Mayo Report for 2011-02

|

|

Top Comics List Top Comics Breakdown Top Trades List Top Trades Breakdown

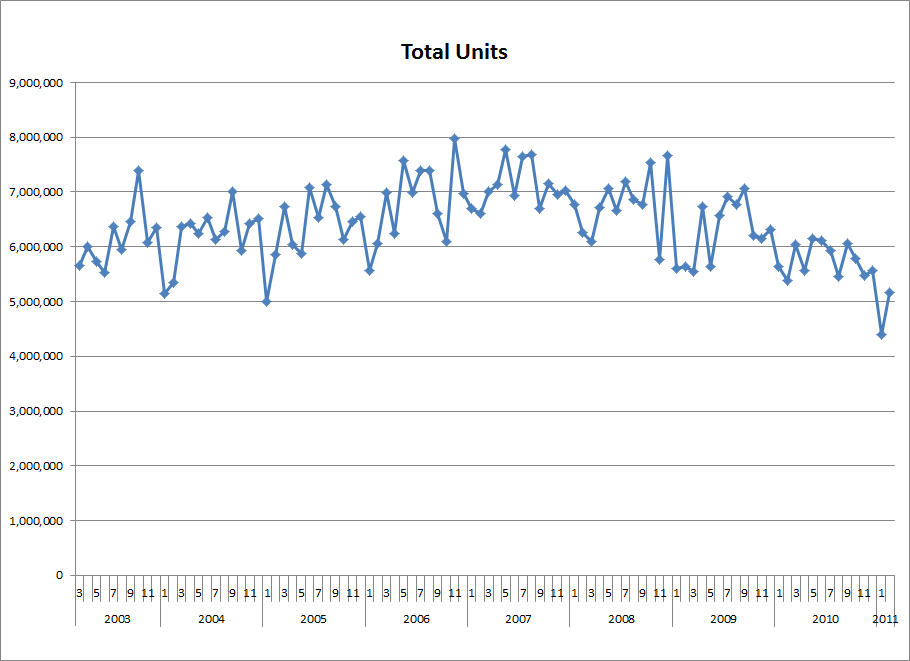

February 2011 was another lackluster month for comic book sales. It had the lowest top selling comic since March 2003 when Diamond first started released data based on what was actually sold to retailers. It also had the fourth lowest total sales for the top 300 comics.

But rather than talk about the trend of the total sales of the top 300 comics over most of the past decade, this month I want to examine the sales trends of a couple of groups of titles and a few of the items which went up in sales in February. These charts are aligned on issue number and are not synchronized by date of initial release.

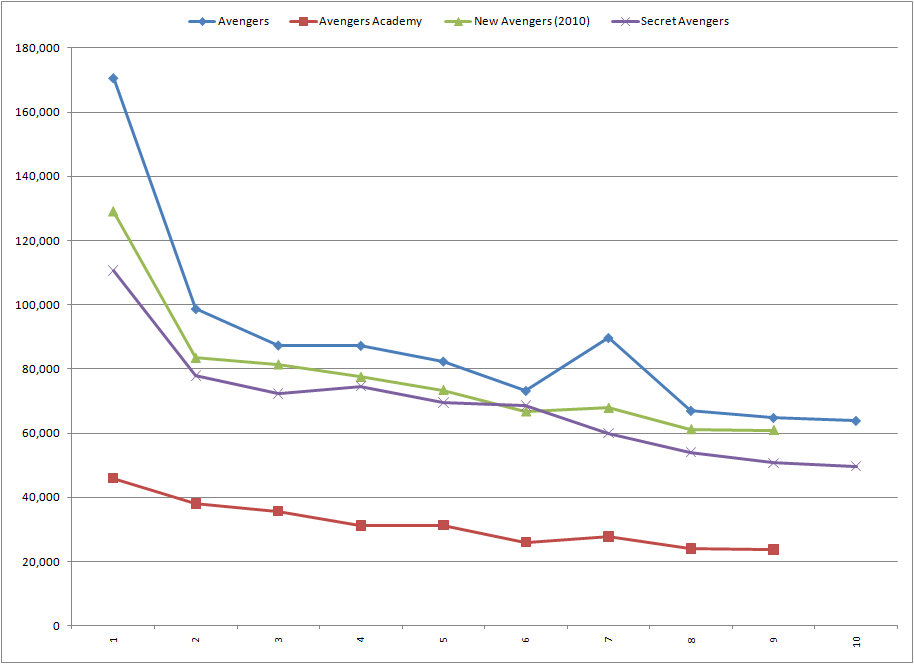

The Avengers titles are often near the top of the chart every month so we'll start by looking at the trends on those titles which restarted about nine months ago:

The sales trends are reasonably consistent across the titles. The first issue has the highest sales for the series. There is a big drop with the second issue then another drop with the third before the titles start to settle into the standard attrition plaguing most titles. These drops happen before the first issues are available to be read and don't really reflect what the readers think of the titles. This is what I refer to as the "honeymoon" phase for the title. These first few months are not impacted by the actual contents of the comics. Instead the sales are based on how the retailers anticipate the readers will like the titles. Retailers are also adjusting their orders down to account for readers sampling the titles with no minimal likelihood of actually getting the series on a regular basis.

The bump on "Avengers" #7 was due to the alternate cover and multiple retailer incentive covers on that issue. Both the regular cover and the blank variant cover could be orders in any amount. For every 15 of the regular cover, a retailer could order 1 of the Tron retailer incentive cover. For every 25 of the regular cover, a retailer could order 1 of the McGuinness retailer incentive cover. For every 50 of the regular cover, a retailer could order 1 of the Djurdjevic gatefold retailer incentive cover.

When I refer to a variant cover, I am speaking of the copies with a different cover which the retailer could explicitly order in whatever amounts desired regardless of how many of the regular cover ordered. A retailer incentive cover requires the purchase of a given amount of the regular cover into to qualify to place an order for the retailer incentive cover. Typically, a retailer incentive cover encourages retailers just below a threshold amount to increase their order of the regular cover to the threshold and to then place an order for the additional copy with the retailer incentive cover. This is usually a very effective and cost effective way for a publisher to increase the sales of an issue. The cost for the additional cover image is usually far more than compensated for by the additional sales it brings in.

