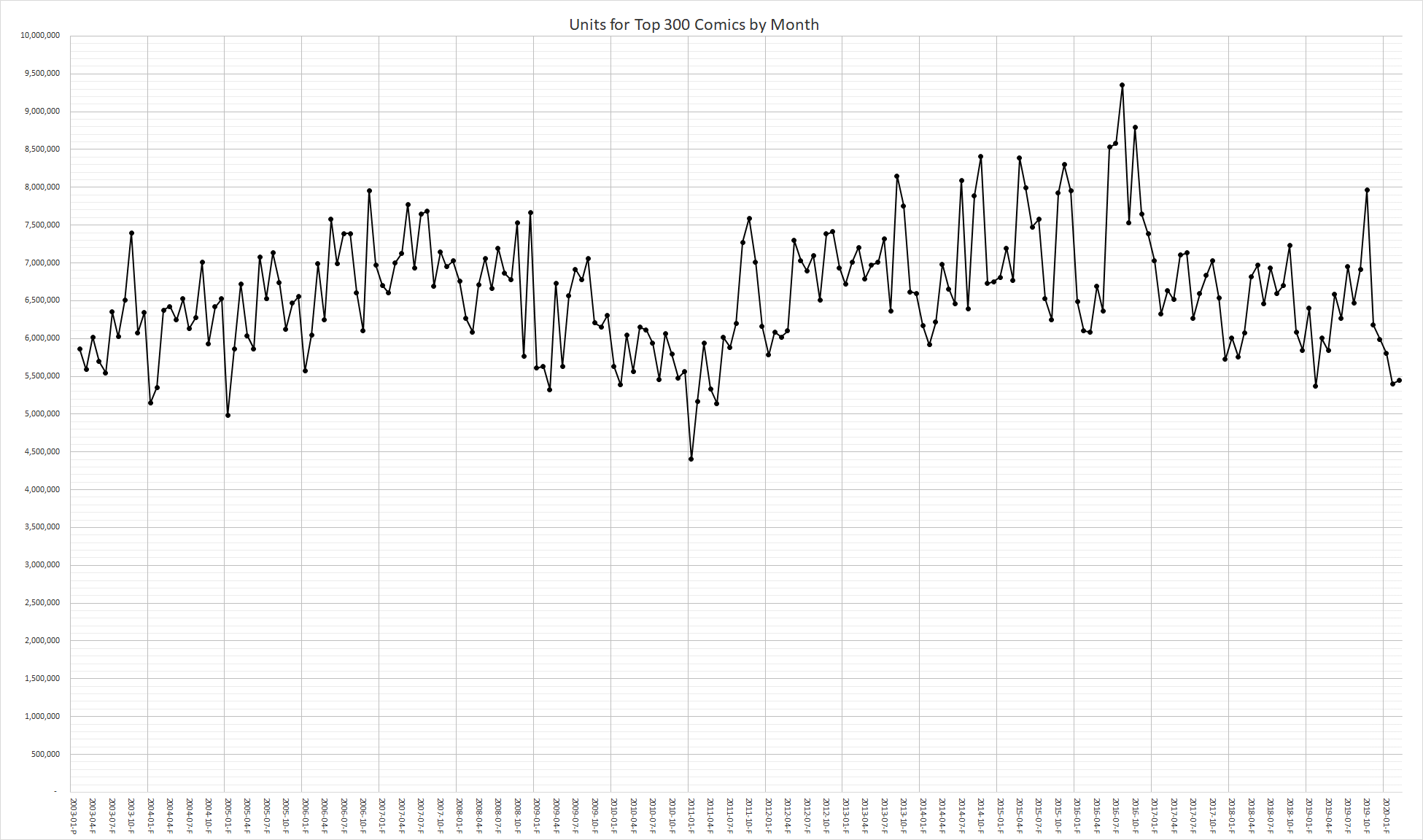

Since March 2020 marks the end of the Diamond Final Order era from February 2003 to March 2020 during which the Diamond data encompasses the top 300 comics for the entire direct market, here are some charts of the sales over that time.

First off, the total units for the top 300 comics by month from February 2003 to March 2020:

The record low of 4,402,738 units in January 2011 and the record high of 9,355,046 units in August 2019. The average was for the top 300 comics 6,606,758 units per month.

