Mayo Report for 2011-01

|

|

Top Comics List Top Comics Breakdown Top Trades List Top Trades Breakdown

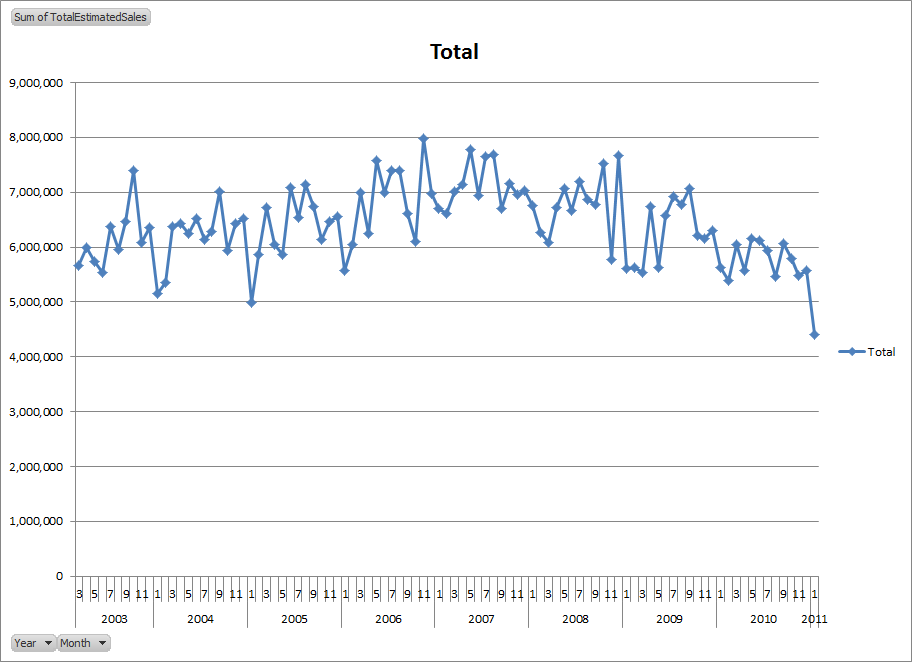

The first month of sales data for 2011 paints a grim picture with the total estimates units for the top 300 at the lowest they have ever been since March 2003 when Diamond first stated releasing sales information based on the final orders. The estimates total of 4,402,738 units is down over half a million units from the next lowest estimates total units of 4,992,620 for January 2005.

The two most obvious questions are: Why are sales down? And will they continue to go down?

One possible explanation is the ever popular "comics cost too much" mantra. There could be some validity to this because even after the DC price rollback to $2.99, there were 135 items on the list at $3.99 and only 127 items at $2.99. The median price for the top 300 comics in January was $3.95. The price of comics is a factor. But it isn't a new factor in January or even in the past months.

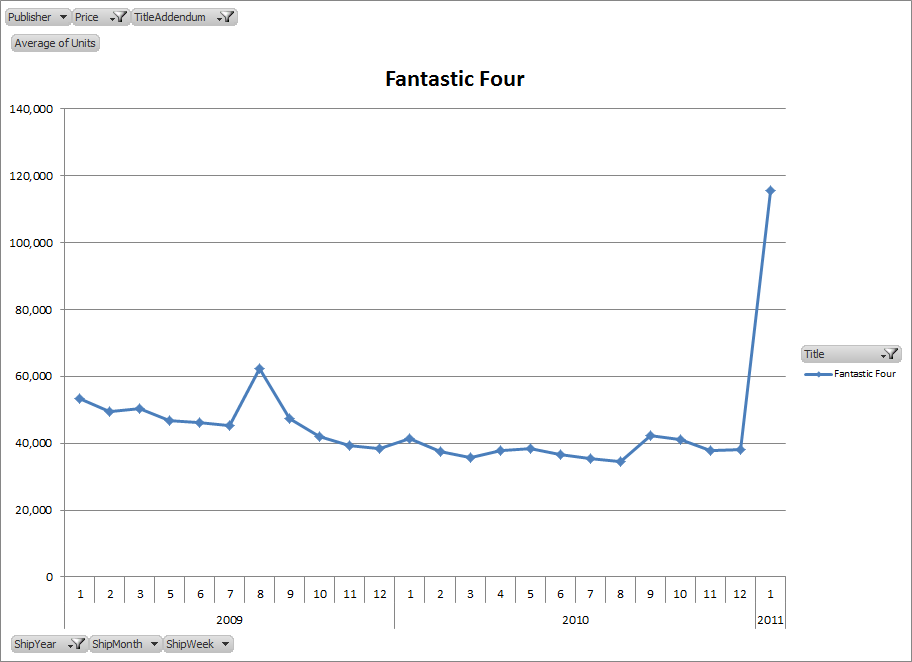

Another possible explanation is fewer items shipped in January 2011 than in either December 2010 or January 2010. Fewer items means there are few opportunities for sales. On the surface this makes a certain amount of sense. One problem with the theory is not all items sell equally well. Just compare the estimated sales of 115,488 for the top item of "Fantastic Four" #587 with the estimated 1,291 reorder units for "Lady Mechanika" #1, the lowest selling item on the list.

