Mayo Report for 2020-02

|

|

Top Comics List Top Comics Breakdown Top Trades List Top Trades Breakdown

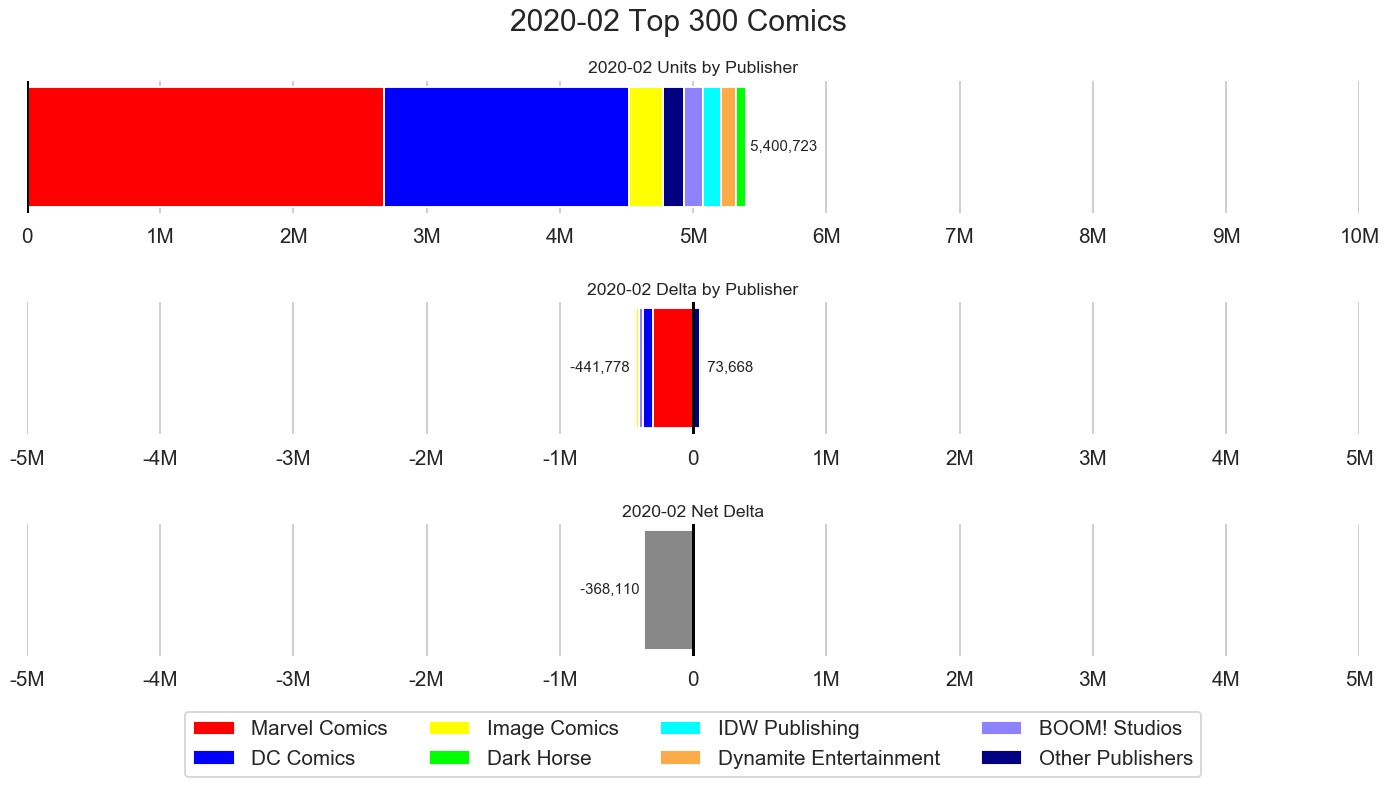

February 2020 had 5,400,723 units in the top 300 comics list, a decrease of 368,110 units from last month. February 2020 was a weak sales month. The average for the past 12 months is 6,364,130 units. The total of 5,400,723 units for the top 300 comics was about halfway between the 6,606,758 unit average for the top 300 and the 4,402,738 unit record low from January 2011. From a retail dollar perspective, the drop is even more pronounced going from the record high dollar total of $35,765,767.37 for the top 300 comics in October 2019 down to $23,731,257.51 for this month. The drop over the past few months is very similar to the drop at the end of 2017 and start of 2018. But a weak first quarter isn't unusual.

Perhaps more concerning is _Wolverine_ #1 which sold 190,568 units was the only item over 100,000 units. _X-Men_ #6 and #7 were the only two other items over 70,000 units. The _Empyre_ event at Marvel and _Generation One_ which kicks the 5G initiative into full swing should help boost sales when they start up.

The premiere publishers accounted for 97.11% of the total units for the top 300 comics this month while all of the other publishers with items in the top 300 accounted for 2.89% of the total units for the top 300 comics.

Marvel Comics placed 2,683,072 units in the top 300 comics, a decrease of 304,345 units and accounted for 49.68% of the total units.

DC Comics placed 1,836,012 units in the top 300 comics, a decrease of 69,240 units and accounted for 34.00% of the total units.

Image Comics placed 257,618 units in the top 300 comics, a decrease of 18,366 units and accounted for 4.77% of the total units.

These totals illustrate how Marvel is the dominate publishers with only DC operating at the even close same basic level. That isn't a bad thing in and of itself. The smaller publishers can focus on niche audiences and serve audiences which Marvel and DC either aren't targeting or aren't pleasing.