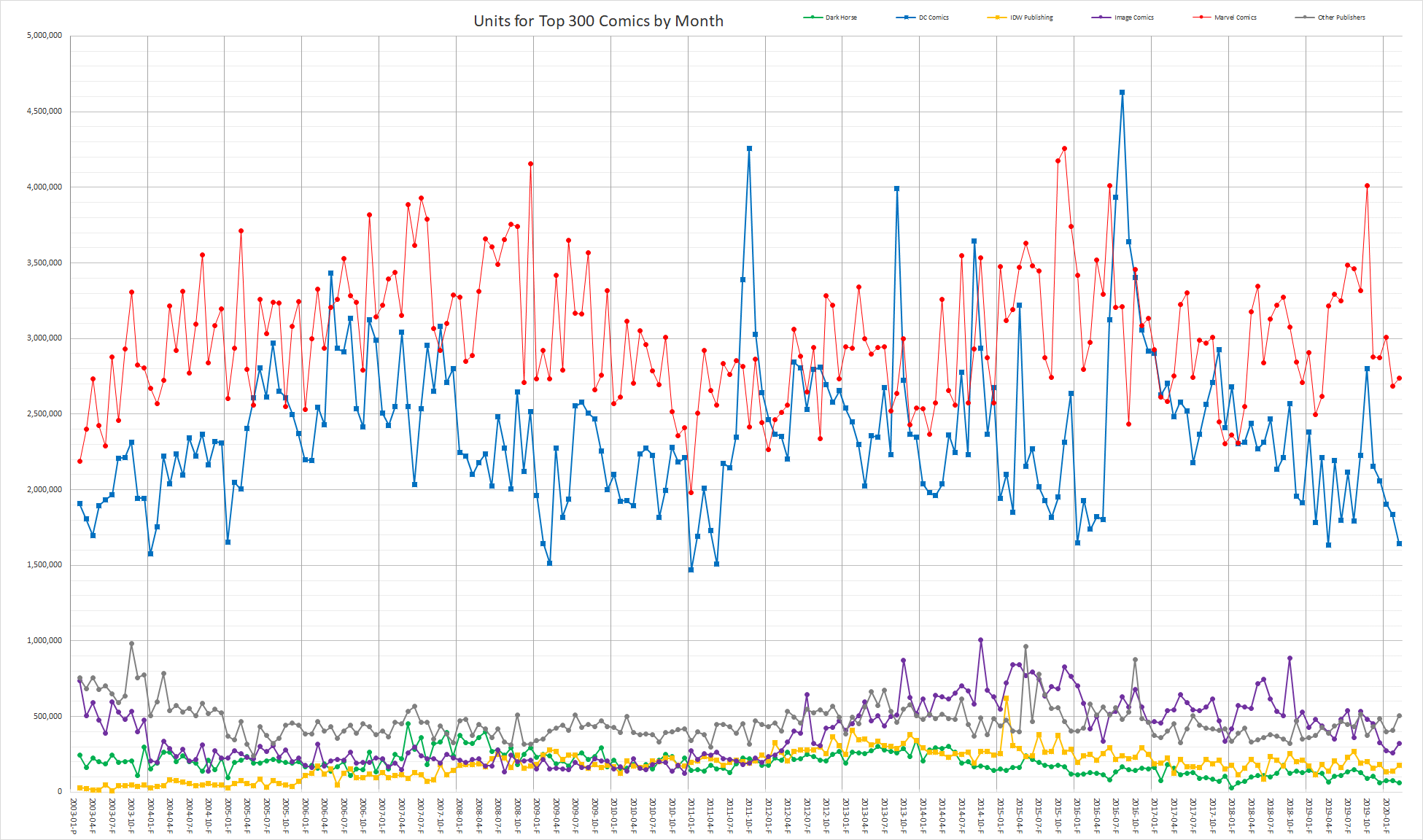

Next, the total units by publisher for the top 300 comics by month from February 2003 to March 2020:

The record low for Marvel of 1,978,842 units in January 2011 and record high for Marvel of 4,255,506 units in November 2015. The record low for DC of 1,470,126 units in January 2011 and record high for DC of 4,626,905 units in August 2016.