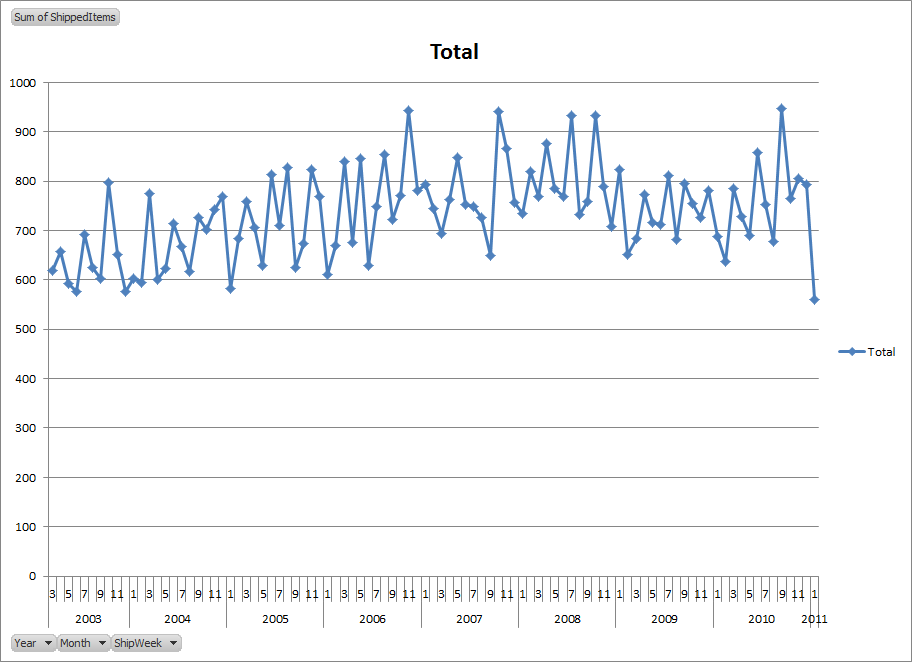

If the number of items available for sale had a direct link to the total sales of the top 300 then the chart of the number of comic books available each month and the chart of the total estimated unit sales for the top 300 comics should be synchronized. While there are some similarities between the two charts, there are also some striking differences. Of particular interest is how the two charts diverge during 2010 with a downward sales trend and an upward trend in the number of comics released during that same year.

Another misleading aspect of how many different items shipped is that it doesn't account for items that only partially shipped during the month. Sometimes items that ship during the first or last week of the month have part of the units shipped in one month and the rest in the other. There are enough items at the bottom of the list that seem to have dropped by around half that we have to at least consider this a possibility. The problem is many of these items shipping near the middle of the month with sales below the bottom end of the December list to know for sure it that is what happened.

A few of the better selling DC titles such as "Flash" and "Green Lantern" and both of the newest Batman titles "Batman: The Dark Knight" and "Batman, Inc" didn't ship in January which clearly contributed to the lower overall sales. Those four titles could account for about a quarter of a million unit drop if the next issue sold as well as the issues in December. Realistically, that won't be the case as each of those titles will likely drop in sales with the next issue. The units those titles would have added to the total for the top 300 would have help but January would have remained the worst selling month during the final order era.

Most of the other titles that had been selling over an estimated 50,000 units during the past year didn't ship because they ended. These include the event title of "Blackest Night" and the related side titles of "Blackest Night: JSA," "Blackest Night: The Flash" and "Blackest Night: Wonder Woman." No such event was published in January. This goes back to the churn based sales model I have talked about before with sales end as titles end. While DC did a good job transitioning readers from "Blackest Night" to "Brightest Day," the companion series of "Justice League: Generation Lost" is selling well under half the units of "Brightest Day." DC might have been better off if the "Justice League: Generation Lost" storyline had been integrated into a weekly "Brightest Day" series instead of those being two different titles.