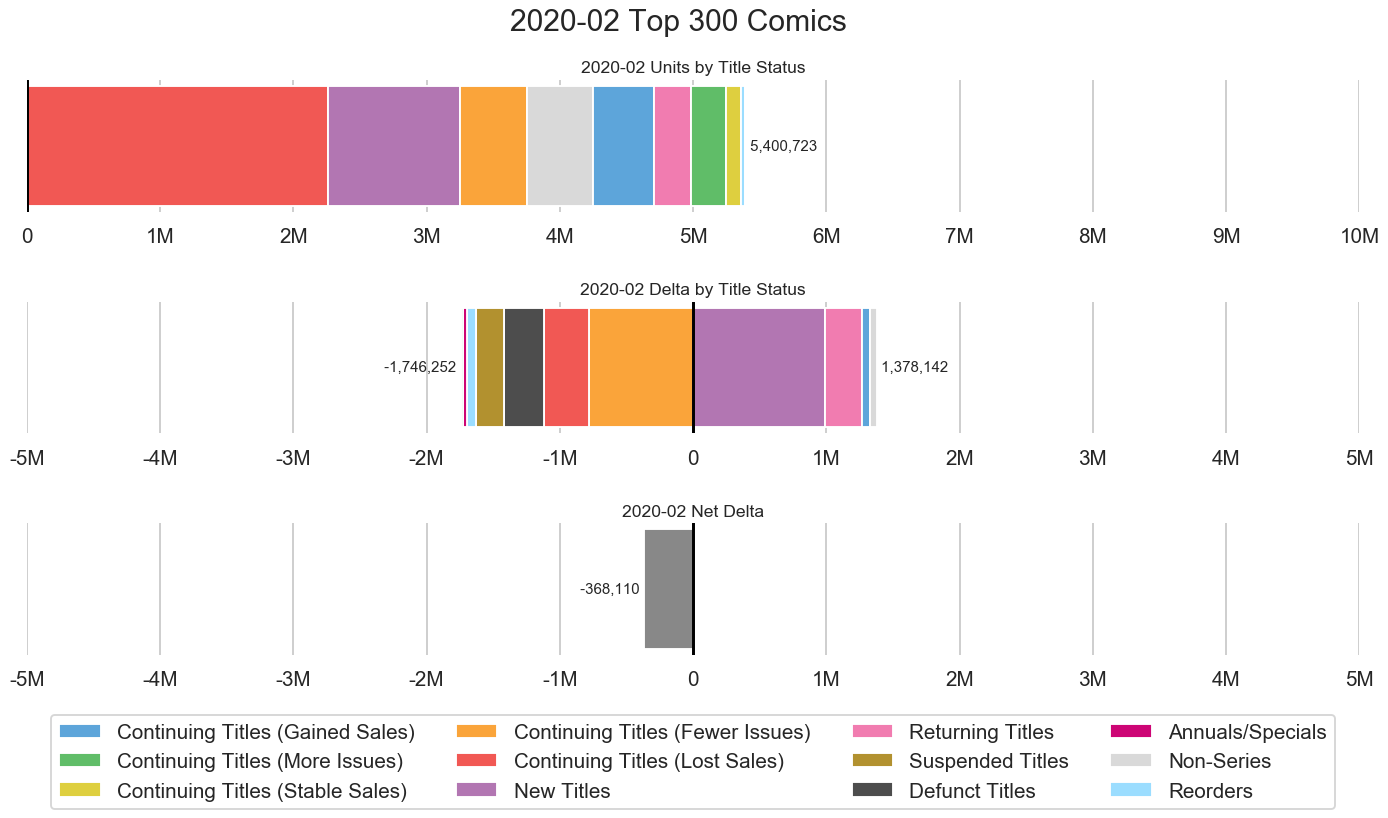

The up-swing of 1,378,142 units from new and increased sales was not enough to compensate for the down-swing of 1,746,252 units from lost sales for the net decrease of 368,110 units. The range of the up-swing and down-swing wasn't quite as large as it has been in many month but there is still a large amount of volatility in sales from month to month.

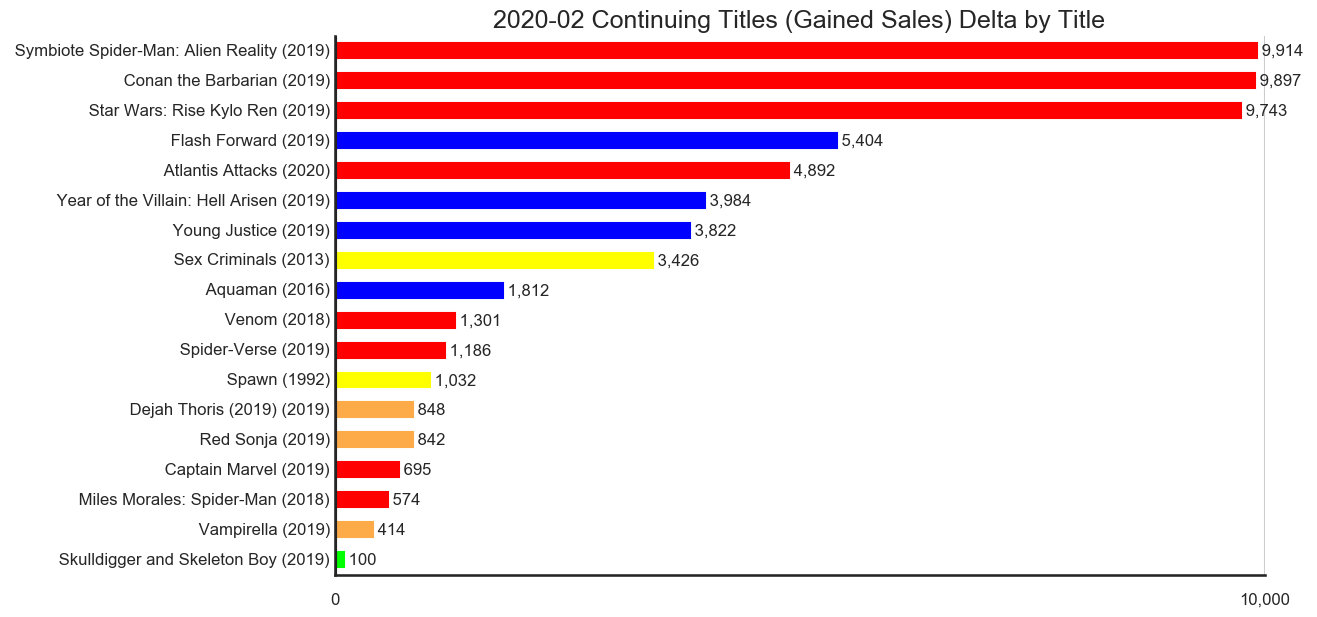

The 18 titles across the 5 publishers in the continuing titles which gained sales category accounted for 458,646 units in the top 300 comics with an upswing of 59,886 units.

Marvel Comics accounted for 63.79% of the change in this category with Symbiote Spider-Man: Alien Reality, Conan the Barbarian and Star Wars: Rise Kylo Ren having gained the most sales in February.

The Flash Forward ended with an uptick in sales but the story has an epilogue in Flash #750 which was released in March. The Wally West storyline which was set up in the Flash series and occurred in Heroes in Crisis and then continued in Flash Forward, had an epilogue in Flash #750 which in turned teased an upcoming title. This sort of stringing a storyline across consecutive titles can be a good thing if done well and a bad thing is done poorly.

Having an exit strategy for a short lives series which transfers those readers onto a different title is a smart thing for a publisher to do. Letting the readers which want to follow the next story for a character know when and where that story is going to be published is a great idea. Where this idea can go wrong is when the story being told in a given limited series stops which actually concluding the storyline. Readers can get frustrated if they feel each limited series only serves to set up the next in a potentially unlimited series of limited series.

As with any story, some readers of the Wally West storyline are going to love it, some are going to hate it and many will be somewhere in the middle. The concern isn't around if the readers like the story or not. The concern is around readers that expected the story to resolve at the end of each of these limited series. The lack of resolution can feel like a bait-and-switch sales tactic and a failure to adhere to the implied "contract" of a limited series.

DC isn't the only publisher to do this. The Atlantis Attacks limited series is a very direct continuation of the Agents of Atlas miniseries which preceded it. These are only two current examples. There are many more such examples.