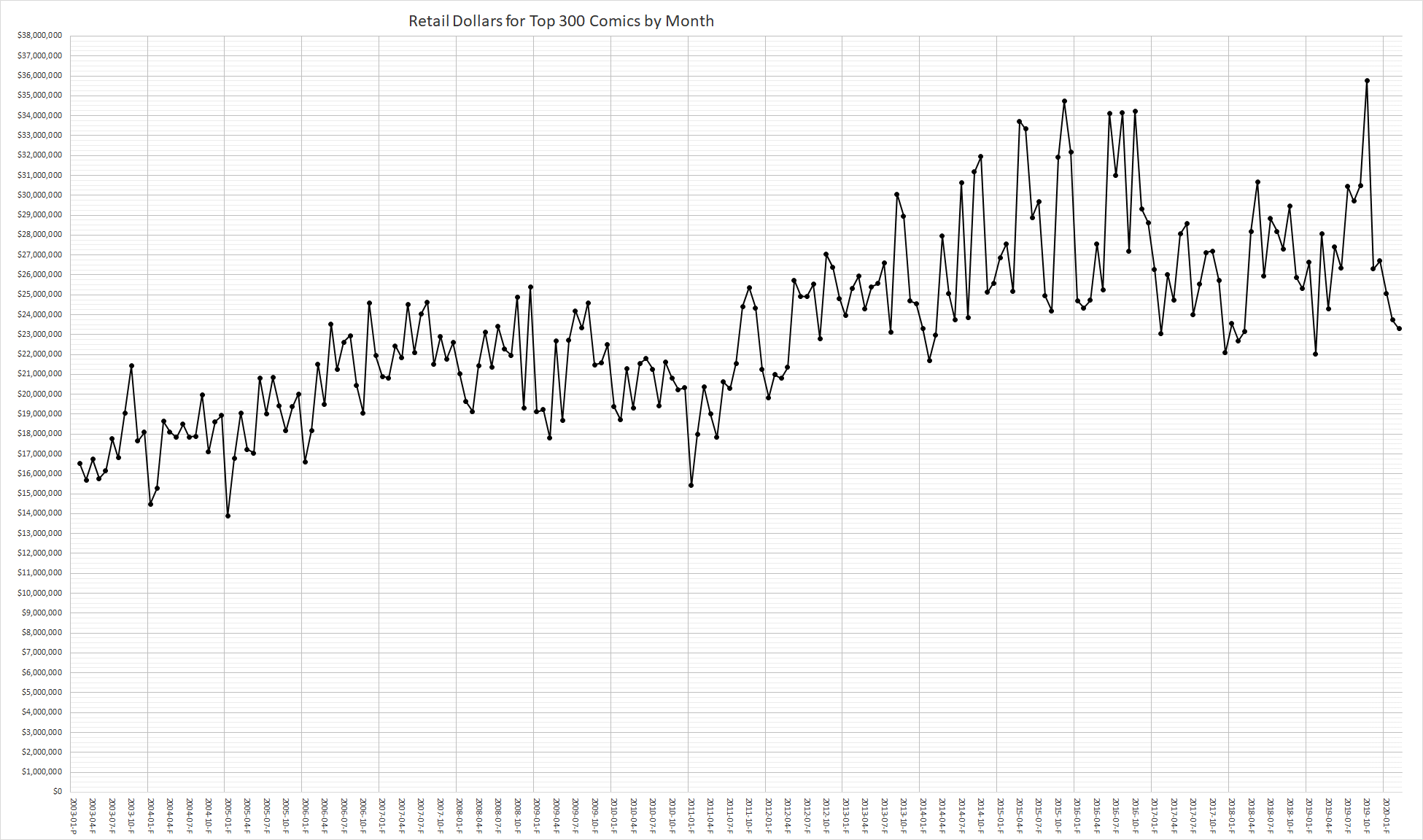

The total retail dollars for the top 300 comics by month from February 2003 to March 2020:

The record low of $13,877,281.30 in January 2005 and the record high of $35,765,767.37 in October 2019. The average was for the top 300 comics $23,312,411.88 per month. Keep in mind cover prices in February 2003 had an average of $3.03 and a weighted average of $2.82 while in March 2020 the average was $40.7 and the weighted average was $4.28.