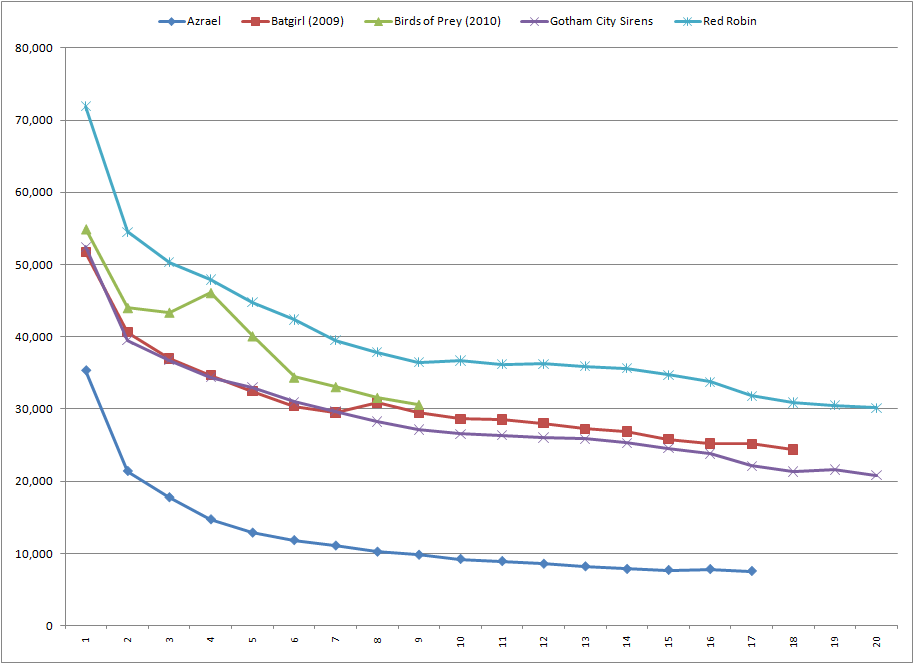

DC also revamped the lineup of titles in the Batman family of titles a while back. Here is how some of those new titles have been doing:

Again, there is a significant drop with the second issue and a generally downward trend after that. The White Lantern retailer incentive cover of "Birds of Prey" #4 accounts for the bump in sales on that issue. Retailers had to order 10 of the regular cover to qualify to order a copy of the White Lantern retailer incentive cover. The minor bump on "Batgirl" #8 corresponds to the start of the crossover storyline which continued in "Red Robin" #10 which also had a minor increase in sales. (Again, the charts are aligned by issue number and are not synchronized by date of initial release.)

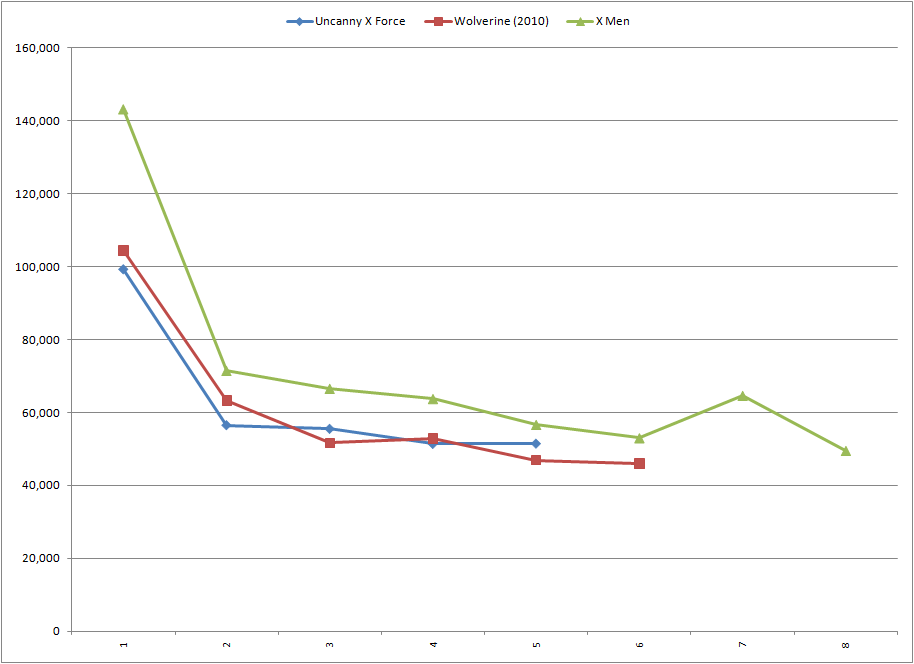

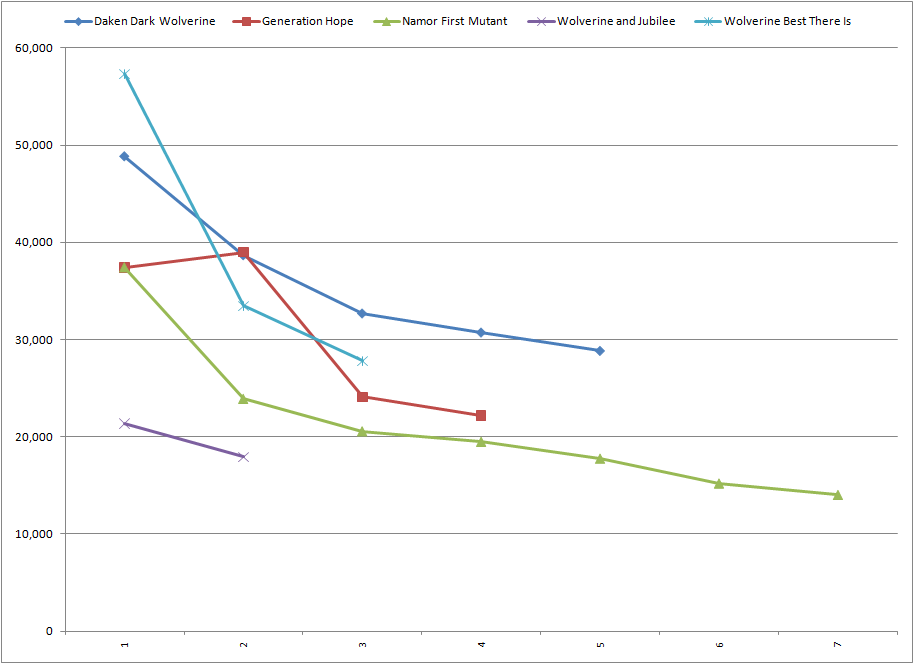

Here are some of the recently launched X-Men titles:

All of these titles had a noticeably larger than average second issue drop. After that, the sales trends are the standard attrition. "Wolverine" #4 had a Tron retailer incentive cover retailers could order a copy of for every 15 copies of the regular cover they ordered. The larger bump in sales on "X-Men" #7 was another case of a variant cover and two retailer incentive covers. Retailers could order any number of the regular cover and the blank variant cover. For every 15 copies of the regular cover, retailers could order a copy of the Bachalo retailer incentive cover and for every 25 copies of the regular cover they could order a copy of the Dodson retailer incentive cover.