It is a fine line between "the adventures of this character continue in this other title" and "this adventure continues in this other title." While it can be a very clear line, it is also a matter of opinion as to exactly where that line is at times.

All publisher should be cautious when employing this strategy of continuing a storyline in another limited series. It seems to be working fine now but overuse of it can leach the sales power out of it. Ultimately, it could cause readers to lose faith that a limited series will contain a beginning, middle and end of a story. Should that happen, many readers may decide to either wait for the trade or just skip the limited series entirely. Given the percentage of current material which is limited series, that could hurt sales significantly.

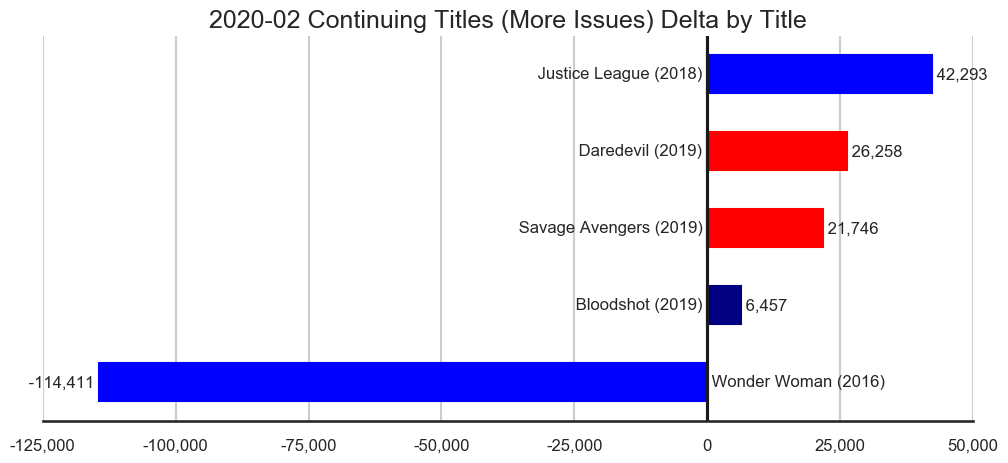

The 5 titles across the 3 publishers in the continuing titles which shipped more issues category accounted for 259,893 units in the top 300 comics with an upswing of 96,754 units, a downswing of 114,411 units for a net a decrease of 17,657 units.

There were five shipping weeks in January and four in February.

Wonder Woman was the title which had the largest impact in this category. Wonder Woman #750 sold 168,632 including the 1,255 units of reorder activity this month. Wonder Woman #751 was down 84.21% and sold 26,624 units followed by Wonder Woman #752 which was down another 1.06% and sold 26.342 units. Those sales are a few thousand units lower than how the title had been averaging prior to Wonder Woman #750.

I'm curious how the title might have done if the title hadn't picked where the first story in #750 left off but instead had picked up from where the last story in the issue left off. It would not have been the first time the Wonder Woman title had shifted focus like that and it is unlikely to have done worse than how the two issues in February sold. Depending how those issues were solicited, the issues might not have done better in the preorder phase but they almost certainly would have had robust reorders. Too bad we can't see the sales data for an alternate timeline in which that happened.

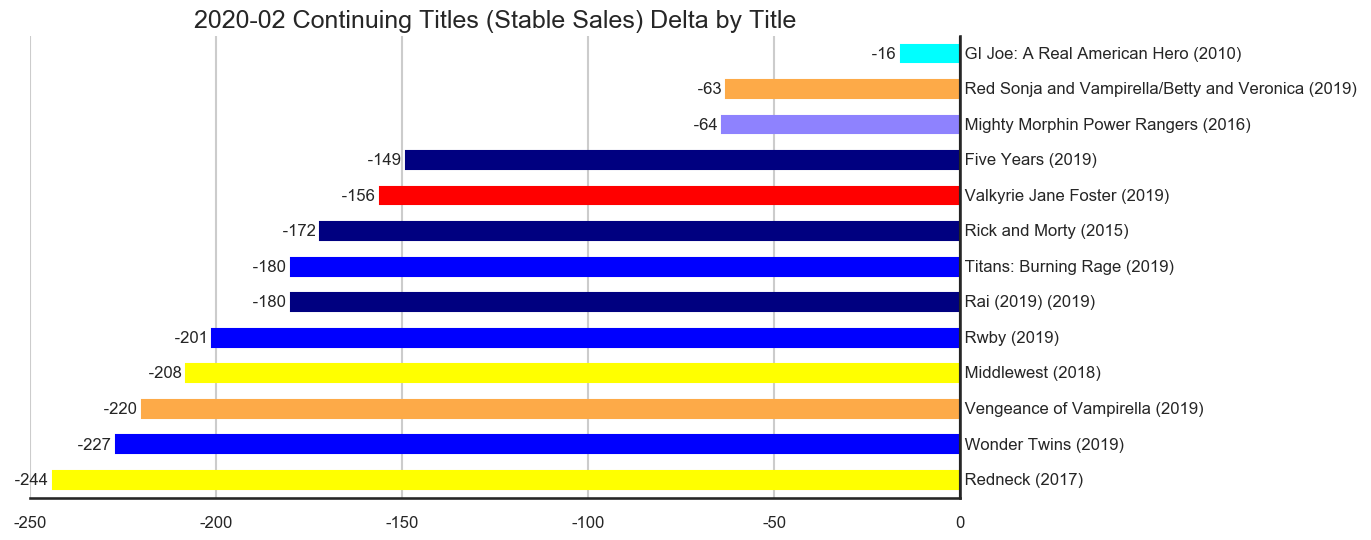

The 13 titles across the 9 publishers in the continuing titles with reasonably stable sales category accounted for 119,552 units in the top 300 comics with a downswing of 2,080 units.