A number of minor events, or "incidents" for the lack of any better term, came and went of the past year some with sales over 50,000 units came and some with much lower sales. These incidents are usually structured like an event title but are limited in scope to a small group of properties. Notable examples of these incident titles include "Bruce Wayne: The Road Home," "Shadowland" and "Siege." "Siege" was the title that most resembled an event but the scope was limited to the Avengers titles. While these titles may look like the events seen in recent years, the limited scope usually yields lower sales than a true event which involves most of the characters and teams in the narrative universe. These incident titles usually sell slightly more than the keystone property. "Shadowland" sold a little above sales of "Daredevil." "Chaos War" had no keystone title since Hercules is currently between titles and the sales suffered as a result with "Chaos War" #5 ending the series at rank 59 with around 24,694 units. The "Age of X" incident is little more than an ongoing crossover between "X-Men: Legacy" and "New Mutants." The "Age of X: Alpha" #1 launched that incident with an estimated 47,050 units putting it solidly above "X-Men: Legacy" #244 which had 40,193 estimated units and with sales nearly double the 23,773 units "New Mutants" #62.

As for the second question of if the overall drop in sales seen in January will continue, that is a much harder question to answer.

On the most positive side, Marvel is going to be rolling out the "Fear Itself" event and DC will be doing the "Flashpoint" event, both of which should inflate sales. But those are short term tactics and are not solutions. The core problem is titles are not maintaining sales from issue to issue. Until most titles can

With the number titles with issue-to-issue of declines outpacing advances by a ten to 1 margin in January and the total issue-to-issue unit losses being double the gains, it is seems extremely likely the downward trends we have been seeing at the per title level will continue indefinitely. Only 18 items on the list went up in sales in January. Nearly half of the total issue-to-issue unit gains in January came from "Fantastic Four" #587. Clearly from a sales perspective, "Fantastic Four" #587 was a major success.

There is a lot we can learn about comic book sales trends from "Fantastic Four" #587. The first question is how much of a bump in sales does killing a character generate? It depends on which character is killed, how the title has been selling and how much hype/buzz the publisher can stir up over the death.

With Fantastic Four, the sales have been below 40,000 recently so tripling the sales would put it right in that top seller area we would expect the aggressively hyped death issue to land in. The next issue will be the final issue of the "Fantastic Four" series followed by "FF" #1. The first issue of the replacement series should sell well due to it being a #1 issue. After that, sales will probably slide back down until around this time next year. At that point, the title will likely revert from "FF" back to "Fantastic Four" just in time for issue #600. Based on how Marvel has been doing #x00 issues, "Fantastic Four" #600 will most likely be a 104 page issue that will also sell better than average for the title.

So, because of how Marvel has been marketing the death of a member of the Fantastic Four, Marvel is getting three sales spikes for the series. The first on #587 with the poly-bagged death issue itself. The second on the new #1 with the renaming of the title and the third when the renaming gets reverted just in time for the anniversary issue of "Fantastic Four." The last one would probably have been a sales bump regardless given how Marvel has been handling the #x00 issues recently so people might argue about this inclusion of it here as part of the death marketing. The deciding factor will be if that issue focused on the events of the death or not. There is the possibility "Fantastic Four" #600 could be the return of the character killed off in "Fantastic Four" #587 and, if so, then it clearly belongs here as part of the marketing blitz for the death.

Of course, other factors can sales too. The first spike in mid 2006 was the issues that crossed over with the highly successful "Civil War" series and event. The second spike in early 2008 was when Mark Millar and Bryan Hitch took over as the creative team. The smaller spike in mid 2009 was when the current writer Jonathan Hickman took over the title. Obviously who is writing and drawing the book can have a major impact on sales, at least initially. That having been said, there were other creative team changes on the title since 2003 that had a much less pronounced impact on sales.

The first takeaway is the sales are driven up by marketing stunts to compensate for the standard attrition on most titles. That standard attrition is the problem. Losing sales issue after issue implies a corresponding loss of readers from issue to issue. Presumably retailers are adjusting their orders each month based on what they have been selling. As sales to readers change, those changes are reflected in the orders placed by retailers.

Another takeaway is the sales spikes were clearly exception cases which quickly evaporate over the following issues. A more sustainable model would be stable sales the go up with these marketing gimmicks stabilizing at the higher levels. But sales don't stabilize at those higher levels. Sales gimmicks aside, sales don't tend to stabilize on most titles.

The last takeaway is the upcoming events at Marvel and DC will, at least for the duration of the events, inflate the total units for top 300 comics giving the illusion of positive sales. But unless the issue-to-issue changes on the various titles stop declining and start advancing, the next time the events stop we could be looking at an even lower total for the top 300 comics.

Of course, the solution is pretty simple: buy more comics.

At the end of the day, we the readers control these sales trends. These numbers go up and down based on what we buy. The retailers act as an "electoral college" and filter our buying patterns into what they buy which are the actual basis for the numbers we see here. The bottom line is these sales figures are going down because collectively we are buying fewer comics.