When there are multiple retailer incentive covers, the thresholds are usually not multiples of each other. By having one threshold value of 15 and another at 25, retailers ordering just below 15, 25, 30, 45, 50, 60, 75, 90, 100, 105, 120 or 125 are encouraged to get the extra copies needed to qualify for the additional copy of the retailer incentive cover. Not all retailers do this and the number of additional copies ordered because of retailer incentive covers varies by the ratios, the actual cover art and will also vary from retailer to retailer and over time for each retailer. Generally speaking, retailer incentive covers increase sales.

The lower selling X-Men titles have similar sales trends. "Generation Hope" #2 had a 20 to 1 Greg Horn retailer incentive cover. Unfortunately, the title compensates for that increase on the second issue with a large drop to the third issue. Perhaps two titles starring Wolverine being

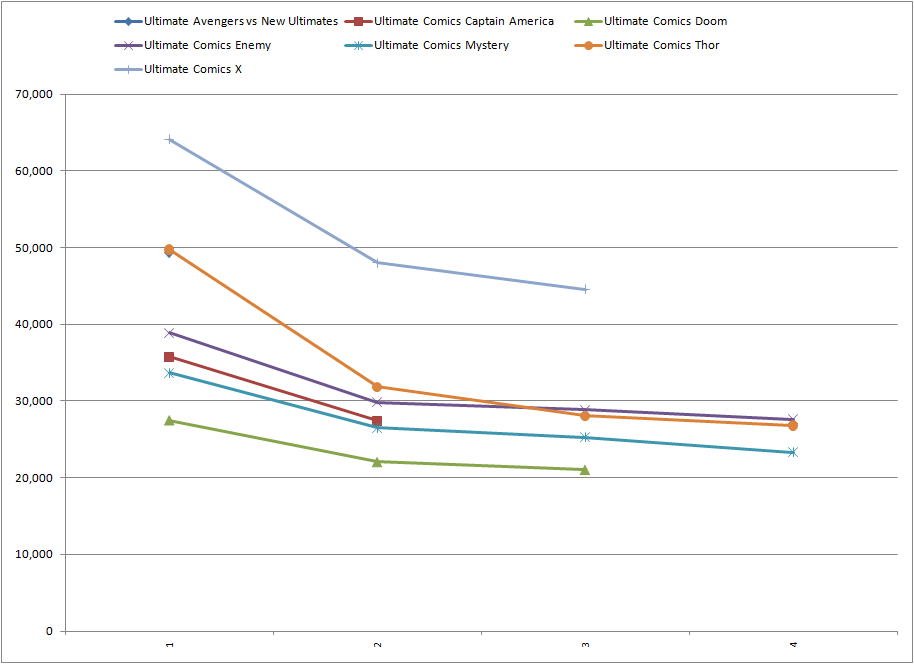

For the current round of miniseries in the Ultimate Comics line over at Marvel we are already seeing the second issue drop on most of them:

It is a little hard to see on the chart but the "Ultimate Avengers vs New Ultimates" #1 did around 400 units less than "Ultimate Comics: Thor" #1. The sales trends on the trilogy of "Ultimate Comics: Enemy," "Ultimate Comics: Mystery" and "Ultimate Comics: Doom" reveal how segmenting the twelve part storyline into thirds resulted in stronger sales at the starts of each new miniseries compared to the end of the previous one. This same trend happened with the three volumes of "Ultimate Comics: Avengers:"

The challenge retailers face with miniseries is they usually end right as the exit the honeymoon phase when retailers are essentially ordering blind.

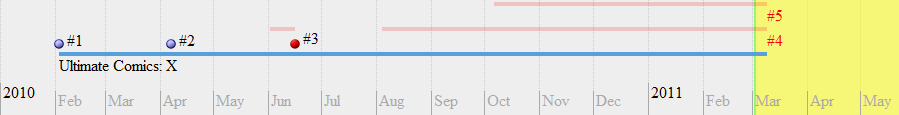

Another challenge the retailers face is late comics. The information the retailers used to order "Ultimate Comics: X" #4 back in June 2010 and #5 in August 2010 gets more and more inaccurate with each week those issues fail to ship. The final order cutoff process offers the retailers a chance to adjust their orders. The challenge is what to adjust them to. With an eight month gap since the most recent issue shipped, retailers have no current information to base what they would order for those issues if they were resolicited by Marvel. In all likelihood, those issues won't be resolicited but will quietly get listed on the final order cutoff list and sneak past many retailers.