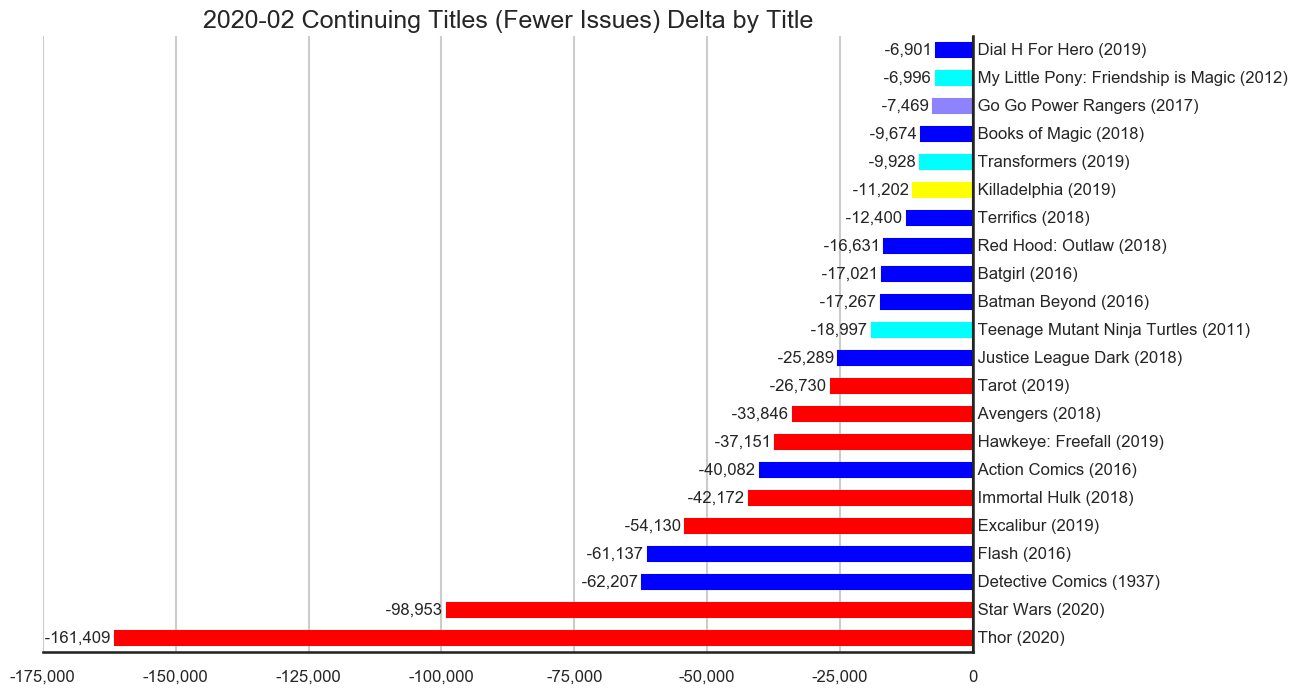

The 22 titles across the 5 publishers in the continuing titles which shipped fewer issues category accounted for 501,767 units in the top 300 comics with a downswing of 777,592 units.

Marvel Comics accounted for 58.44% of the change in this category with Thor and Star Wars being the most notable titles. Both title had high selling first and second issues issues last month so the drops are a combination only releasing a single issue and that issue having a third issue drop of 4.95% for Thor and 6.68% for Star Wars.

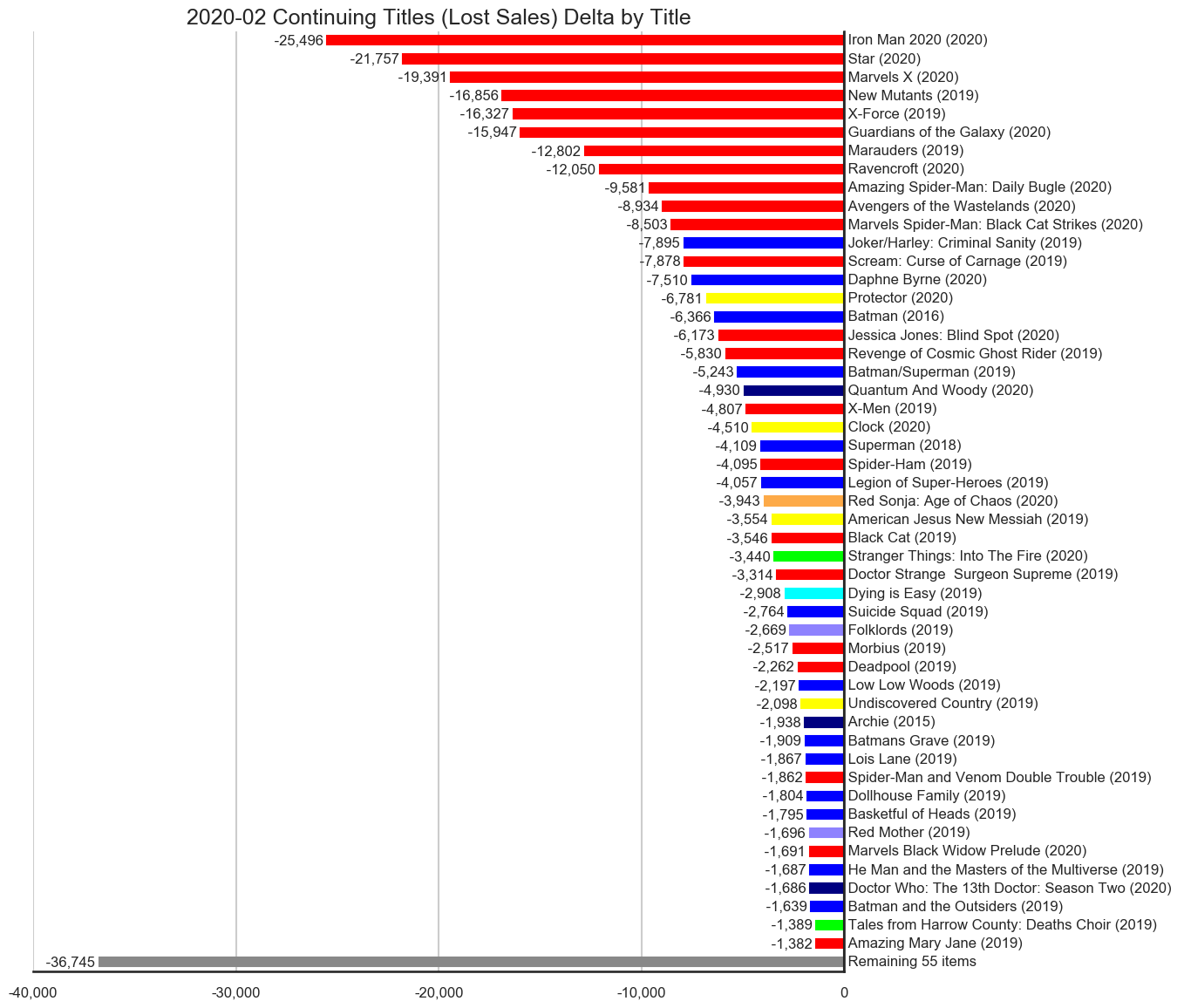

The 105 titles across the 11 publishers in the continuing titles which lost sales category accounted for 2,259,955 units in the top 300 comics with a downswing of 342,130 units.

Marvel Comics accounted for 64.84% of the change in this category across numerous titles. Iron man 2020 had a second issue drop of 46.68%. Star had a second issue drop of 39.56%. Marvels X had a second issue drop of 38.34%. Guardians of the Galaxy had a second issue drop of 26.29%. Second issue drops like these are not unusual for Marvel titles. Sometime the second issue drops are even higher.

The Dawn of X titles are just now starting to get out of the honeymoon period so the sales are still settling into what might be the new baseline for them. The shuffling of content for a few issues of a few titles like New Mutants might serve to sort of extend that period slightly. Even with the drop in sales, X-Force, New Mutants and Marauders are all still inside the top 40 items.