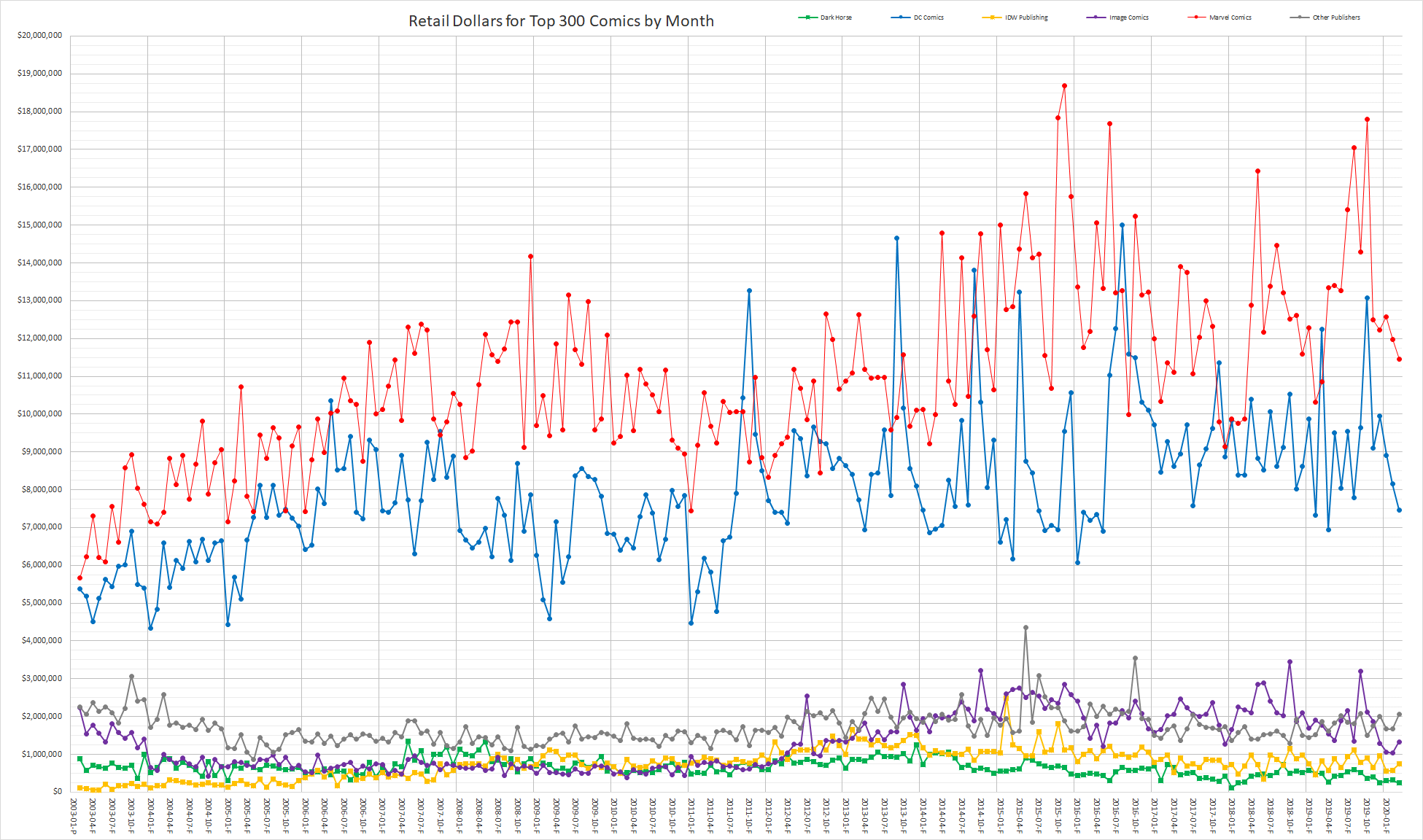

The total retail dollars by publisher for the top 300 comics by month from February 2003 to March 2020:

The record low for Marvel of $5,662,930.90 in February 2003 and record high for Marvel of $18,687,289.94 in November 2015. Note the record low for DC of $4,333,113.15 in January 2004 and record high for DC of $15,002,375.95 in August 2016.

The comic book industry has evolved many times over the decades. This is yet another in that series of evolutions. Dealing with a pandemic, massive economic issues and significant changes at the distribution level all at once will be a challenge for the industry. Fortunately comics are at a height of popularity. Comic book properties have been a mainstay in movies and on television for years. Things will continue to evolve over the coming month until a new normal emerges for the comic book industry.

For a more in-depth discussion of the sales data, check out the Mayo Report episodes of the Comic Book Page podcast at www.ComicBookPage.com. The episode archived cover the past decade of comic book sales on a monthly basis with yearly recap episodes. In addition to those episodes on the sales data, every Monday is a Weekly Comics Spotlight episode featuring a comic by DC, a comic by Marvel and a comic by some other publisher. I read around 200 new comics a month so the podcast covers a wide variety of the comics currently published. If you are looking for more or different comics to read, check out the latest Previews Spotlight episode featuring clips from various comic book fans talking about the comics they love. With thousands of comics in Previews every month, Previews Spotlight episodes are a great way to find out about new comic book titles that may have flown under your comic book radar.

As always, if you have any questions or comments, please feel free to email me at John.Mayo@ComicBookResources.com.