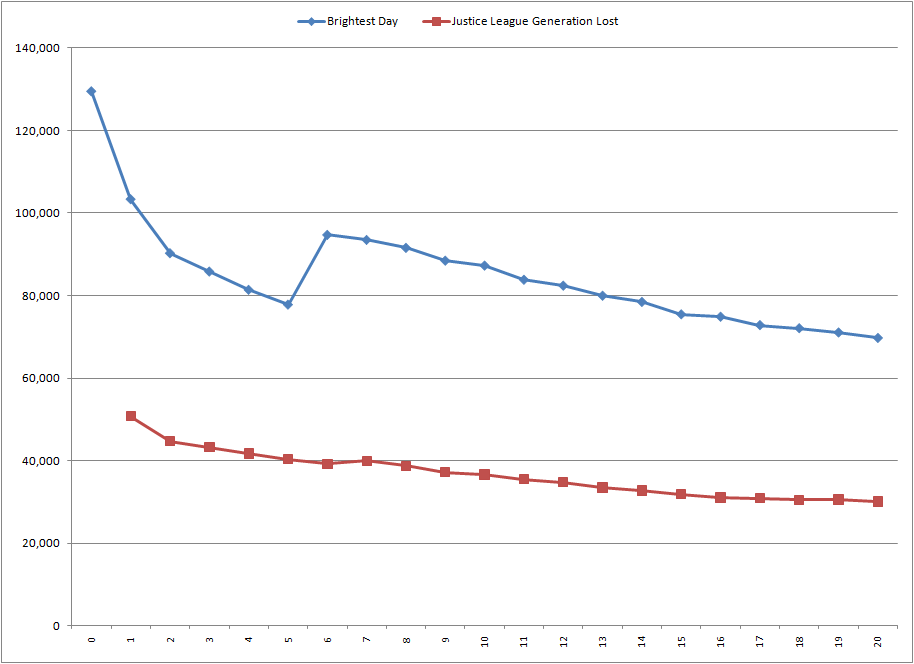

The difference in sales between "Brightest Day" and "Justice League: Generation Lost" is staggering. Both are part of the same overall arc storyline at DC but one is named after the arc and the other isn't. No doubt DC will learn from this and name future titles accordingly. What looks like a jump in sales on "Brightest Day" #6 is really a reflection of how Diamond adjusted the reported numbers of the earlier issues to compensate for the partially returnable. This same artificial bump happened with "52", "Countdown to Final Crisis" and "Trinity."

Lest anyone think that I've been picking titles to make things look bleak, here is a quick rundown of all of the titles with issue-to-issue sales gains in February starting with the best-selling titles.

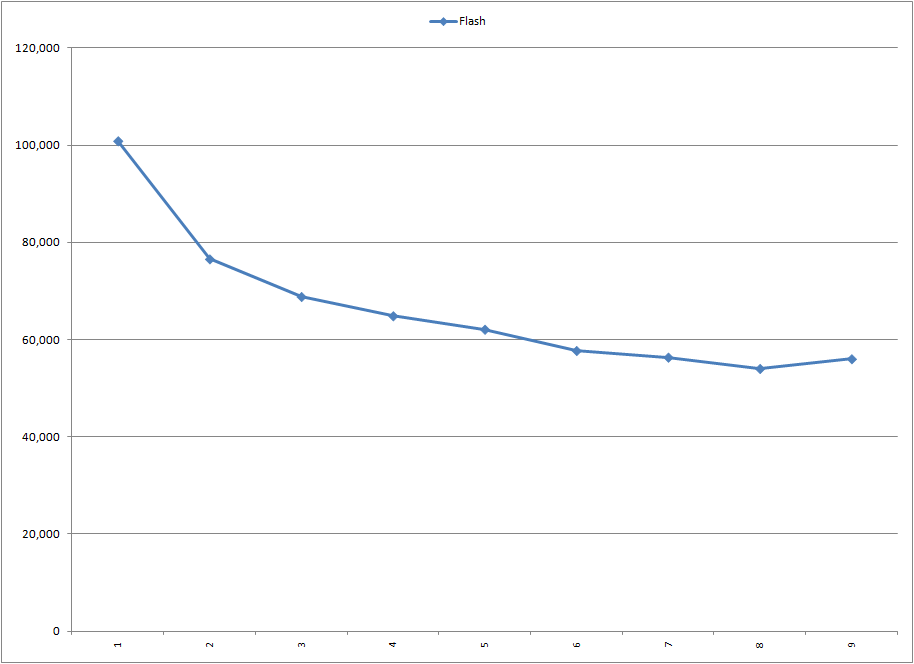

"Flash" #9 recouped some of the sales lost with the previous issue but still came in around 324 units below the sales of "Flash" #7. This lift is most likely in anticipation of the upcoming Flashpoint event which should lift the sales of "Flash" and a number of other titles for DC in the coming months.

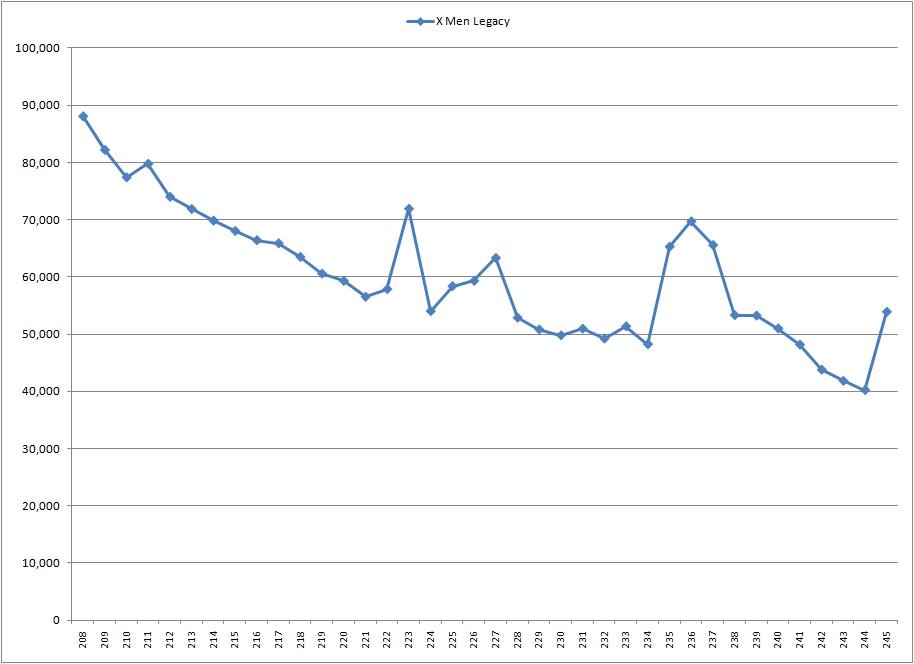

"X-Men: Legacy" #211 has a Skrull retailer incentive cover and #223 also had some retailer incentive covers. "X-Men: Legacy" #226 and #227 were part of the Utopia incident that crossover into a number of X-Men titles. (An incident is how I refer to a mini-Event involving a handful of titles and not the majority of the publishing line.) The bump with issues #235 to #237 was the Second Coming incident involving a number of the X-Men titles and characters. "X-Men: Legacy" #245 is the first chapter of the Age of X storyline which is crossing over between this title and "New Mutants" few the next few months. This is the best sales since "X-Men: Legacy" #237 released last June. The irony is this storyline is set in a radically altered timeline in which the X-Men never existed. One way to interpret this jump in sales is readers are interested in the X-Men characters but not in the recent X-Men storylines.