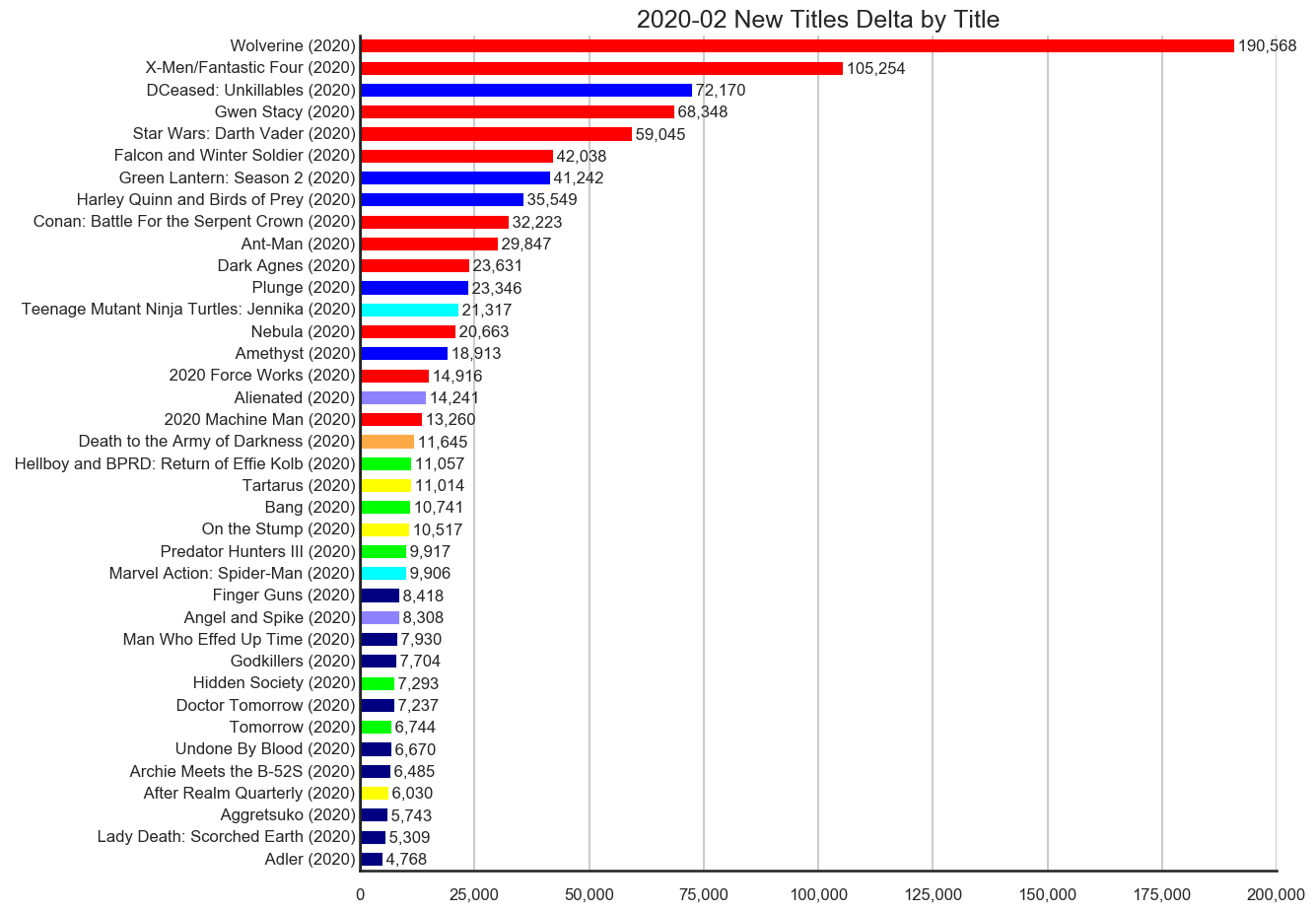

The 38 titles across the 14 publishers in the new titles category accounted for an upswing of 990,007 units.

Marvel Comics accounted for 60.58% of the change in this category with Wolverine and the X-Men/Fantastic Four limited series being the most notable titles.

Gwen Stacy #1 launched with 68,348 units across the regular cover, the 1-in-25 cover, the 1-in-100 cover, the 1-in-200 cover, the two signed covers and the connecting Chinese New Year cover and the three other covers. The second issue only has a regular cover, a 1-in-25 cover, a 1-in-50 cover and one other variant cover so sales will most likely drop significantly as a result. The third and fourth issues of the Gwen Stacy limited series only have a regular cover and a 1-in-25 cover. In addition to the usual sales attrition, the title is seeing a drop in sales based on fewer variant covers on the later issues.

Star Wars: Darth Vader is a similar case with the first issue having a regular cover, a 1-in-10 cover, a 1-in-25 cover, a 1-in-50 cover, a 1-in-100 cover and one other cover. The second and third issues only have a regular cover, a 1-in-25 cover and one other cover while the fourth issue only has a regular cover and one other cover. In general, fewer covers means lower sales. With incentive covers, the higher the ratio is the larger the potential sale bump can be.

DCeased: Unkillables, on the other hand, has the same regular cover and two card stock covers for each of the first three issues solicited. The second issue probably won't be is large on this title as on Gwen Stacy and Star Wars: Darth Vader. Obviously the story content and general strength of the properties influence how the titles sell but the use of variant covers to promote a title are also a major influence on sales.

It is worth noting that a few titles launched with low enough sales which could have been ground for cancellation at Marvel and DC a decade or two back such as Amethyst, 2020 Force Works and 2020 Machine Man. Smaller publishers tend to have lower overhead costs and can operate titles profitably at lower sales levels. This is one of the main stretches of the smaller publishers. It would benefit the entire comic book industry and community to find a way to support these smaller publishers better. Unfortunately, because these items tend to be offered to retailers at lower discounts than the premiere publishers, the comic simply aren't as profitable for retailers to sell as the comics from the premiere publishers.