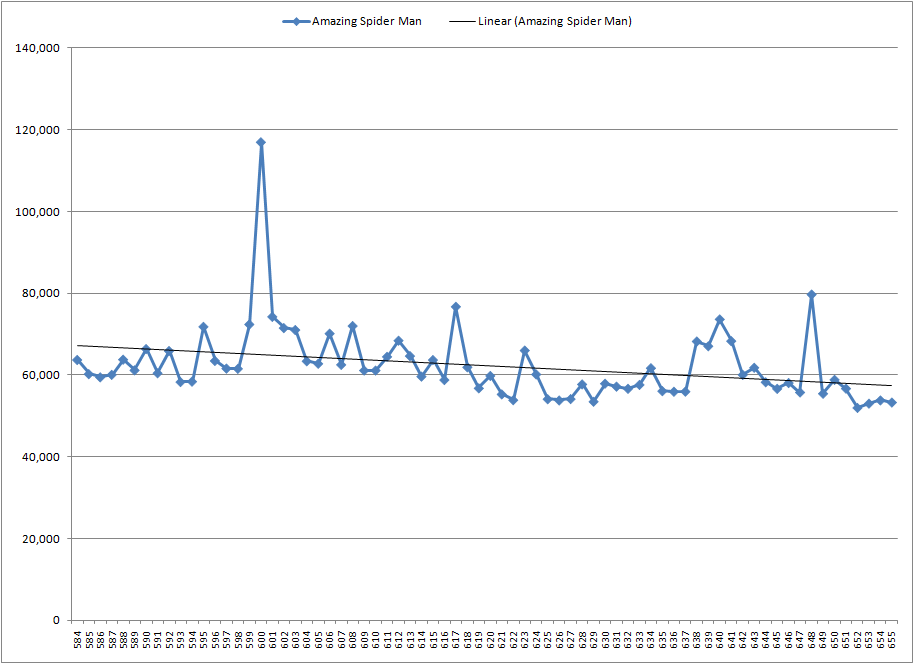

I've limited this chart to the issues after "Amazing Spider-Man" #583 which featured President Obama and sold well over half a million copies. This title bounces around almost as much as Spider-Man himself. Recent issues had some modest gains but the title is selling right at the lowest point it has done since "Amazing Spider-Man" #583 which featured President Obama. The majority of issues over the past few years have had one or more variant and/or retailer incentive covers masking the slow but steady standard attrition hidden behind the aggressive marketing of this title.

We already looked at "Uncanny X-Force" but in this chart it is a bit more obvious how the title has leveled off around 51,400 units. "Uncanny X-Force" #5.1 will be released in March and this might be a good title to gauge the impact of the Marvel.1 initiative given the minimal sales decline over the recent issues.

This is another title with an upward trend which will probably continue for the next few months during the War of the Green Lanterns storyline which is running cross the three Green Lantern titles.

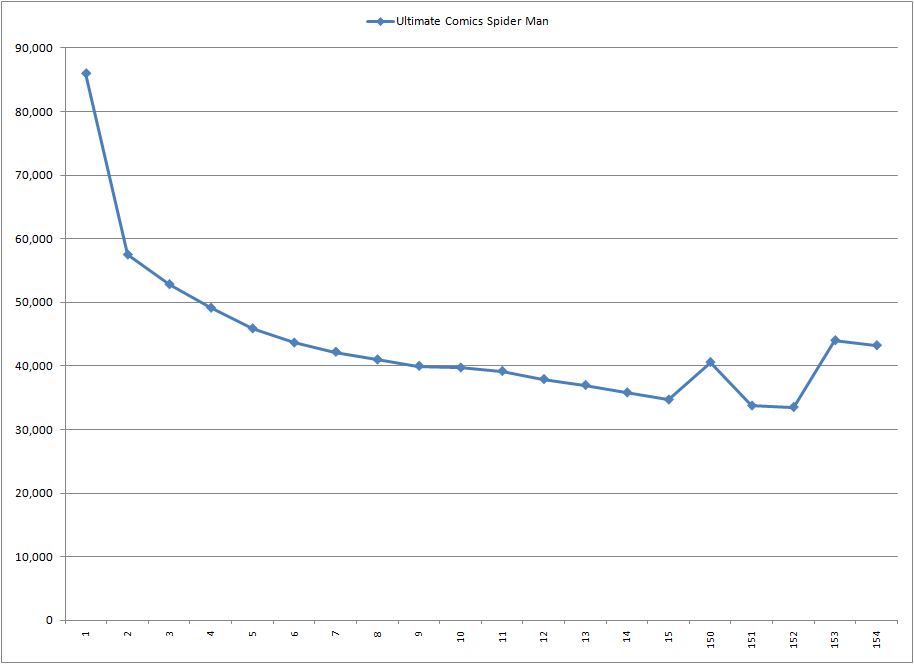

This is yet another case of a major second issue drop followed by the usual attrition. The bump on #150 was a result of the bump that usually happens on milestone issue numbers. Sometimes that "magic number" bump is due to the increased page count and content but often it is a combination of that and other marketing tactics. In this case, the 15 to 1 wraparound retailer incentive cover and the 25 to 1 Campbell retailer incentive cover were a clear factor in the sales bump.

The bump on #153 and #154 is due to the Death of Spider-Man event running through this title and "Ultimate Avengers vs New Ultimates" through July. Neither of these issues were originally solicited with retailer incentive covers but both seem to have shipped with them. This makes it difficult to tell if the bump was because of the Death of Spider-Man event, the extra covers or a combination of the two. It may simply be that readers are anxious for Spider-Man to die in the Ultimate Universe.

"Detective Comics" is a great example of the sales trends for a long running title. The sales either are level or dropping off until something shakes up the status quo and bumps up sales. Sales then level off or drop off until the cycle repeats.

The increased sales between "Detective Comics" #766 and #772 were the result of the Bruce Wayne: Murderer? And Bruce Wayne: Fugitive storylines. The bump on #797 to #800 was the War Games storyline which crossed through a number of Batman family titles at the time. "Detective Comics" #809 and #810 were part of the War Crimes storyline. The lasting increase in sales on "Detective Comics" #817 came as part of the "Face the Face" storyline which was also part of the One Year Later initiative. "Detective Comics" #838 and #839 were part of The Resurrection of Ra's al Ghul storyline.

The common element to these sales bumps is the issues are all part of a storyline which is a mini-event in the Batman family of titles. These incidents are very effective sales boosts for a group of titles and much easier to do in rapid succession than full blown events involving the majority of the publishing line. Given the established track record of this technique of boosting sales, it is unreasonable to expect publishers to abandon it anytime soon.

The peak sales on "Detective Comics" #853 happened on the "Whatever Happened to the Capes Crusader?" issue which was a much anticipated issue by Neil Gaiman and Andy Kubert. The following issue Batwoman took over the title for a while making it essentially a new title as far as sales trends are concerned. Batman reclaims the title with "Detective Comics" #866 explaining the minor bump in sales with that issue. The previous story arc served as a transition from Batwoman to Batman which served to undercut #866 as a true return to the title for Batman since he'd already been back in the title for a few issues by then.

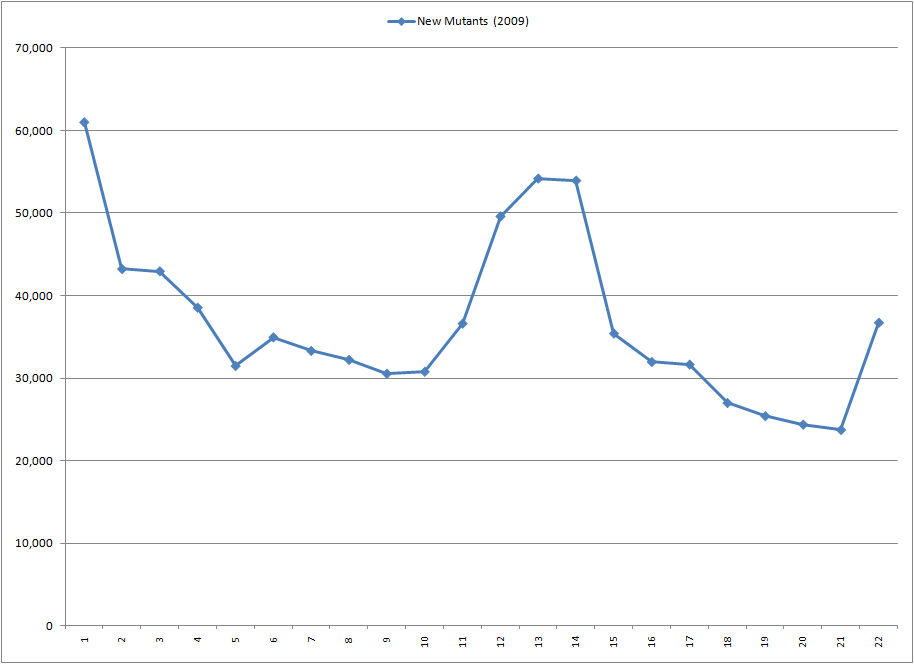

"New Mutants" is a great example of what the sales trends on a lower selling title in a larger family of titles can look like. In this case, in addition to the numerous sales boosts due to things like the Zombie retailer incentive cover on "New Mutants" #6, there is a major jump in sales with issues #12 to #14 which were part of the Second Coming X-Men incident. This storyline took over a number of X-Men titles for a few months and the resulting sales increase on this title is much more dramatic than cover gimmicks usually cause. The Age of X incident taking over the "New Mutants" and "X-Men: Legacy" titles is another example of how one of these mini-events can help sustain a lower selling title by cross-selling it to the readers of the higher selling titles in the group of titles.

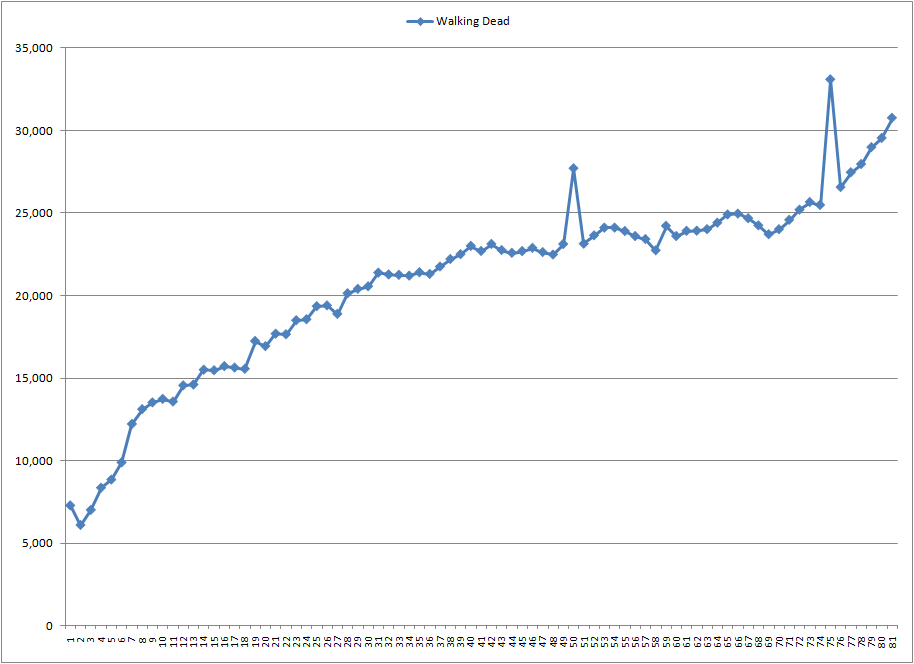

This is one of the few titles with a very clear and consistent upward sales trend. The two spikes are issues #50 and #75.