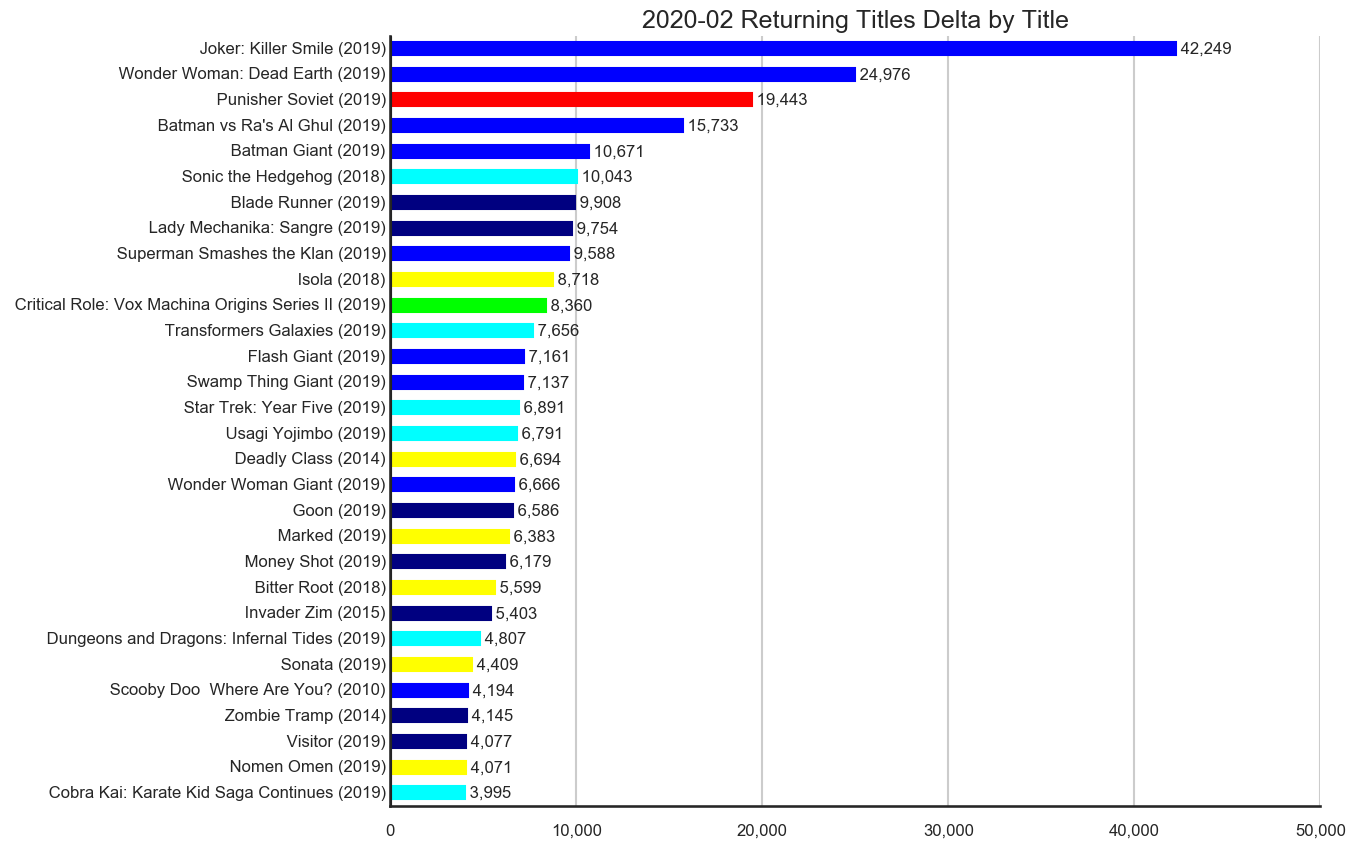

The 30 titles across the 12 publishers in the returning titles category accounted for 278,287 units in the top 300 comics with an upswing of 278,287 units. There were no returning titles with sales larger than 43,000 units.

DC Comics accounted for 46.13% of the change in this category. The best selling title in this category was Joker: Killer Smile #3 which sold 42,249 units, a drop of 11.53% from the previous issue.

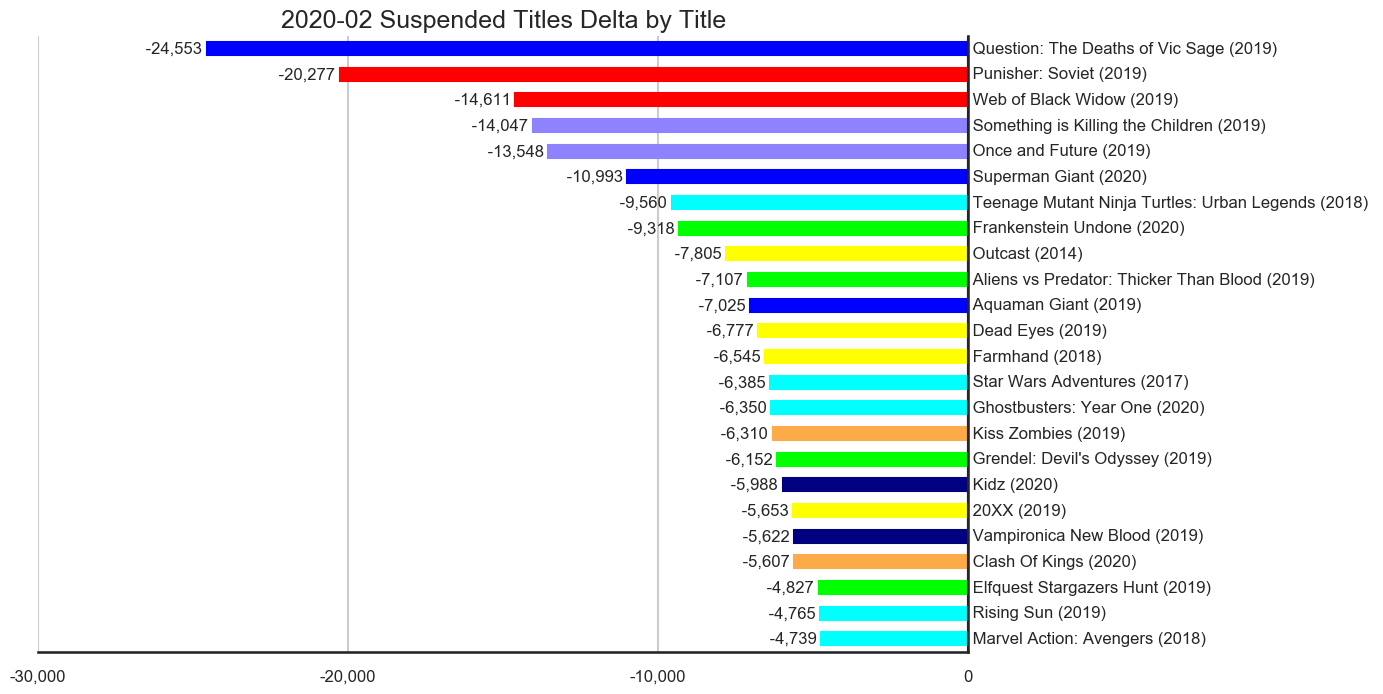

The 24 titles across the 9 publishers in the suspended titles category accounted for a downswing of 214,564 units. Question: The Deaths of Vic Sage (2019) was the most significant title in this category and accounted for 11.44% of the change in this category with the 24,553 units it sold last month. Over the past year, it hasn't been unusual to see much higher selling titles skip months resulting in larger impacts to the suspended titles and returning titles categories.