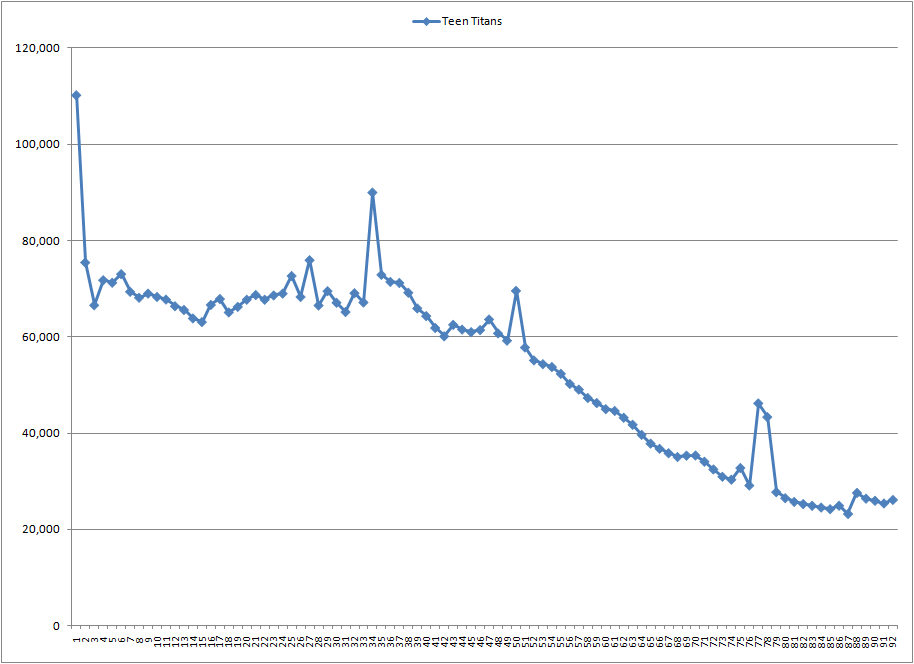

While the sales of "Teen Titans" are viable, they are few below what the title had been doing during the first few years. "Teen Titans" #34 was the first One Year Later issue which reset the status quo on the title. A strong case could be made that was the beginning of the decline in sales for the title. "Teen Titans" #50 was double sized and had a second cover. "Teen Titans" #77 and #78 were the issues the tied into the Blackest Night event. "Teen Titans" #88 through #91 all had 10 to 1 retailer incentive covers explaining the minor bump in sales over the recent few issues.

The One Year Later initiative at DC was a huge success but revealed and underlying failure. The status quo and creative team shake-ups resulted in bumps on the majority of the DC titles that month. The failure it revealed was the inability of most titles to retain readers and sales over time. The various new reader initiatives have the built in assumption of those new readers sticking around and becoming regular readers. But One Year Later illustrated even a successful new reader campaign doesn't yield new regular readers over the long term.

The increase on "Morning Glories" #3 is fairly unusual as is the leveling off the level after that. The title is averaging around 11,135 units which is only about 100 units above than #7 sold. The consistent sales level gives this title solid footing to build sales from over time.

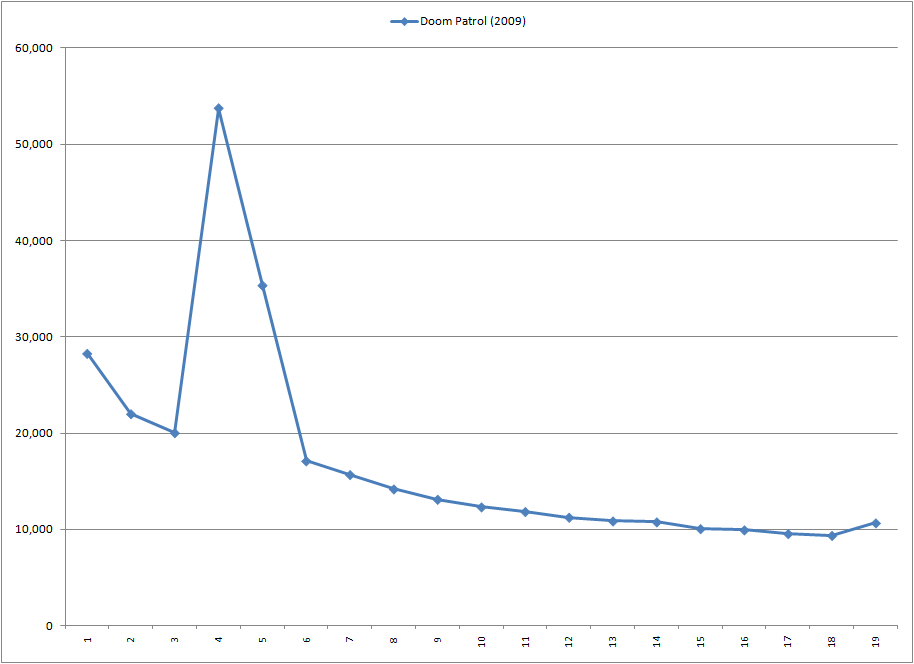

The spike on "Doom Patrol" #4 shipped with the promotional Yellow Power Ring and tied into the Blackest Night storyline. "Doom Patrol" #5 also tied into the Blackest Night event but had no additional premium with issue. Immediately after those issues, the title fell right back into the sales trend it has been in without missing a beat. The lack of any carry over from the promotional Power Ring and Blackest Night crossover indicates the problem is not just getting readers to try a new title but to stick with it once they have.

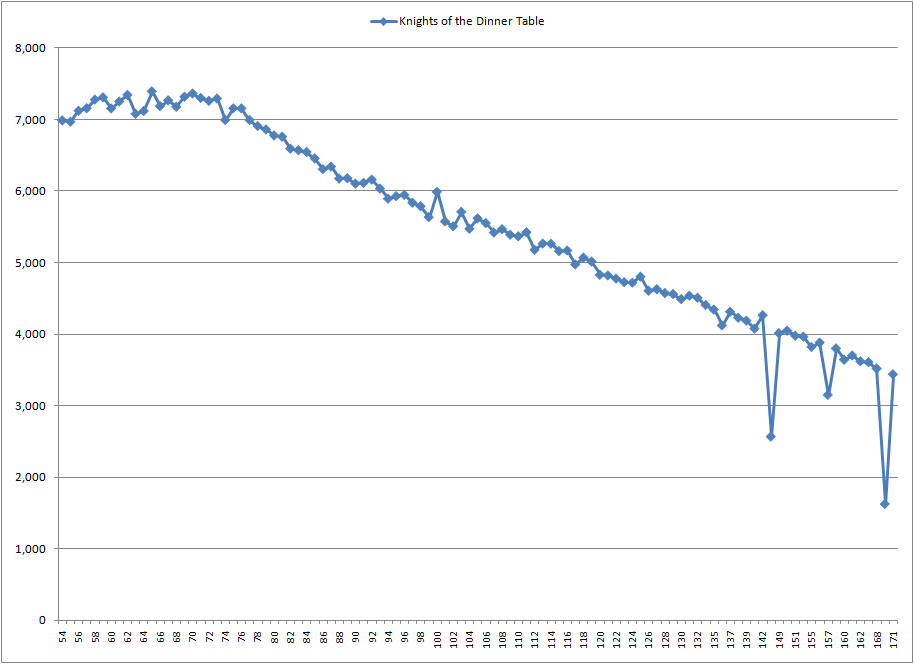

As with some of these other titles selling around where the top 300 list cuts off, some of these issues had sales across two months with one of those two months not making the list. "Knights of the Dinner Table" #170 is an example of this. It placed at rank 336 according to the top 25 small press list with an estimated 1,863 units of reorder activity putting the total known sales at an estimated 3,486 units which is squarely between the sales of "Knights of the Dinner Table" #168 and #171. "Knights of the Diner Table" #169 failed to make the top 300 at all in December landing at rank 307 according to the top 25 small press list with an estimated 3,498 units.

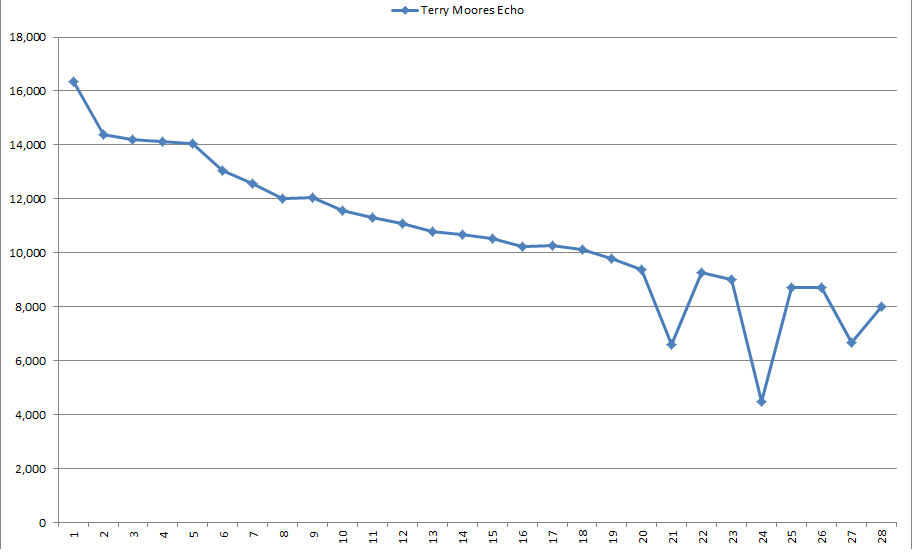

"Echo" is another example of a title which had shipments split across months on a few issues. The dips on #21, #24 and #27 are most likely a reflection of the sales for these issues being split across months with the remainder of them being too low to appear on the list when they shipped.

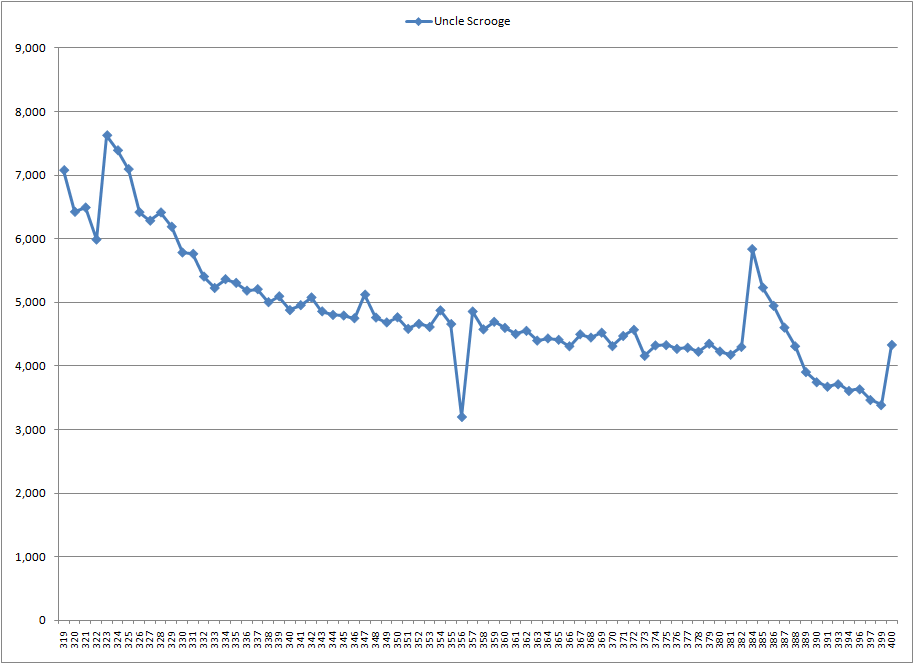

"Uncle Scrooge" #356 is likely another case in which some sales happened under the radar in an adjacent month. "Uncle Scrooge" #384 marked the start of the Boom Studios run and the change in format from a 64 page comics costing $7.99 to a standard 32 page comics costing $2.99. The price recently increased to $3.99 with the 40 page "Uncle Scrooge" #400 and remained that way with following issue which was back to the standard 32 page format. This technique of using a large milestone issue to obscure a price hike has been used numerous times by Marvel.

With very few exceptions such as "Walking Dead" and "Morning Glories", all of the titles we've looked have had a clear downward sales trend. This is the norm and not the exception. Until sales stabilize on the individual titles, publishers are going to rely on retailer incentive covers, events involving the majority of the publishing line and incidents, smaller event-like storylines across a group of titles, to boost sales. Reading comics is a hobby but publishing and selling comics is a business.