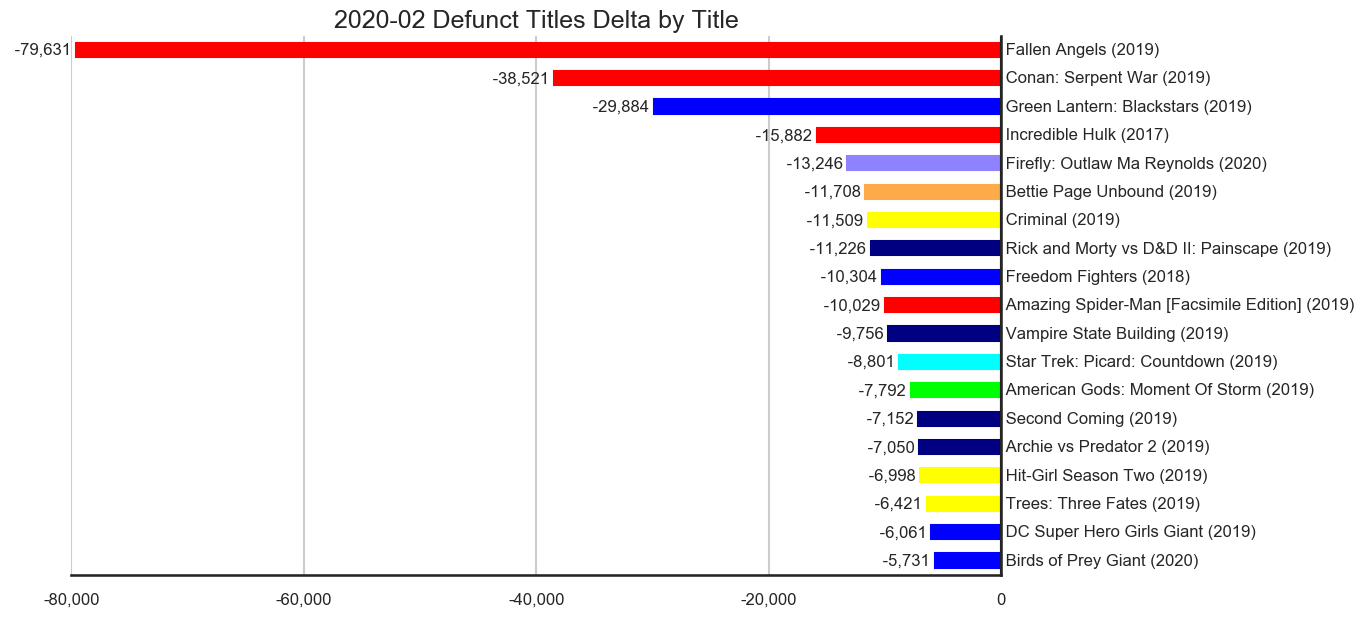

The 19 titles across the 11 publishers in the defunct titles category accounted for a downswing of 297,702 units. Marvel Comics accounted for 48.39% of the change in this category.

Fallen Angels alone accounted for 26.75% of the change in this category. That was the first Dawn of X title to end. It seemed to be solicited as if it were an ongoing title but last as only as long as a miniseries. This is one of the many things which renders the distinction between ongoing titles and limited series increasingly meaningless. The key distinction, which seems to still have some meaning, is with a limited series the run length is generally known at the first of the series while an ongoing title is expected to run for as long as it can. This known end point can set the expectation of a clear beginning, middle and, perhaps most importantly, end to the story within a finite duration. Arguments can be made on both sides around if this is a reasonable expectation or not.

In either case, Fallen Angels might have sold a little differently had it been known at the outset that it would only last six issues. Some readers which pass on it because it seemed to be an ongoing title might have been willing to pick it up if they knew it was only a six issue commitment. Likewise, there might have been some readers which picked it up that might have passed on it had they known it would only last six issues. Some of those readers might have opted for the trade while some might have skipped it entirely. Different readers have different criteria for what they get. Some readers don't care abut the expected length of the title while it can play in to the purchasing decision for other readers.

Fallen Angels ended with sales averaging 39,812 units last month. Those are more than sustainable sales for a Marvel title these days. While it was the lowest selling Dawn of X title, there is no particular reason to think the title was ended because of low sales.

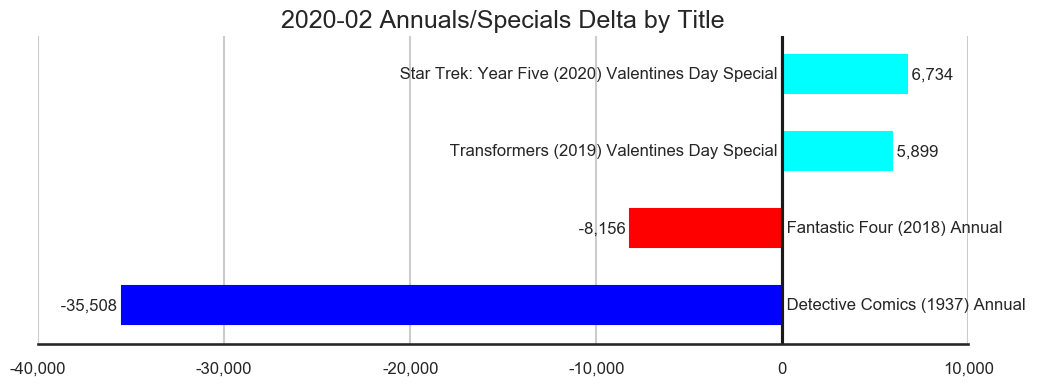

The 4 titles across the 3 publishers in the annuals/specials category accounted for 12,633 units in the top 300 comics with an upswing of 12,633 units, a downswing of 43,664 units for a net a decrease of 31,031 units.

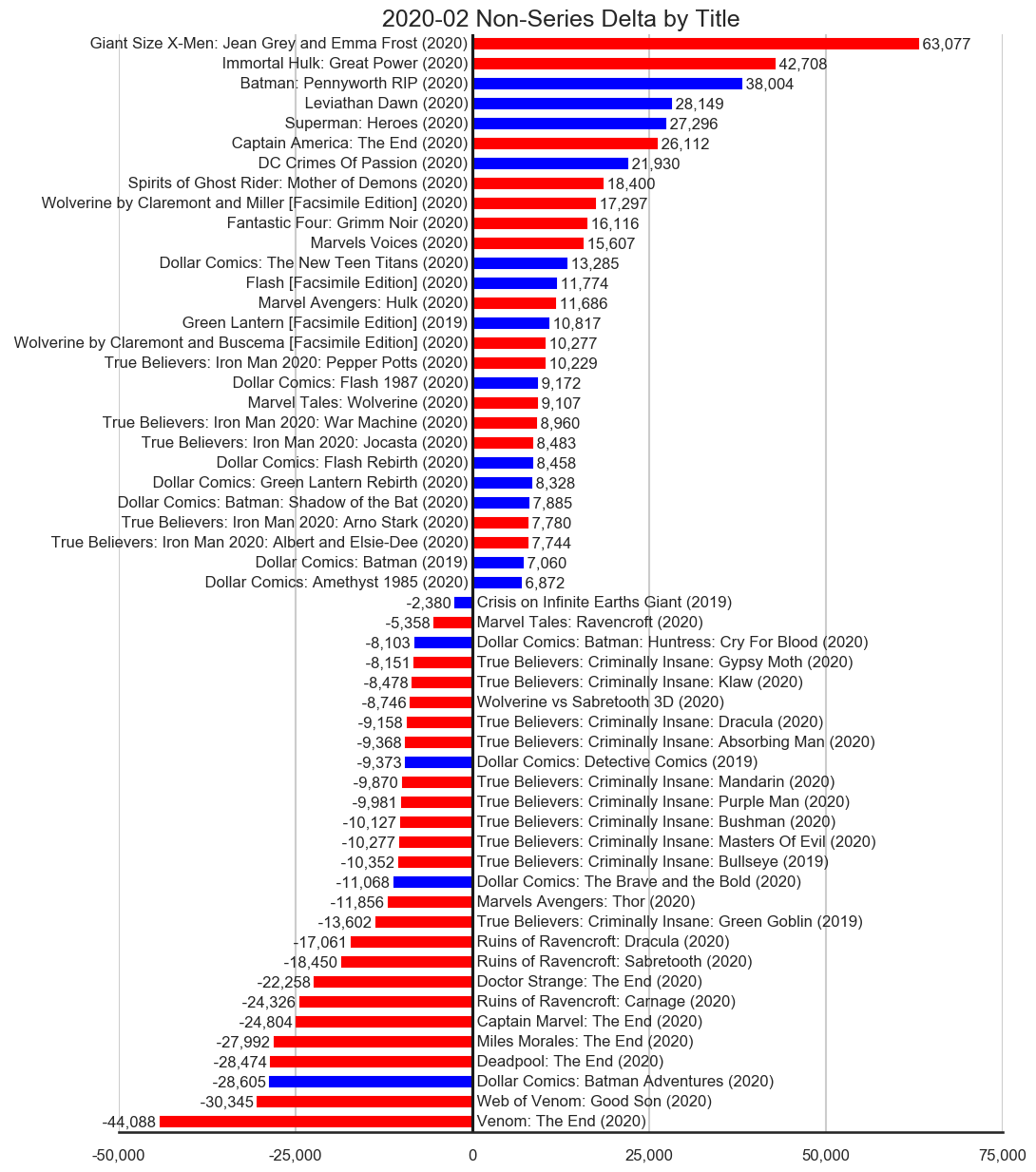

The 55 titles across the 2 publishers in the non-series category accounted for 494,813 units in the top 300 comics with an upswing of 472,613 units, a downswing of 422,651 units for a net an increase of 49,962 units.

Marvel Comics accounted for 57.89% of the up-swing and 85.92% of the down-swing. Once again, the True Believers line continues to be a major influence in the category.

Batman: Pennyworth RIP, Leviathan Dawn and Superman: Heroes sold decent but unimpressive numbers. The Dollar Comics line at DC is doing roughly comparable numbers to the True Believers line on an item by item basis but there are far more True Believers items than there are Dollar Comics items.

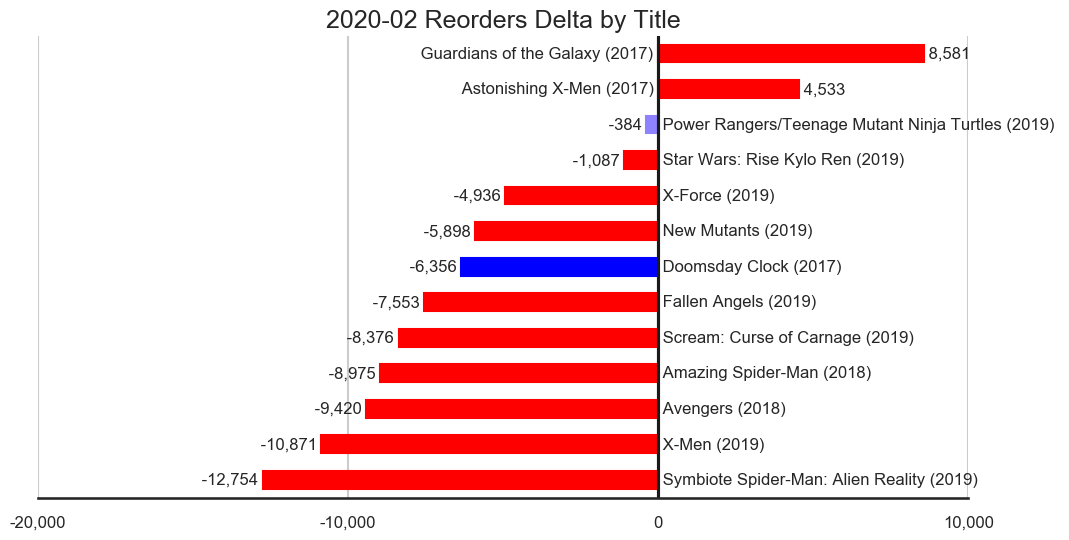

The 13 titles across the 3 publishers in the reorders category accounted for 25,170 units in the top 300 comics with an upswing of 13,114 units, a downswing of 76,610 units for a net a decrease of 63,496 units.

All of the reorder activity in the top 300 comics was on Marvel titles, specifically Guardians of the Galaxy #146 which was originally released in November 1st, 2017 and Star Wars: Rise of Kylo Ren which was originally released last month. Reorder activity on the Dawn of X titles has cooled off with only Marauders #5 showing up between ranks 301 and 500 with 1,099 units.

Sales aren't in a great place but that isn't unusual for first quarter. What is unusual is the market conditions we are currently in. The COVID-19 virus is impacting numerous communities and industries. What impact this will have on comics is unclear. Hopefully the impact will be minimal. A few conventions have already be postponed or canceled. It could be that the closing down of television and movie production reignites some interest in comics for some lapsed readers. This might also be an opportunity for digital comics to increase in sales if people are reluctant to go out to stores or if stores can't get new physical comics for some reason. We'll see how things pan out. Meanwhile, stay safe and enjoy some comics.

For a more in-depth discussion of the sales data, check out the Mayo Report episodes of the Comic Book Page podcast at www.ComicBookPage.com. The episode archived cover the past decade of comic book sales on a monthly basis with yearly recap episodes. In addition to those episodes on the sales data, every Monday is a Weekly Comics Spotlight episode featuring a comic by DC, a comic by Marvel and a comic by some other publisher. I read around 200 new comics a month so the podcast covers a wide variety of the comics currently published. If you are looking for more or different comics to read, check out the latest Previews Spotlight episode featuring clips from various comic book fans talking about the comics they love. With thousands of comics in Previews every month, Previews Spotlight episodes are a great way to find out about new comic book titles that may have flown under your comic book radar.

As always, if you have any questions or comments, please feel free to email me at John.Mayo@ComicBookResources.com.